Intro

Discover 5 ways to navigate 1099 forms, including filing, reporting, and tax obligations, with tips on freelancer taxes, independent contractor income, and self-employment deductions.

The 1099 form is a crucial document for individuals and businesses in the United States, as it reports various types of income earned throughout the year. Understanding the different types of 1099 forms and their purposes is essential for tax compliance and accurate reporting. In this article, we will delve into the world of 1099 forms, exploring five key aspects of these documents and providing valuable insights for taxpayers.

The importance of 1099 forms cannot be overstated, as they play a vital role in the tax reporting process. The Internal Revenue Service (IRS) requires businesses and individuals to report certain types of income on these forms, which helps to ensure that taxes are paid on all earnings. With the rise of the gig economy and freelance work, the use of 1099 forms has become more widespread, making it essential for taxpayers to understand their obligations and responsibilities.

As we navigate the complexities of the tax system, it is crucial to stay informed about the latest developments and changes. The IRS regularly updates its forms and guidelines, and taxpayers must stay up-to-date to avoid penalties and fines. By understanding the different types of 1099 forms and their purposes, individuals and businesses can ensure compliance with tax laws and regulations. Whether you are a freelancer, independent contractor, or business owner, this article will provide you with the knowledge and insights needed to navigate the world of 1099 forms with confidence.

Introduction to 1099 Forms

Types of 1099 Forms

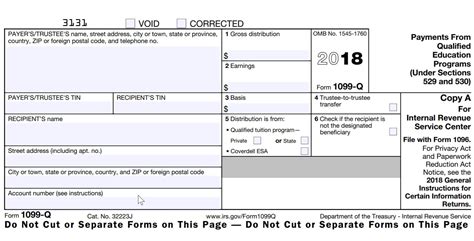

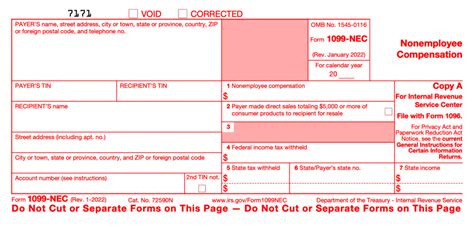

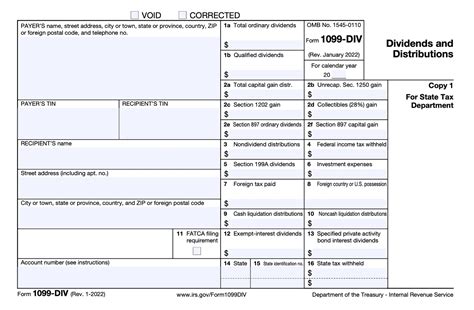

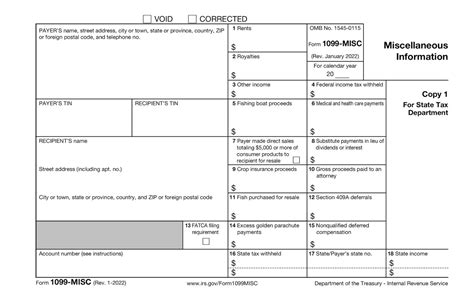

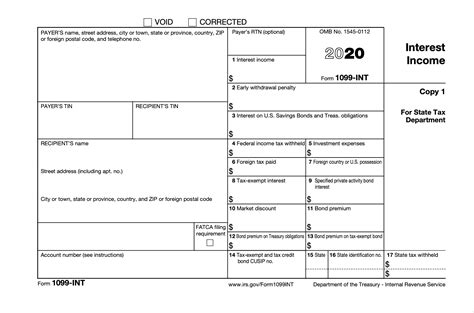

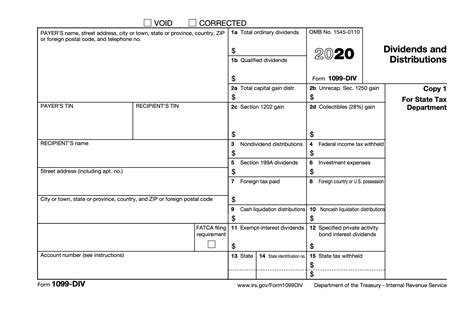

There are several types of 1099 forms, each with its own specific purpose. Some of the most common types of 1099 forms include: * 1099-MISC: Used to report miscellaneous income, such as freelance work, independent contracting, and other non-employee compensation. * 1099-INT: Used to report interest income earned from banks, credit unions, and other financial institutions. * 1099-DIV: Used to report dividend income earned from stocks, mutual funds, and other investments. * 1099-K: Used to report payment card and third-party network transactions, such as credit card payments and online transactions. * 1099-B: Used to report proceeds from broker and barter exchange transactions, such as stock sales and other investment transactions.Purpose of 1099 Forms

Benefits of 1099 Forms

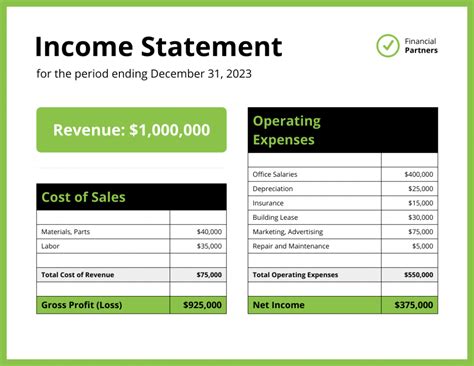

There are several benefits to using 1099 forms, including: * Accurate reporting of income: 1099 forms help to ensure that all income earned throughout the year is reported accurately. * Compliance with tax laws: By reporting income on 1099 forms, businesses and individuals can ensure compliance with tax laws and regulations. * Reduced risk of penalties: Failing to report income on 1099 forms can result in penalties and fines. By using these forms, taxpayers can reduce their risk of penalties and ensure that they are in compliance with tax laws.How to Complete a 1099 Form

Tips for Completing 1099 Forms

Here are some tips to keep in mind when completing 1099 forms: * Ensure that all information is accurate and complete. * Use the correct type of 1099 form for the type of income being reported. * Review the form carefully for errors before submitting it. * Submit the form on time to avoid penalties and fines. * Keep a copy of the form for your records.Common Mistakes to Avoid

Consequences of Mistakes

Failing to avoid these common mistakes can result in serious consequences, including: * Penalties and fines * Delayed tax refunds * Increased risk of audit * Damage to credit scoreBest Practices for 1099 Forms

Importance of Accuracy

Accuracy is crucial when completing 1099 forms. Inaccurate or incomplete information can result in serious consequences, including penalties and fines. By ensuring that all information is accurate and complete, taxpayers can reduce their risk of errors and ensure compliance with tax laws.Conclusion and Next Steps

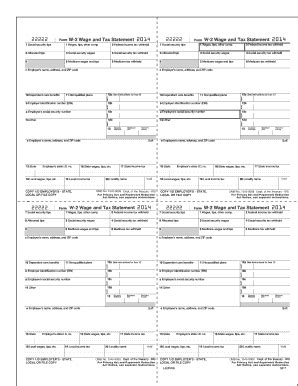

1099 Form Image Gallery

What is a 1099 form?

+A 1099 form is a series of documents used to report various types of income earned throughout the year.

Who needs to file a 1099 form?

+Businesses and individuals who earn income from freelance work, independent contracting, and other non-employee compensation need to file a 1099 form.

What types of income are reported on a 1099 form?

+Various types of income are reported on a 1099 form, including freelance work, independent contracting, interest income, dividend income, and payment card and third-party network transactions.

We hope this article has provided you with valuable insights and information about 1099 forms. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with others who may benefit from this information, and stay tuned for more informative articles on tax compliance and reporting.