Intro

Discover 5 ways to utilize 1099 printable forms, including independent contractor tax filing, freelancer income reporting, and self-employment documentation, making tax season easier with accurate IRS forms and compliant record-keeping.

The 1099 printable form is a crucial document for individuals and businesses to report various types of income to the Internal Revenue Service (IRS). The form is used to document income earned from self-employment, freelance work, investments, and other sources. In this article, we will explore the importance of the 1099 printable form and provide guidance on how to obtain and use it.

The 1099 printable form is a versatile document that serves multiple purposes. It is used by businesses to report payments made to independent contractors, freelancers, and other non-employees. The form is also used by individuals to report income earned from self-employment, investments, and other sources. The IRS requires businesses and individuals to file the 1099 printable form annually to report income earned during the tax year.

The 1099 printable form is an essential document for tax compliance. It provides the IRS with information about income earned by individuals and businesses, which is used to determine tax liability. The form is also used to report income earned from various sources, such as self-employment, investments, and rental properties. By using the 1099 printable form, individuals and businesses can ensure that they are in compliance with tax laws and regulations.

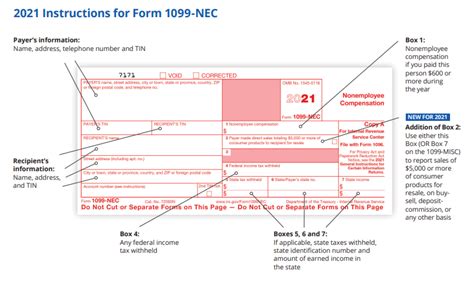

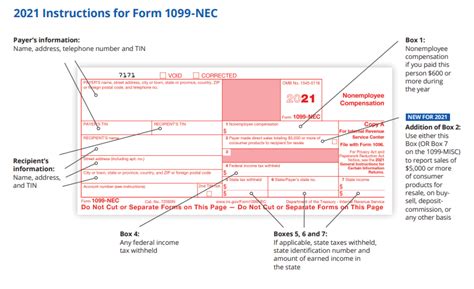

Understanding the 1099 Printable Form

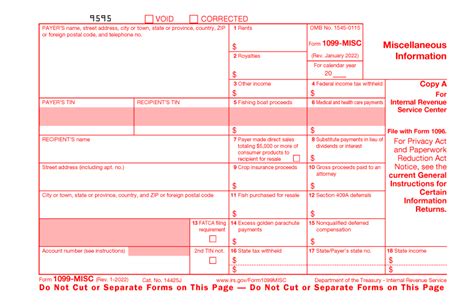

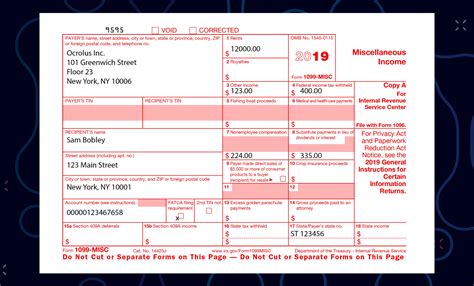

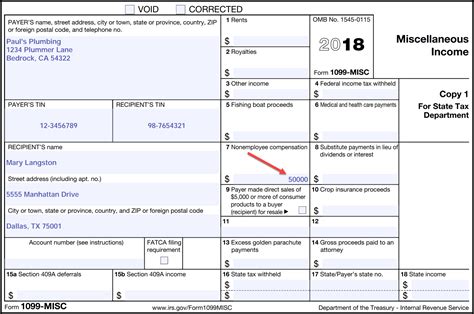

The 1099 printable form is a complex document that requires careful attention to detail. It consists of multiple boxes and sections, each of which requires specific information. The form is used to report various types of income, including self-employment income, investment income, and rental income. To complete the form accurately, individuals and businesses must understand the different types of income and the corresponding boxes and sections.

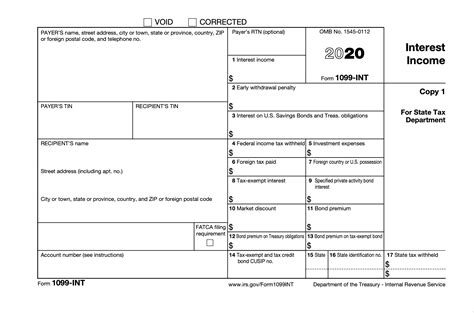

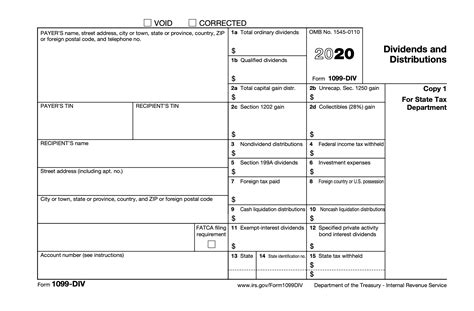

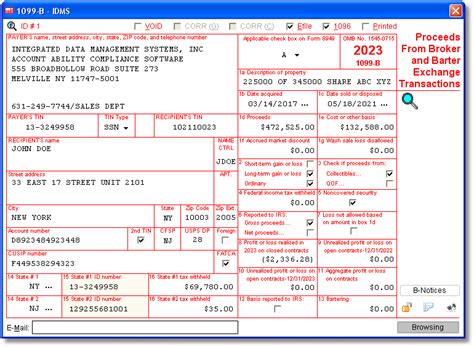

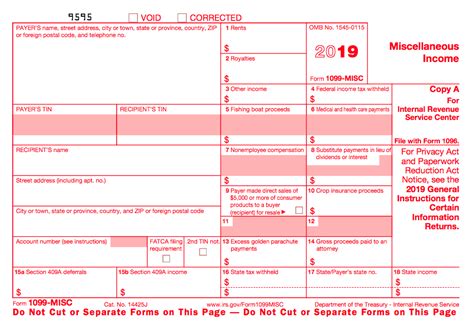

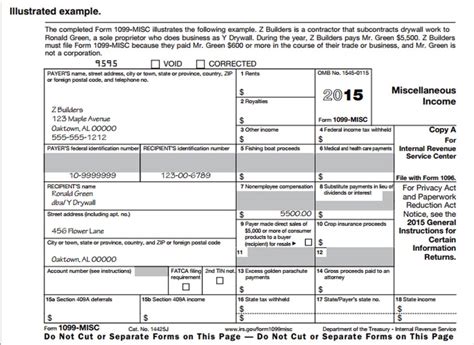

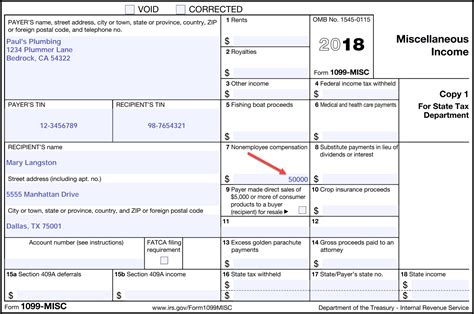

Types of 1099 Forms

There are several types of 1099 forms, each of which is used to report specific types of income. The most common types of 1099 forms include: * 1099-MISC: Used to report miscellaneous income, such as self-employment income and investment income. * 1099-INT: Used to report interest income earned from investments. * 1099-DIV: Used to report dividend income earned from investments. * 1099-B: Used to report income earned from the sale of securities.Benefits of Using the 1099 Printable Form

The 1099 printable form offers several benefits to individuals and businesses. It provides a convenient and efficient way to report income earned during the tax year. The form is also used to claim deductions and credits, which can help reduce tax liability. By using the 1099 printable form, individuals and businesses can ensure that they are in compliance with tax laws and regulations.

Some of the benefits of using the 1099 printable form include:

- Convenience: The form is easy to obtain and complete, and can be filed electronically or by mail.

- Efficiency: The form provides a standardized way to report income earned during the tax year.

- Accuracy: The form helps ensure that income is reported accurately, which can help reduce errors and penalties.

- Compliance: The form helps individuals and businesses comply with tax laws and regulations.

How to Obtain the 1099 Printable Form

The 1099 printable form can be obtained from the IRS website or from a tax professional. The form is available in multiple formats, including PDF and online fillable. To obtain the form, individuals and businesses can visit the IRS website and search for the 1099 printable form. The form can also be obtained from a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA).Completing the 1099 Printable Form

Completing the 1099 printable form requires careful attention to detail. The form consists of multiple boxes and sections, each of which requires specific information. To complete the form accurately, individuals and businesses must understand the different types of income and the corresponding boxes and sections.

Some of the steps to complete the 1099 printable form include:

- Identifying the type of income earned: The form is used to report various types of income, including self-employment income, investment income, and rental income.

- Completing the boxes and sections: The form consists of multiple boxes and sections, each of which requires specific information.

- Reporting income earned: The form is used to report income earned during the tax year.

- Claiming deductions and credits: The form is used to claim deductions and credits, which can help reduce tax liability.

Common Mistakes to Avoid

When completing the 1099 printable form, there are several common mistakes to avoid. These include: * Inaccurate reporting of income: The form requires accurate reporting of income earned during the tax year. * Incomplete information: The form requires complete and accurate information, including the taxpayer's name, address, and Social Security number. * Failure to report income: The form is used to report income earned during the tax year, and failure to report income can result in penalties and fines.Filing the 1099 Printable Form

The 1099 printable form must be filed annually with the IRS. The form is due on January 31st of each year, and must be filed electronically or by mail. To file the form, individuals and businesses can visit the IRS website and use the electronic filing system, or mail the form to the IRS address listed on the form.

Some of the steps to file the 1099 printable form include:

- Gathering required information: The form requires specific information, including the taxpayer's name, address, and Social Security number.

- Completing the form: The form must be completed accurately and thoroughly, with all required information included.

- Filing the form: The form must be filed electronically or by mail, and is due on January 31st of each year.

Penalties for Late Filing

Failure to file the 1099 printable form on time can result in penalties and fines. The IRS imposes penalties for late filing, which can range from $30 to $100 per form, depending on the circumstances. To avoid penalties, individuals and businesses must file the form on time, and ensure that all required information is included.For more information on tax compliance and the 1099 printable form, you can visit our previous article on the topic.

Gallery of 1099 Forms

1099 Form Image Gallery

Frequently Asked Questions

What is the purpose of the 1099 printable form?

+The 1099 printable form is used to report various types of income earned during the tax year, including self-employment income, investment income, and rental income.

Who is required to file the 1099 printable form?

+Businesses and individuals who earn income from self-employment, investments, and other sources are required to file the 1099 printable form annually.

What are the consequences of late filing?

+Failure to file the 1099 printable form on time can result in penalties and fines, which can range from $30 to $100 per form, depending on the circumstances.

How can I obtain the 1099 printable form?

+The 1099 printable form can be obtained from the IRS website or from a tax professional.

Can I file the 1099 printable form electronically?

+Yes, the 1099 printable form can be filed electronically or by mail.

In conclusion, the 1099 printable form is a crucial document for individuals and businesses to report various types of income earned during the tax year. By understanding the purpose and benefits of the form, individuals and businesses can ensure that they are in compliance with tax laws and regulations. We encourage readers to share their experiences and ask questions about the 1099 printable form in the comments section below. Additionally, readers can share this article with others who may benefit from the information provided.