Intro

Discover 5 ways to save money, budget effectively, and reduce expenses with smart financial tips, frugal living, and money management strategies.

Saving money is an essential aspect of personal finance, allowing individuals to achieve their long-term goals, such as buying a house, retiring comfortably, or funding their children's education. With the rising cost of living and increasing financial uncertainties, it has become more crucial than ever to develop healthy saving habits. In this article, we will explore five effective ways to save money, providing you with practical tips and strategies to manage your finances efficiently.

The importance of saving cannot be overstated. It not only helps individuals build wealth over time but also provides a safety net during unexpected expenses or financial downturns. Moreover, saving money can reduce stress and anxiety related to financial insecurity, allowing individuals to enjoy a more peaceful and secure life. By implementing the right saving strategies, individuals can make significant progress toward their financial goals, whether it's saving for a short-term expense or a long-term investment.

Developing a saving mindset requires discipline, patience, and persistence. It involves making conscious financial decisions, avoiding unnecessary expenses, and allocating a portion of your income toward savings. With the numerous saving options available, individuals can choose the methods that best suit their financial goals and preferences. From traditional savings accounts to innovative mobile apps, there are various tools and resources designed to help individuals save money effectively. By leveraging these resources and adopting a consistent saving habit, individuals can achieve financial stability and security.

Understanding the Importance of Saving

To develop an effective saving strategy, it's essential to understand the importance of saving and its benefits. Saving money provides individuals with a sense of financial security, allowing them to withstand unexpected expenses or financial shocks. Additionally, saving can help individuals achieve their long-term goals, such as buying a house, funding their retirement, or pursuing higher education. By prioritizing saving, individuals can make significant progress toward their financial objectives, enjoying a more stable and secure financial future.

Benefits of Saving

Some of the key benefits of saving include: * Financial security and stability * Ability to achieve long-term goals * Reduced stress and anxiety related to financial insecurity * Increased wealth and net worth over time * Improved financial flexibility and freedom5 Effective Ways to Save Money

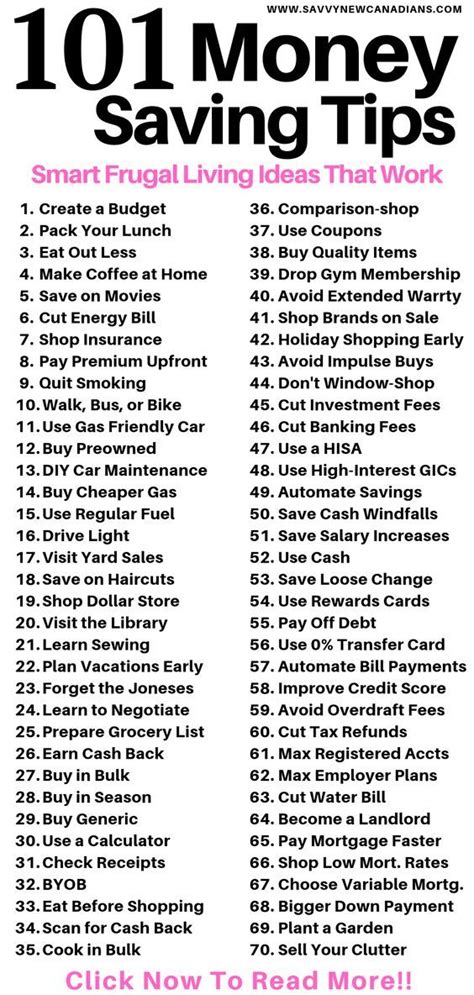

Now that we've discussed the importance of saving, let's explore five effective ways to save money. These strategies can help individuals develop healthy saving habits, achieve their financial goals, and enjoy a more secure financial future.

1. Create a Budget and Track Expenses

The first step to saving money is to create a budget and track expenses. This involves monitoring your income and expenses, identifying areas where you can cut back, and allocating a portion of your income toward savings. By creating a budget, individuals can make conscious financial decisions, avoid unnecessary expenses, and prioritize saving.2. Set Financial Goals

Setting financial goals is another crucial step in developing an effective saving strategy. This involves identifying your short-term and long-term objectives, such as saving for a emergency fund, buying a house, or funding your retirement. By setting clear financial goals, individuals can stay motivated, focused, and committed to their saving efforts.3. Automate Savings

Automating savings is a simple yet effective way to save money. This involves setting up automatic transfers from your checking account to your savings or investment accounts. By automating savings, individuals can ensure that they save a fixed amount regularly, without having to think about it.4. Avoid Unnecessary Expenses

Avoiding unnecessary expenses is another key aspect of saving money. This involves cutting back on discretionary spending, such as dining out, entertainment, or hobbies. By reducing unnecessary expenses, individuals can allocate more money toward savings, achieving their financial goals faster.5. Take Advantage of Savings Tools and Resources

Finally, individuals can take advantage of various savings tools and resources to save money effectively. This includes using mobile apps, such as Mint or You Need a Budget (YNAB), to track expenses and stay on top of finances. Additionally, individuals can use traditional savings accounts, such as high-yield savings accounts or certificates of deposit (CDs), to earn interest on their savings.Additional Tips for Saving Money

In addition to the five effective ways to save money, there are several other tips and strategies that individuals can use to save more effectively. These include:

- Using the 50/30/20 rule, where 50% of income goes toward necessary expenses, 30% toward discretionary spending, and 20% toward saving and debt repayment

- Avoiding impulse purchases and waiting 24 hours before buying non-essential items

- Using cashback and rewards credit cards for daily expenses

- Shopping during sales and using coupons to reduce expenses

- Avoiding lifestyle inflation by saving a portion of salary increases

For more information on personal finance and saving strategies, you can check out our article on budgeting and expense tracking.

Common Saving Mistakes to Avoid

While saving money is essential, there are several common mistakes that individuals can make, hindering their progress toward their financial goals. These include:

- Not having a clear financial plan or budget

- Not prioritizing saving and debt repayment

- Not taking advantage of savings tools and resources

- Not avoiding unnecessary expenses and lifestyle inflation

- Not reviewing and adjusting savings strategies regularly

Avoiding Saving Mistakes

To avoid these common saving mistakes, individuals can: * Create a comprehensive financial plan and budget * Prioritize saving and debt repayment * Take advantage of savings tools and resources * Avoid unnecessary expenses and lifestyle inflation * Review and adjust savings strategies regularlyGallery of Saving Images

Saving Money Image Gallery

Frequently Asked Questions

What is the best way to save money?

+The best way to save money is to create a budget and track expenses, set financial goals, automate savings, avoid unnecessary expenses, and take advantage of savings tools and resources.

How much should I save each month?

+The amount you should save each month depends on your income, expenses, and financial goals. A general rule of thumb is to save at least 20% of your income toward savings and debt repayment.

What are the benefits of saving money?

+The benefits of saving money include financial security and stability, ability to achieve long-term goals, reduced stress and anxiety related to financial insecurity, increased wealth and net worth over time, and improved financial flexibility and freedom.

In conclusion, saving money is an essential aspect of personal finance, allowing individuals to achieve their long-term goals, enjoy financial security and stability, and reduce stress and anxiety related to financial insecurity. By implementing the five effective ways to save money, avoiding common saving mistakes, and taking advantage of savings tools and resources, individuals can make significant progress toward their financial objectives. Remember to create a budget and track expenses, set financial goals, automate savings, avoid unnecessary expenses, and take advantage of savings tools and resources. With discipline, patience, and persistence, you can develop healthy saving habits and achieve financial stability and security. Share your thoughts and experiences on saving money in the comments below, and don't forget to share this article with your friends and family to help them achieve their financial goals.