Intro

Learn how to pay off debt with the Air Force Loan Repayment Program. Discover 5 effective ways to leverage this benefit and accelerate your debt repayment journey. From consolidating loans to maximizing your monthly payments, get expert tips on managing debt with this valuable military perk.

Debt can be overwhelming, especially for military personnel who may be dealing with the stress of deployment, relocation, and other unique challenges. Fortunately, the Air Force offers a loan repayment program to help alleviate some of that financial burden. If you're struggling with debt and serving in the Air Force, here are five ways to pay off debt with the Air Force loan repayment program.

Having a solid understanding of your financial situation is crucial to creating a debt repayment plan. Take a close look at your income, expenses, debts, and credit score. Make a list of all your debts, including the balance, interest rate, and minimum payment due for each one. This will help you prioritize your debts and create a plan to tackle them.

Understanding the Air Force Loan Repayment Program

The Air Force loan repayment program is designed to help active-duty airmen pay off their student loans. The program offers up to $65,000 in loan repayment assistance over a period of three years. To be eligible, you must have a minimum debt of $20,000, and you must agree to serve in the Air Force for at least three years.

How the Program Works

Here's how the Air Force loan repayment program works:

- The Air Force will pay up to 33.33% of your outstanding loan balance each year, up to a maximum of $65,000 over three years.

- You must agree to serve in the Air Force for at least three years to be eligible for the program.

- You can only receive loan repayment assistance for federally guaranteed student loans, such as Direct Loans and Federal Family Education Loans.

- You cannot receive loan repayment assistance for private student loans or other types of debt.

5 Ways to Pay Off Debt with the Air Force Loan Repayment Program

Now that you understand how the Air Force loan repayment program works, here are five ways to pay off debt using this program:

-

Pay Off High-Interest Debt First

If you have multiple debts with different interest rates, it's a good idea to pay off the ones with the highest interest rates first. This will save you the most money in interest payments over time. For example, if you have a credit card with an 18% interest rate and a student loan with a 6% interest rate, you should prioritize paying off the credit card debt first.

-

Use the Debt Snowball Method

The debt snowball method is a debt repayment strategy that involves paying off your debts one by one, starting with the smallest balance first. This approach can be motivating, as you'll see progress quickly and be able to eliminate smaller debts from your list.

For example, if you have the following debts:

- Credit card with a $500 balance and an 18% interest rate

- Student loan with a $10,000 balance and a 6% interest rate

- Car loan with a $20,000 balance and a 4% interest rate

You would pay off the credit card debt first, followed by the student loan, and finally the car loan.

-

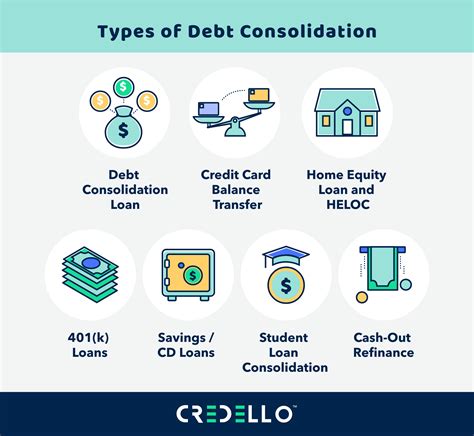

Consolidate Your Debt

If you have multiple debts with high interest rates, you may want to consider consolidating them into a single loan with a lower interest rate. This can simplify your payments and save you money on interest over time.

For example, if you have two credit cards with balances of $2,000 and $3,000, respectively, and interest rates of 18% and 20%, you may be able to consolidate them into a single loan with a 12% interest rate.

-

Make Bi-Weekly Payments

Instead of making one monthly payment, try making bi-weekly payments. This can help you pay off your debt faster and save money on interest over time.

For example, if your monthly payment is $500, you would make two payments of $250 each, every two weeks. This will result in 26 payments per year, rather than 12.

-

Use the 50/30/20 Rule

The 50/30/20 rule is a budgeting strategy that involves allocating 50% of your income towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

By following this rule, you can ensure that you're making progress on your debt repayment goals while still enjoying some discretionary income.

Gallery of Air Force Loan Repayment Program

Air Force Loan Repayment Program Image Gallery

Frequently Asked Questions

What is the Air Force loan repayment program?

+The Air Force loan repayment program is a program designed to help active-duty airmen pay off their student loans. The program offers up to $65,000 in loan repayment assistance over a period of three years.

How do I apply for the Air Force loan repayment program?

+To apply for the Air Force loan repayment program, you must submit an application through the Air Force's website. You will need to provide documentation of your student loans and agree to serve in the Air Force for at least three years.

What types of debt are eligible for the Air Force loan repayment program?

+The Air Force loan repayment program is only available for federally guaranteed student loans, such as Direct Loans and Federal Family Education Loans. Private student loans and other types of debt are not eligible.

We hope this article has provided you with a comprehensive understanding of the Air Force loan repayment program and how to pay off debt using this program. Remember to always review the terms and conditions of any loan repayment program before applying, and don't hesitate to reach out to a financial advisor for personalized advice.