Intro

Master 5 Leaps Calendar Spreads, a trading strategy using calendar spreads, iron condors, and options spreads to manage risk and maximize profits in volatile markets with hedging techniques.

The world of trading and investing is filled with numerous strategies and techniques, each designed to help individuals navigate the complex markets and make informed decisions. Among these strategies, the 5 Leaps Calendar Spread has gained significant attention due to its potential for managing risk and generating profits. This approach is particularly intriguing for those looking to balance their investment portfolios and mitigate the impacts of market volatility.

Understanding the basics of options trading and calendar spreads is essential before diving into the specifics of the 5 Leaps Calendar Spread. Options trading involves contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) before a certain date (expiration date). A calendar spread, also known as a time spread, involves buying and selling options with the same strike price but different expiration dates. This strategy can be used to speculate on the price movement of the underlying asset or to hedge against potential losses.

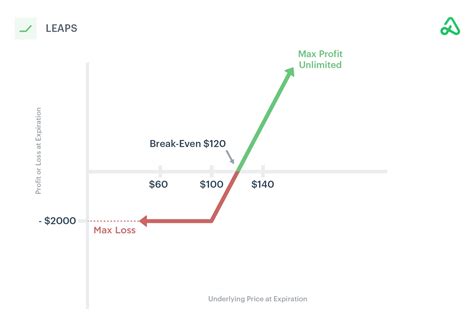

The 5 Leaps Calendar Spread is a more advanced strategy that involves selling and buying options with expiration dates that are further apart, typically by several months. "LEAPS" stands for Long-Term Equity Anticipation Securities, which are options with expiration dates that are more than nine months away. This strategy is appealing because it can provide a higher premium income due to the longer duration of the options involved. However, it also comes with its own set of complexities and risks, including the potential for significant losses if the market moves against the trader's position.

Introduction to 5 Leaps Calendar Spreads

To implement a 5 Leaps Calendar Spread, an investor would typically sell a LEAPS call or put option with a shorter expiration date and buy a LEAPS call or put option with the same strike price but a longer expiration date. The goal is to profit from the difference in premium between the sold and bought options, as well as from the potential decrease in volatility over time. This strategy can be adjusted based on the investor's outlook on the market and the specific asset involved.

Benefits of the 5 Leaps Calendar Spreads Strategy

The benefits of the 5 Leaps Calendar Spreads strategy include the potential for high premium income, flexibility in adjusting the strategy based on market conditions, and the ability to hedge against potential losses in other investment positions. However, it's crucial for investors to thoroughly understand the risks involved, including the potential for unlimited losses if the position is not properly managed.

Key Considerations for Implementing 5 Leaps Calendar Spreads

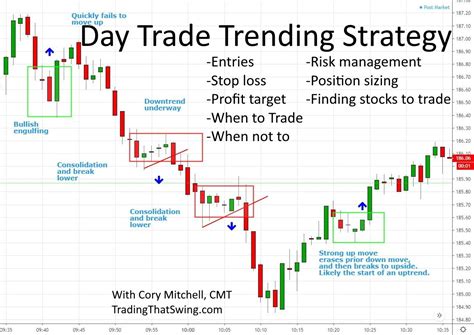

When considering the implementation of a 5 Leaps Calendar Spread, several key factors must be taken into account: - **Volatility**: Changes in volatility can significantly impact the profitability of the strategy. A decrease in volatility can lead to a decrease in the value of the options, potentially resulting in losses. - **Time Decay**: The rate at which options lose their value over time. Selling options with shorter expiration dates can benefit from time decay, as the buyer of the option sees the value of their option decrease over time. - **Interest Rates**: Changes in interest rates can affect the pricing of options, with higher interest rates potentially increasing the value of call options and decreasing the value of put options. - **Market Direction**: The direction of the market can significantly impact the strategy. A movement against the position can result in losses.Steps to Implement a 5 Leaps Calendar Spread

Implementing a 5 Leaps Calendar Spread involves several steps:

- Identify the Underlying Asset: Choose an asset that is expected to experience low to moderate volatility.

- Select the Strike Price: The strike price should be close to the current market price of the underlying asset to maximize the premium income.

- Determine the Expiration Dates: Sell options with shorter expiration dates and buy options with longer expiration dates.

- Monitor and Adjust: Continuously monitor the position and adjust as necessary to manage risk and maximize profits.

Risks and Challenges Associated with 5 Leaps Calendar Spreads

While the 5 Leaps Calendar Spread can be a profitable strategy, it comes with significant risks and challenges. These include the potential for unlimited losses, the impact of time decay, changes in volatility, and the effects of interest rates and market direction. It's essential for investors to have a deep understanding of these risks and to implement rigorous risk management strategies.

Managing Risk in 5 Leaps Calendar Spreads

Managing risk is crucial when implementing a 5 Leaps Calendar Spread. This can be achieved through: - **Position Sizing**: Limiting the size of the position to manage potential losses. - **Stop-Loss Orders**: Setting stop-loss orders to automatically close the position if it reaches a certain level of loss. - **Diversification**: Diversifying the investment portfolio to spread risk across different assets and strategies.Conclusion and Future Outlook

In conclusion, the 5 Leaps Calendar Spread is a complex options trading strategy that offers the potential for high premium income but also comes with significant risks. As the financial markets continue to evolve, understanding and mastering such advanced strategies will become increasingly important for investors looking to navigate the complexities of the market and achieve their financial goals.

Final Thoughts on 5 Leaps Calendar Spreads

As investors consider incorporating the 5 Leaps Calendar Spread into their investment strategies, it's essential to approach this strategy with caution and thorough preparation. This includes educating oneself on the intricacies of options trading, understanding the risks involved, and developing a comprehensive risk management plan.

Gallery of 5 Leaps Calendar Spreads

5 Leaps Calendar Spreads Image Gallery

What is a 5 Leaps Calendar Spread?

+A 5 Leaps Calendar Spread is an advanced options trading strategy involving the sale and purchase of LEAPS options with different expiration dates to profit from premium income and potential decreases in volatility.

What are the benefits of using a 5 Leaps Calendar Spread?

+The benefits include potential high premium income, flexibility in strategy adjustment, and the ability to hedge against potential losses in other investment positions.

What are the risks associated with a 5 Leaps Calendar Spread?

+Risks include the potential for unlimited losses, the impact of time decay, changes in volatility, and the effects of interest rates and market direction.

We invite you to share your thoughts and experiences with the 5 Leaps Calendar Spread strategy in the comments below. Whether you're a seasoned investor or just starting to explore the world of options trading, your insights can help others navigate this complex but potentially rewarding field. Consider sharing this article with others who might benefit from understanding the intricacies of the 5 Leaps Calendar Spread, and don't hesitate to reach out with any questions or topics you'd like to discuss further.