Intro

Discover the ins and outs of Army Cola, the Cost of Living Allowance that helps military personnel offset expenses in high-cost areas. Learn how COLA is calculated, whos eligible, and how it impacts your pay. Get expert insights on COLA rates, entitlements, and benefits to make informed decisions about your military compensation.

The Cost of Living Allowance (COLA) - a vital component of military compensation that helps ensure service members and their families can maintain a decent standard of living, regardless of where they are stationed. For many, the term "COLA" is synonymous with "Army COLA," given the significant number of soldiers who rely on this allowance to make ends meet. In this article, we will delve into the world of Army COLA, exploring what it is, how it works, and what you can expect from this essential benefit.

What is Army COLA?

COLA is a monthly allowance paid to service members to help offset the higher cost of living in certain areas. The allowance is based on the location where the soldier is stationed, and it is designed to ensure that their purchasing power is not diminished by higher prices for goods and services in that area. In other words, COLA is intended to help level the playing field, so to speak, by providing additional compensation to soldiers who are stationed in areas with a higher cost of living.

How Does Army COLA Work?

The process of determining Army COLA is complex, involving a combination of data collection, analysis, and calculation. Here's a simplified overview of how it works:

- Data Collection: The government collects data on the cost of living in various locations, including prices for groceries, housing, transportation, and other necessities.

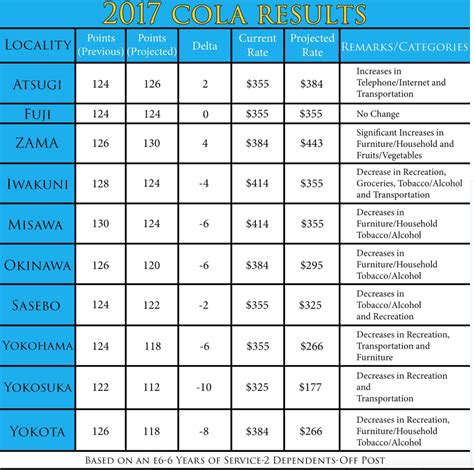

- Index Calculation: The collected data is used to calculate a Cost of Living Index (COLI) for each location. The COLI is a numerical representation of the relative cost of living in a particular area, compared to a base location (usually the continental United States).

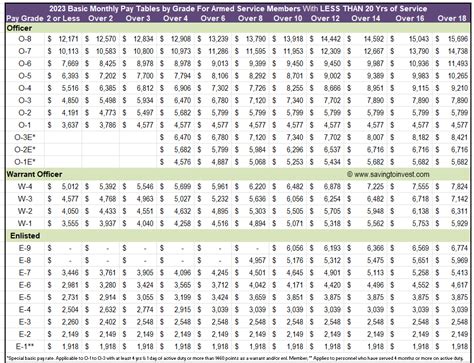

- Allowance Calculation: The COLI is then used to calculate the COLA for each location. The allowance is based on the soldier's pay grade, family size, and the COLI for their duty station.

- Payment: The calculated COLA is paid to the soldier as part of their monthly compensation.

Types of COLA

There are two types of COLA: Contiguous United States (CONUS) COLA and Outside the Continental United States (OCONUS) COLA.

- CONUS COLA: Applies to soldiers stationed within the continental United States, where the cost of living varies significantly from one location to another.

- OCONUS COLA: Applies to soldiers stationed outside the continental United States, where the cost of living can be significantly higher due to factors such as remote locations and limited access to goods and services.

How to Calculate Your Army COLA

Calculating your Army COLA can be a complex process, but here's a simplified example to illustrate the basic steps:

- Step 1: Determine your pay grade and family size.

- Step 2: Look up the COLI for your duty station.

- Step 3: Use the COLI to calculate your COLA based on your pay grade and family size.

For example, let's say you're a Sergeant (E-5) with a family of four, stationed in San Francisco, California. The COLI for San Francisco is 146.2, which means it's 46.2% more expensive than the base location. Based on this, your COLA might be calculated as follows:

- COLA: $500 per month (based on pay grade and family size)

- COLI: 146.2 (San Francisco)

- Adjusted COLA: $730 per month (calculated by multiplying the COLA by the COLI)

Keep in mind that this is a simplified example, and actual calculations may vary depending on individual circumstances.

FAQs

Here are some frequently asked questions about Army COLA:

- Q: Who is eligible for Army COLA? A: All active-duty soldiers who are stationed in areas with a higher cost of living are eligible for COLA.

- Q: How often is COLA paid? A: COLA is paid monthly, as part of your regular compensation.

- Q: Can I opt out of COLA? A: No, COLA is a mandatory benefit for eligible soldiers.

How is COLA affected by deployment?

+COLA is suspended during deployment, as the military provides other forms of compensation and support during this time.

Can I claim COLA on my taxes?

+No, COLA is not taxable income.

How do I update my COLA information?

+Contact your unit's personnel office or the Defense Travel Management Office (DTMO) to update your COLA information.

Army COLA Image Gallery

In conclusion, Army COLA is an essential benefit that helps service members and their families maintain a decent standard of living, regardless of where they are stationed. By understanding how COLA works and how it's calculated, you can better navigate the complexities of military compensation and make informed decisions about your financial future. We encourage you to share this article with your fellow service members and leave a comment below with any questions or concerns you may have.