Intro

Discover how military pay adjusts with kids. Learn about the 6 ways military compensation changes with dependents, including Basic Allowance for Housing (BAH) and Subsistence (BAS) increases, and additional allowances for childcare and education expenses. Get informed about military pay for families and plan your financial future with confidence.

Having children can bring significant changes to a military family's life, including their pay. As a military member, understanding how your pay is affected by the addition of kids is essential to plan for your family's financial future. In this article, we will explore the six ways military pay changes with kids, providing you with the information you need to make informed decisions about your family's finances.

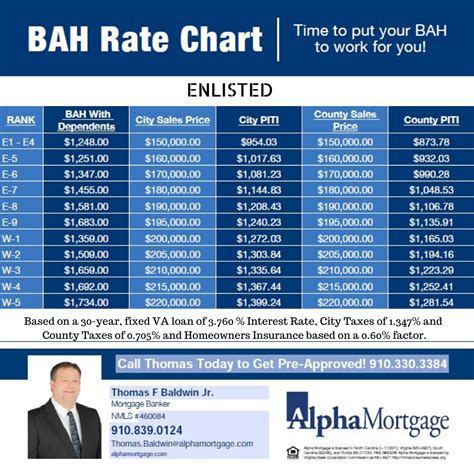

1. Basic Allowance for Housing (BAH)

Basic Allowance for Housing (BAH) is a tax-free allowance that helps military members pay for housing expenses. When you have children, your BAH rate may increase, depending on the location and the number of dependents you have. The BAH rate is determined by the military's housing costs in the area where you are stationed.

For example, if you are a single service member without dependents, your BAH rate might be lower than a service member with two children. The BAH rate is adjusted annually based on the housing market conditions in your area.

BAH Rates with Dependents

- With one dependent, the BAH rate is approximately 10% higher than without dependents.

- With two dependents, the BAH rate is approximately 20% higher than without dependents.

- With three or more dependents, the BAH rate is approximately 30% higher than without dependents.

Keep in mind that these rates are estimates and may vary depending on the location and the number of dependents.

2. Basic Allowance for Subsistence (BAS)

Basic Allowance for Subsistence (BAS) is a tax-free allowance that helps military members pay for food expenses. When you have children, your BAS rate may increase, depending on the number of dependents you have. The BAS rate is determined by the military's food costs and is adjusted annually.

BAS Rates with Dependents

- With one dependent, the BAS rate is approximately 10% higher than without dependents.

- With two dependents, the BAS rate is approximately 20% higher than without dependents.

- With three or more dependents, the BAS rate is approximately 30% higher than without dependents.

Again, these rates are estimates and may vary depending on the number of dependents.

3. Child Care Subsidy

The military offers a child care subsidy to help military families pay for child care expenses. The subsidy is based on the family's income and the number of children in child care. The subsidy can help reduce the financial burden of child care, making it more affordable for military families.

Child Care Subsidy Rates

- The subsidy rate varies depending on the family's income and the number of children in child care.

- The subsidy can cover up to 50% of child care costs, depending on the family's income.

To be eligible for the child care subsidy, military families must meet certain requirements, including:

- The service member must be on active duty or in the Selected Reserve.

- The family must have a child under the age of 13 or a child with a disability.

- The family must be using a Child Development Center (CDC) or a Family Child Care (FCC) home.

4. Family Separation Allowance (FSA)

Family Separation Allowance (FSA) is a tax-free allowance that helps military members who are separated from their families due to military duties. When you have children, your FSA rate may increase, depending on the number of dependents you have.

FSA Rates with Dependents

- With one dependent, the FSA rate is approximately 10% higher than without dependents.

- With two dependents, the FSA rate is approximately 20% higher than without dependents.

- With three or more dependents, the FSA rate is approximately 30% higher than without dependents.

Again, these rates are estimates and may vary depending on the number of dependents.

5. Military Housing Incentives

The military offers various housing incentives to help military families pay for housing expenses. When you have children, you may be eligible for additional housing incentives, depending on the location and the number of dependents you have.

For example, the military offers a Basic Allowance for Housing (BAH) Differential, which is an additional allowance for service members who live in high-cost areas. The BAH Differential can help offset the high cost of housing in these areas.

Military Housing Incentives with Dependents

- The BAH Differential can be up to 25% higher for service members with dependents.

- The military also offers a Variable Housing Allowance (VHA), which is an additional allowance for service members who live in areas with high housing costs.

To be eligible for these housing incentives, military families must meet certain requirements, including:

- The service member must be on active duty or in the Selected Reserve.

- The family must live in a high-cost area.

- The family must meet certain income and family size requirements.

6. Tax Benefits

The military offers various tax benefits to help military families reduce their tax liability. When you have children, you may be eligible for additional tax benefits, depending on the number of dependents you have.

For example, the military offers a tax credit for child care expenses, which can help reduce the financial burden of child care. The tax credit can be up to 50% of child care costs, depending on the family's income.

Tax Benefits with Dependents

- The tax credit for child care expenses can be up to 50% of child care costs.

- The military also offers a tax exemption for BAH and BAS, which can help reduce the family's tax liability.

To be eligible for these tax benefits, military families must meet certain requirements, including:

- The service member must be on active duty or in the Selected Reserve.

- The family must have a child under the age of 13 or a child with a disability.

- The family must meet certain income and family size requirements.

In conclusion, having children can bring significant changes to a military family's life, including their pay. Understanding how your pay is affected by the addition of kids is essential to plan for your family's financial future. By knowing the six ways military pay changes with kids, you can make informed decisions about your family's finances and take advantage of the various benefits and incentives available to military families.

Gallery of Military Pay Changes with Kids

Military Pay Changes with Kids Image Gallery

FAQs

How does having children affect my military pay?

+Having children can affect your military pay in several ways, including an increase in BAH and BAS rates, eligibility for child care subsidies, and tax benefits.

What is the Basic Allowance for Housing (BAH)?

+The Basic Allowance for Housing (BAH) is a tax-free allowance that helps military members pay for housing expenses.

What is the Child Care Subsidy?

+The Child Care Subsidy is a program that helps military families pay for child care expenses.