Intro

Discover how the Army Loan Repayment Plan can help you pay off debt with military service. Learn about the benefits of the program, including loan forgiveness and debt consolidation. Find out if youre eligible and how to apply. Start your journey to financial freedom with the Armys loan repayment assistance.

Paying off debt can be a significant challenge, especially for those who have dedicated their lives to serving their country. However, the military offers a range of programs designed to help service members manage their debt and achieve financial stability. One such program is the Army Loan Repayment Plan (LRP), which provides financial assistance to soldiers who agree to serve for a specified period. In this article, we will explore the Army Loan Repayment Plan, its benefits, and how it can help soldiers pay off their debt.

What is the Army Loan Repayment Plan?

The Army Loan Repayment Plan is a program offered by the United States Army to help soldiers pay off their student loans. The program is designed to attract and retain high-quality soldiers by providing financial assistance to those who agree to serve for a specified period. Under the program, the Army will repay a portion of a soldier's student loans in exchange for their service.

Benefits of the Army Loan Repayment Plan

The Army Loan Repayment Plan offers several benefits to soldiers who participate in the program. Some of the key benefits include:

- Financial assistance: The program provides financial assistance to soldiers who are struggling to pay off their student loans.

- Debt reduction: The program can help soldiers reduce their debt burden, which can improve their overall financial stability.

- Increased cash flow: By reducing their debt burden, soldiers can increase their cash flow and enjoy greater financial flexibility.

- Improved credit score: Paying off debt can help soldiers improve their credit score, which can make it easier to obtain credit in the future.

How Does the Army Loan Repayment Plan Work?

The Army Loan Repayment Plan is a relatively straightforward program. Here's how it works:

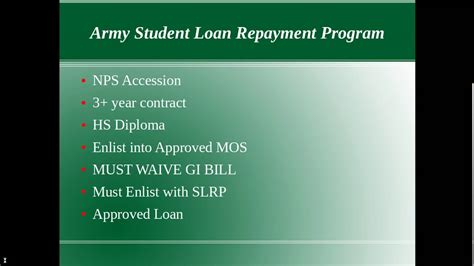

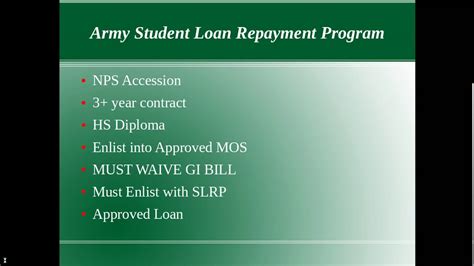

- Eligibility: To be eligible for the program, soldiers must meet certain criteria, including having a student loan debt and agreeing to serve for a specified period.

- Application: Soldiers who meet the eligibility criteria must apply for the program through their Army recruiter or career counselor.

- Approval: If the application is approved, the Army will repay a portion of the soldier's student loans.

- Service commitment: In exchange for the financial assistance, soldiers must agree to serve for a specified period, typically three to six years.

Army Loan Repayment Plan Requirements

To be eligible for the Army Loan Repayment Plan, soldiers must meet certain requirements. Some of the key requirements include:

- Student loan debt: Soldiers must have a student loan debt to be eligible for the program.

- Service commitment: Soldiers must agree to serve for a specified period, typically three to six years.

- Citizenship: Soldiers must be U.S. citizens to be eligible for the program.

- Age: Soldiers must be under the age of 35 to be eligible for the program.

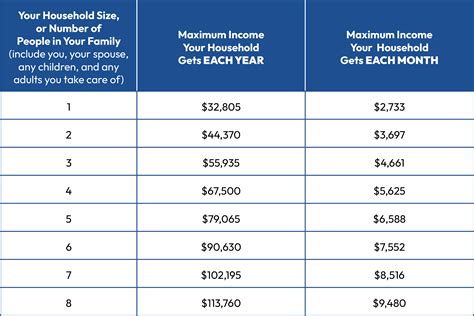

Army Loan Repayment Plan Pay Chart

The Army Loan Repayment Plan pay chart is used to determine the amount of financial assistance that soldiers will receive under the program. The pay chart takes into account the soldier's rank, time in service, and student loan debt.

Army Loan Repayment Plan Rates

The Army Loan Repayment Plan rates vary depending on the soldier's rank and time in service. Here are some of the rates that apply to the program:

- Up to $65,000: The Army will repay up to $65,000 of a soldier's student loan debt under the program.

- 33 1/3%: The Army will repay 33 1/3% of a soldier's student loan debt per year of service.

Army Loan Repayment Plan vs. National Guard Loan Repayment Plan

The Army Loan Repayment Plan and the National Guard Loan Repayment Plan are two similar programs that offer financial assistance to soldiers who are struggling to pay off their student loans. While both programs offer similar benefits, there are some key differences between them.

Key Differences

Some of the key differences between the Army Loan Repayment Plan and the National Guard Loan Repayment Plan include:

- Service commitment: The Army Loan Repayment Plan requires a longer service commitment than the National Guard Loan Repayment Plan.

- Financial assistance: The Army Loan Repayment Plan offers more financial assistance than the National Guard Loan Repayment Plan.

- Eligibility: The Army Loan Repayment Plan has stricter eligibility requirements than the National Guard Loan Repayment Plan.

Army Loan Repayment Plan Calculator

The Army Loan Repayment Plan calculator is a tool that can be used to estimate the amount of financial assistance that soldiers will receive under the program. The calculator takes into account the soldier's rank, time in service, and student loan debt.

How to Use the Calculator

To use the Army Loan Repayment Plan calculator, soldiers will need to provide some basic information, including:

- Rank: Soldiers will need to provide their rank to use the calculator.

- Time in service: Soldiers will need to provide their time in service to use the calculator.

- Student loan debt: Soldiers will need to provide their student loan debt to use the calculator.

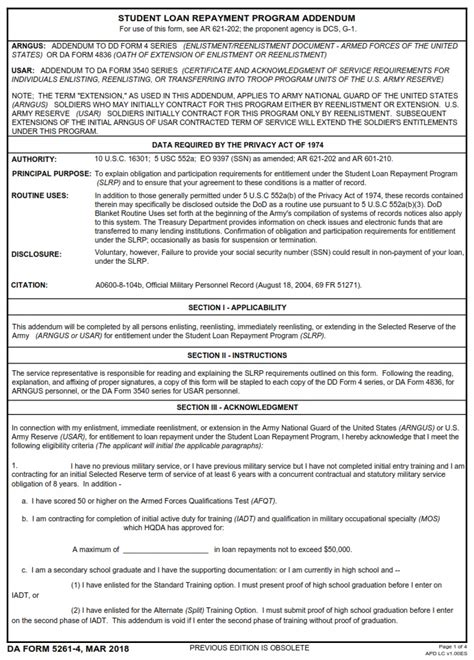

Army Loan Repayment Plan Application

The Army Loan Repayment Plan application is the first step in applying for the program. To apply, soldiers will need to provide some basic information, including:

- Name: Soldiers will need to provide their name to apply for the program.

- Rank: Soldiers will need to provide their rank to apply for the program.

- Time in service: Soldiers will need to provide their time in service to apply for the program.

- Student loan debt: Soldiers will need to provide their student loan debt to apply for the program.

Application Process

The application process for the Army Loan Repayment Plan typically takes several weeks to complete. Here are the steps that soldiers will need to follow to apply for the program:

- Contact a recruiter: Soldiers will need to contact a recruiter to start the application process.

- Provide documentation: Soldiers will need to provide documentation, including their student loan debt and time in service.

- Apply for the program: Soldiers will need to apply for the program through their recruiter or career counselor.

Gallery of Army Loan Repayment Plan

Army Loan Repayment Plan Image Gallery

Frequently Asked Questions

What is the Army Loan Repayment Plan?

+The Army Loan Repayment Plan is a program offered by the United States Army to help soldiers pay off their student loans.

How does the Army Loan Repayment Plan work?

+The Army Loan Repayment Plan works by providing financial assistance to soldiers who agree to serve for a specified period.

What are the benefits of the Army Loan Repayment Plan?

+The benefits of the Army Loan Repayment Plan include financial assistance, debt reduction, increased cash flow, and improved credit score.

By providing financial assistance to soldiers who are struggling to pay off their student loans, the Army Loan Repayment Plan can help service members achieve financial stability and reduce their debt burden. Whether you're a new recruit or a seasoned veteran, the Army Loan Repayment Plan is definitely worth considering. So why not take the first step today and start exploring the benefits of the Army Loan Repayment Plan for yourself?