Intro

Learn how to calculate your Army National Guard pay with our comprehensive guide. Discover the 5 key methods to determine your pay, including Basic Pay, Allowances, and Special Pay. Understand the factors affecting your earnings, such as rank, time-in-grade, and deployment. Get the latest information on Drill Pay, Active Duty Pay, and more.

Serving in the Army National Guard is a noble pursuit that requires dedication, hard work, and sacrifice. While the sense of duty and service to one's country is a significant motivator, it's essential to understand the financial aspects of serving in the Guard. Calculating Army National Guard pay can be complex, but we'll break it down into five manageable ways to help you understand your compensation.

Understanding the Components of Army National Guard Pay

Before we dive into the calculations, it's crucial to understand the various components that make up your Army National Guard pay. These include:

- Basic Pay: This is the standard pay rate for your rank and time in service.

- Drill Pay: This is the pay you receive for attending monthly drills and annual training.

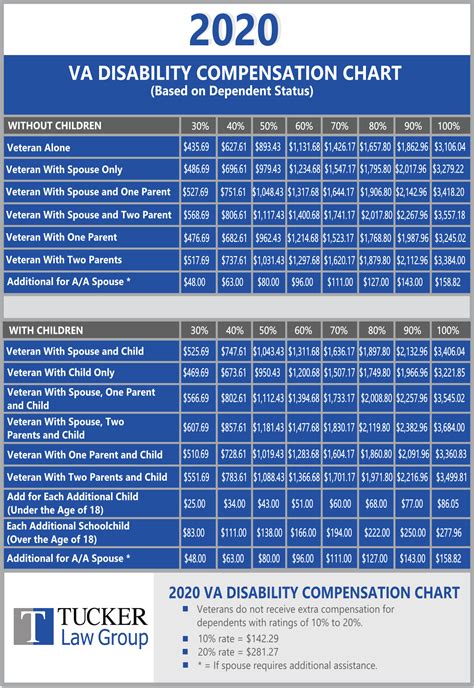

- Special Pay: This includes additional pay for specialized skills, hazardous duty, or other unique circumstances.

- Allowances: These are tax-free payments to help offset the cost of living, food, and other expenses.

- Bonuses: These are one-time payments for enlisting, re-enlisting, or achieving specific milestones.

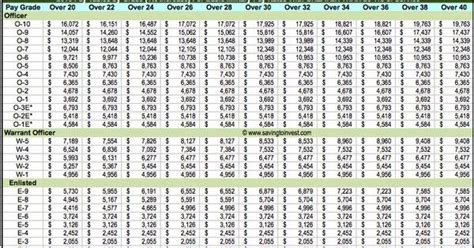

Method 1: Basic Pay Calculation

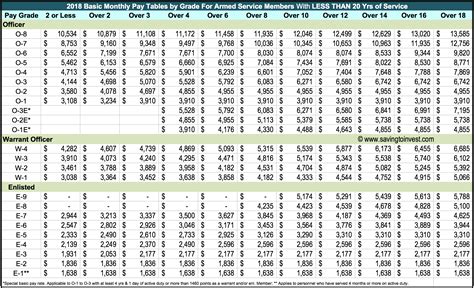

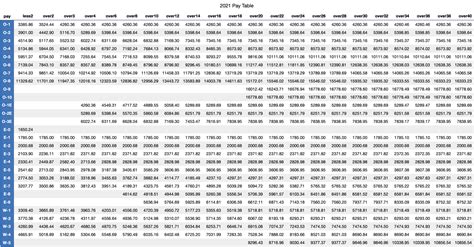

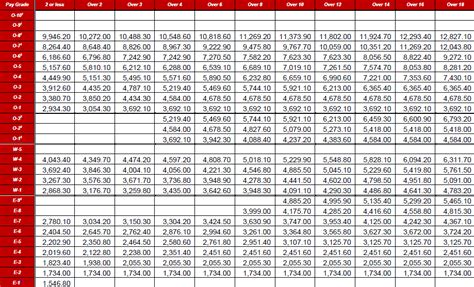

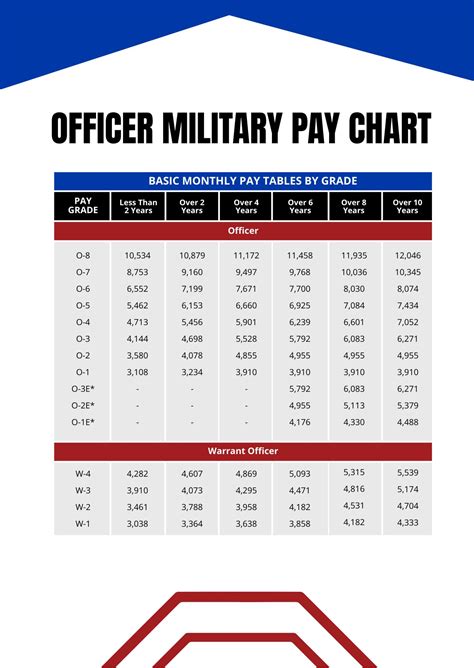

To calculate your basic pay, you'll need to refer to the Army National Guard's pay chart, which is based on your rank and time in service. Here's a step-by-step guide:

- Determine your rank: Check your rank on your military ID or personnel records.

- Find your time in service: Calculate your total time in service, including any prior military experience.

- Refer to the pay chart: Look up your rank and time in service on the pay chart to find your basic pay rate.

- Multiply by the number of pay periods: There are 26 pay periods in a year, so multiply your basic pay rate by 26 to get your annual basic pay.

For example, if you're a Sergeant (E-5) with 6 years of service, your basic pay rate might be $3,500 per month. Multiply that by 26 pay periods, and your annual basic pay would be $91,000.

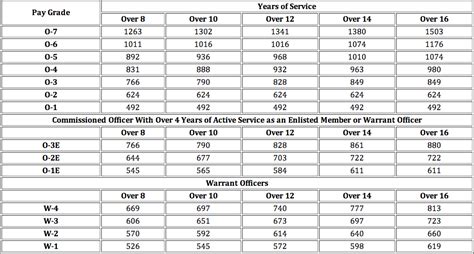

Method 2: Drill Pay Calculation

Drill pay is calculated based on your rank and the number of drills you attend. Here's how to calculate your drill pay:

- Determine your drill pay rate: Refer to the Army National Guard's drill pay chart to find your pay rate based on your rank.

- Calculate the number of drills: Count the number of drills you attend in a year. Typically, this is 12-14 drills per year.

- Multiply by the drill pay rate: Multiply the number of drills by your drill pay rate to get your annual drill pay.

For example, if you're a Sergeant (E-5) with a drill pay rate of $200 per drill, and you attend 12 drills per year, your annual drill pay would be $2,400.

Method 3: Special Pay Calculation

Special pay is additional compensation for specialized skills, hazardous duty, or other unique circumstances. Here's how to calculate your special pay:

- Determine your special pay rate: Refer to the Army National Guard's special pay chart to find your pay rate based on your specialty or circumstances.

- Calculate the number of months: Count the number of months you receive special pay in a year.

- Multiply by the special pay rate: Multiply the number of months by your special pay rate to get your annual special pay.

For example, if you're a diver with a special pay rate of $500 per month, and you receive special pay for 6 months, your annual special pay would be $3,000.

Method 4: Allowance Calculation

Allowances are tax-free payments to help offset the cost of living, food, and other expenses. Here's how to calculate your allowances:

- Determine your allowance rate: Refer to the Army National Guard's allowance chart to find your allowance rate based on your location and circumstances.

- Calculate the number of months: Count the number of months you receive allowances in a year.

- Multiply by the allowance rate: Multiply the number of months by your allowance rate to get your annual allowance.

For example, if you're stationed in a high-cost area with an allowance rate of $1,000 per month, and you receive allowances for 12 months, your annual allowance would be $12,000.

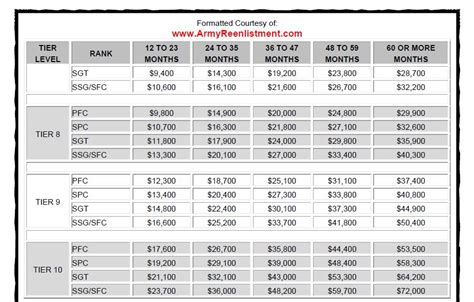

Method 5: Bonus Calculation

Bonuses are one-time payments for enlisting, re-enlisting, or achieving specific milestones. Here's how to calculate your bonus:

- Determine your bonus amount: Refer to the Army National Guard's bonus chart to find your bonus amount based on your enlistment contract or achievement.

- Calculate the bonus: The bonus is a one-time payment, so you can simply use the amount listed on the chart.

For example, if you're eligible for a $10,000 enlistment bonus, that's your total bonus amount.

Army National Guard Pay Image Gallery

How often do I get paid in the Army National Guard?

+You get paid twice a month, on the 1st and 15th of every month.

Do I get paid for drill weekends?

+Yes, you get paid for attending drill weekends, which typically occur once a month.

How much do I get paid for annual training?

+Your pay for annual training depends on your rank and time in service. You can refer to the Army National Guard's pay chart for more information.

By understanding the different components of your Army National Guard pay and using these five methods, you can accurately calculate your compensation and plan your finances accordingly. Remember to regularly review your pay and allowances to ensure you're receiving the correct amount. If you have any questions or concerns, don't hesitate to reach out to your unit's administrative office or a financial advisor for guidance.