Intro

Discover the Armys student loan repayment programs and options, designed to help soldiers pay off debt. Learn about the Loan Repayment Program (LRP), College Loan Repayment Program (CLRP), and other military student loan forgiveness options. Reduce your financial burden and focus on serving with these Army student loan repayment benefits.

Serving in the military comes with numerous benefits, including access to various education and career advancement opportunities. One of the most significant advantages of serving in the army is the availability of student loan repayment programs and options. These programs are designed to help soldiers repay their educational debts, making it easier for them to focus on their military careers and achieve financial stability.

In this article, we will delve into the various army student loan repayment programs and options available to soldiers. We will explore the benefits, eligibility requirements, and application processes for each program, providing you with a comprehensive understanding of the opportunities available to you.

Understanding the Importance of Student Loan Repayment Programs

For many soldiers, student loan debt can be a significant burden. The weight of debt can make it challenging to focus on military service, let alone plan for the future. The army recognizes the importance of providing support to its soldiers, which is why student loan repayment programs are available.

These programs not only help soldiers repay their educational debts but also provide a sense of financial security and stability. By reducing the burden of student loan debt, soldiers can focus on their military careers, achieve their goals, and plan for a brighter future.

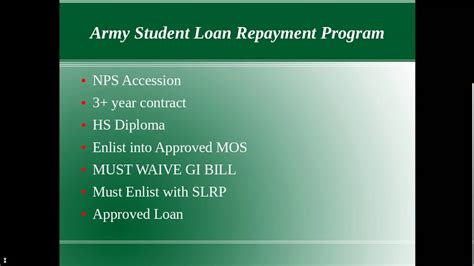

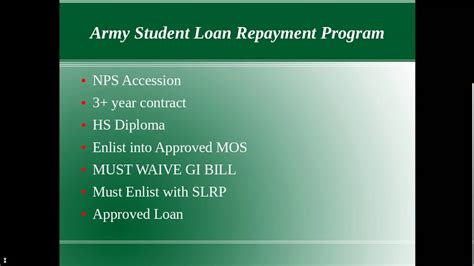

Army Student Loan Repayment Programs

The army offers several student loan repayment programs, each with its own set of benefits and eligibility requirements. Here are some of the most popular programs:

- Army Loan Repayment Program (LRP): The LRP is a popular program that offers up to $65,000 in loan repayment assistance. The program is available to active-duty soldiers who enlist for at least three years and meet specific eligibility requirements.

- National Guard Student Loan Repayment Program: This program is available to National Guard soldiers who enlist for at least six years. The program offers up to $50,000 in loan repayment assistance.

- Army Reserve Student Loan Repayment Program: This program is available to Army Reserve soldiers who enlist for at least six years. The program offers up to $20,000 in loan repayment assistance.

Other Student Loan Repayment Options

In addition to the army's student loan repayment programs, there are other options available to soldiers. Here are some of the most popular options:

- Public Service Loan Forgiveness (PSLF): The PSLF program is available to soldiers who work in public service, including those who serve in the military. The program offers forgiveness of federal student loans after 120 qualifying payments.

- Perkins Loan Cancellation: The Perkins Loan Cancellation program is available to soldiers who serve in the military for at least one year. The program offers cancellation of Perkins Loans, which are federal student loans.

- Income-Driven Repayment (IDR) Plans: IDR plans are available to soldiers who are struggling to repay their federal student loans. The plans offer lower monthly payments based on income and family size.

Eligibility Requirements and Application Processes

To be eligible for the army's student loan repayment programs, soldiers must meet specific requirements, including:

- Enlisting for a minimum of three years (active-duty) or six years (National Guard or Army Reserve)

- Meeting specific credit score requirements

- Having a qualifying student loan debt

- Meeting specific eligibility requirements for each program

To apply for the army's student loan repayment programs, soldiers must submit an application through the Army's Human Resources Command. The application process typically involves submitting documentation, including proof of student loan debt and credit score reports.

Benefits of Army Student Loan Repayment Programs

The army's student loan repayment programs offer numerous benefits to soldiers, including:

- Reduced student loan debt

- Increased financial stability

- Improved credit scores

- Greater flexibility in career choices

- Enhanced sense of financial security

By taking advantage of the army's student loan repayment programs, soldiers can achieve financial stability and focus on their military careers.

Conclusion

In conclusion, the army's student loan repayment programs and options are designed to help soldiers repay their educational debts and achieve financial stability. By understanding the various programs and options available, soldiers can make informed decisions about their financial futures.

We encourage you to explore the army's student loan repayment programs and options in more detail. By doing so, you can take the first step towards achieving financial stability and securing a brighter future.

Gallery of Army Student Loan Repayment Programs and Options

Army Student Loan Repayment Programs and Options Image Gallery

FAQs

What is the Army Loan Repayment Program (LRP)?

+The LRP is a program that offers up to $65,000 in loan repayment assistance to active-duty soldiers who enlist for at least three years and meet specific eligibility requirements.

How do I apply for the Army's student loan repayment programs?

+To apply for the army's student loan repayment programs, soldiers must submit an application through the Army's Human Resources Command. The application process typically involves submitting documentation, including proof of student loan debt and credit score reports.

What are the benefits of the army's student loan repayment programs?

+The benefits of the army's student loan repayment programs include reduced student loan debt, increased financial stability, improved credit scores, greater flexibility in career choices, and enhanced sense of financial security.