Intro

Learn from the downfall of Arthur Andersen and Co, one of the largest accounting firms in history. Discover 7 crucial lessons on corporate governance, risk management, and ethical leadership that can help your business avoid similar pitfalls. Improve your financial management and auditing practices with these valuable insights.

In the early 2000s, the world witnessed the spectacular downfall of two giants in the accounting industry: Arthur Andersen and Coopers & Lybrand (now part of PricewaterhouseCoopers). Both firms were among the largest and most respected in the world, but they succumbed to hubris, greed, and poor decision-making. The consequences were catastrophic, with both firms facing financial ruin, reputational damage, and even extinction. In this article, we will explore seven valuable lessons from the downfall of Arthur Andersen and Coopers & Lybrand.

Lesson 1: Independence is Crucial

Arthur Andersen's demise was largely due to its failure to maintain independence from its clients. The firm's auditing and consulting arms were so intertwined that it became difficult to distinguish between the two. This lack of independence led to a conflict of interest, where Andersen's auditors were too close to their clients to provide objective assessments. In contrast, Coopers & Lybrand managed to maintain some level of independence, but it was still criticized for its close relationships with clients.

Maintaining Independence in Accounting

- Ensure separate auditing and consulting arms

- Establish clear guidelines for auditor independence

- Regularly review and enforce independence policies

Lesson 2: Greed Can be Destructive

Both Arthur Andersen and Coopers & Lybrand were driven by greed, which led them to take on high-risk clients and engagements. In pursuit of short-term gains, they compromised their professional standards and ignored warning signs. The Enron scandal, which involved Andersen, is a classic example of how greed can lead to catastrophic consequences.

The Dangers of Greed in Business

- Prioritize long-term sustainability over short-term gains

- Establish a culture of integrity and professionalism

- Regularly review and enforce risk management policies

Lesson 3: Culture Matters

The culture of both firms played a significant role in their downfall. Arthur Andersen's culture was described as arrogant and dismissive, while Coopers & Lybrand's culture was criticized for being too focused on growth and profit. A toxic culture can lead to poor decision-making, ignoring of warning signs, and a lack of accountability.

Building a Positive Corporate Culture

- Foster a culture of integrity and professionalism

- Encourage open communication and transparency

- Regularly review and enforce cultural standards

Lesson 4: Risk Management is Essential

Both firms failed to manage risk effectively, which led to catastrophic consequences. Arthur Andersen's failure to identify and manage risk led to the Enron scandal, while Coopers & Lybrand's failure to manage risk led to several high-profile audit failures.

Effective Risk Management Strategies

- Establish a risk management framework

- Regularly review and update risk assessments

- Encourage a culture of risk awareness and management

Lesson 5: Regulation is Necessary

The downfall of both firms highlights the need for effective regulation in the accounting industry. The lack of regulation and oversight allowed both firms to engage in questionable practices, which ultimately led to their downfall.

The Importance of Regulation in Accounting

- Establish clear guidelines and standards for accounting firms

- Regularly review and enforce regulatory requirements

- Encourage transparency and accountability in accounting practices

Lesson 6: Leadership Matters

The leadership of both firms played a significant role in their downfall. Arthur Andersen's leadership was criticized for being too focused on growth and profit, while Coopers & Lybrand's leadership was criticized for being too slow to respond to warning signs.

Effective Leadership Strategies

- Establish a clear vision and mission for the firm

- Foster a culture of integrity and professionalism

- Encourage open communication and transparency

Lesson 7: Accountability is Key

The final lesson from the downfall of both firms is the importance of accountability. Both firms failed to hold themselves and their employees accountable for their actions, which led to a lack of transparency and a culture of impunity.

The Importance of Accountability in Accounting

- Establish clear guidelines and standards for accountability

- Regularly review and enforce accountability policies

- Encourage a culture of transparency and accountability

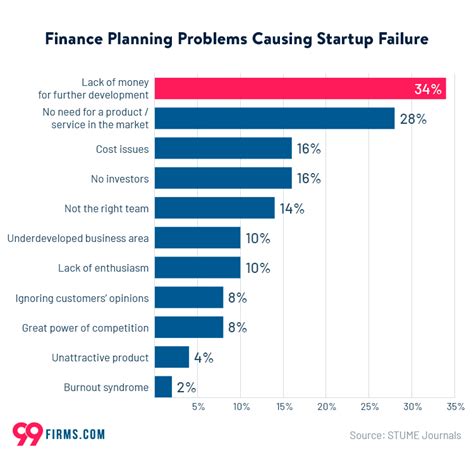

Gallery of Accounting Failure

Accounting Failure Image Gallery

FAQs

What led to the downfall of Arthur Andersen and Coopers & Lybrand?

+Both firms were criticized for their lack of independence, greed, and poor decision-making. They failed to manage risk effectively and ignored warning signs, which ultimately led to their downfall.

What can accounting firms learn from the downfall of Arthur Andersen and Coopers & Lybrand?

+Accounting firms can learn the importance of independence, effective risk management, and a culture of integrity and professionalism. They must also prioritize transparency and accountability and establish clear guidelines and standards for accounting practices.

How can accounting firms prevent similar failures in the future?

+Accounting firms can prevent similar failures by establishing a culture of integrity and professionalism, prioritizing transparency and accountability, and regularly reviewing and enforcing risk management policies and guidelines.

We hope this article has provided valuable insights into the downfall of Arthur Andersen and Coopers & Lybrand. By learning from their mistakes, accounting firms can prevent similar failures and maintain the trust and confidence of their clients and stakeholders.