Intro

Learn how to file Ohio Articles of Incorporation with ease. Discover the step-by-step process for incorporating a business in Ohio, including required documents, filing fees, and processing times. Get expert guidance on Ohio incorporation laws, business entity types, and registered agent requirements to ensure a smooth filing experience.

Ohio Articles of Incorporation: A Step-By-Step Filing Guide

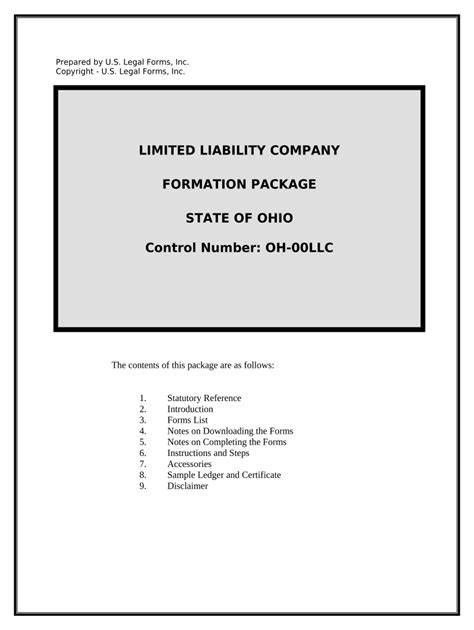

Incorporating a business in Ohio can seem like a daunting task, but with the right guidance, it can be a smooth and efficient process. One of the most critical steps in incorporating a business in Ohio is filing the Articles of Incorporation. In this article, we will provide a step-by-step guide on how to file the Ohio Articles of Incorporation, ensuring that you have all the necessary information to get started.

Why File Articles of Incorporation in Ohio?

Filing the Articles of Incorporation in Ohio is a crucial step in incorporating a business. The Articles of Incorporation serve as the foundation of a corporation, outlining its purpose, structure, and powers. By filing the Articles of Incorporation, you are officially creating a corporation in the state of Ohio, which provides several benefits, including:

- Limited liability protection for shareholders

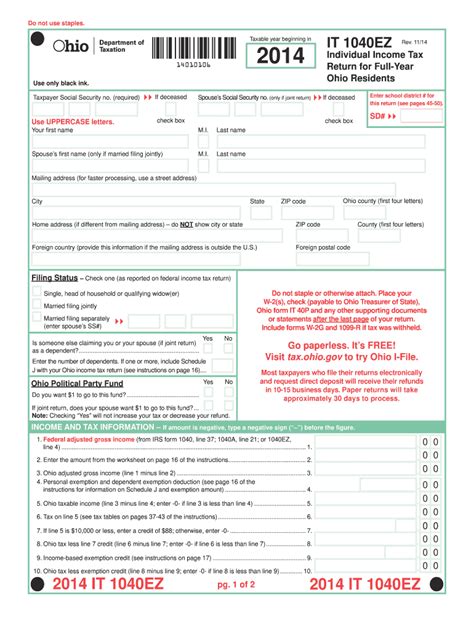

- Tax benefits

- Increased credibility and legitimacy

- Ability to raise capital through stock sales

What Information is Required for the Ohio Articles of Incorporation?

To file the Ohio Articles of Incorporation, you will need to provide the following information:

- Corporation name and address

- Purpose of the corporation

- Number of shares authorized

- Par value of shares

- Director and officer information

- Registered agent information

- Incorporator information

Ohio Articles of Incorporation Filing Requirements

Before filing the Ohio Articles of Incorporation, you must ensure that you meet the following requirements:

- The corporation name must be unique and not already in use by another Ohio corporation.

- The corporation name must include the word "Corporation," "Company," "Incorporated," or an abbreviation of one of these words.

- The corporation must have a registered agent in Ohio who is authorized to receive service of process on behalf of the corporation.

- The corporation must have at least one incorporator who signs the Articles of Incorporation.

How to File the Ohio Articles of Incorporation

To file the Ohio Articles of Incorporation, follow these steps:

- Prepare the Articles of Incorporation:

- Draft the Articles of Incorporation, ensuring that all required information is included.

- Have the incorporator sign the Articles of Incorporation.

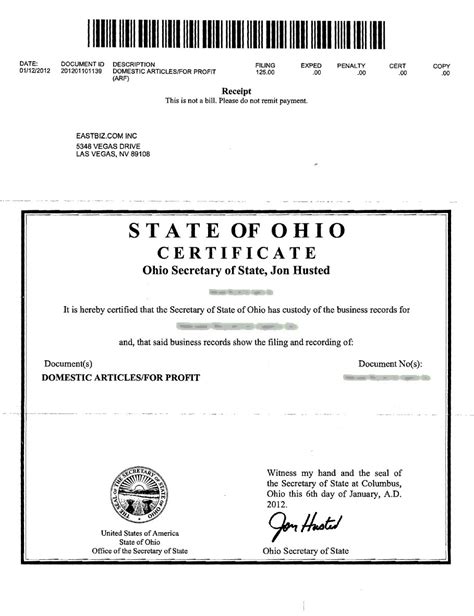

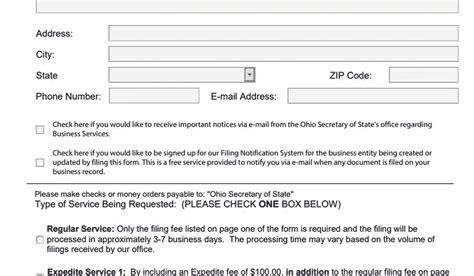

- File the Articles of Incorporation with the Ohio Secretary of State:

- Submit the signed Articles of Incorporation to the Ohio Secretary of State's office.

- Pay the filing fee of $125.

- Wait for the Ohio Secretary of State to process the filing, which typically takes 2-3 business days.

Ohio Articles of Incorporation Filing Fee

The filing fee for the Ohio Articles of Incorporation is $125. This fee must be paid when submitting the Articles of Incorporation to the Ohio Secretary of State's office.

How Long Does it Take to File the Ohio Articles of Incorporation?

The processing time for the Ohio Articles of Incorporation typically takes 2-3 business days. However, this time may vary depending on the workload of the Ohio Secretary of State's office.

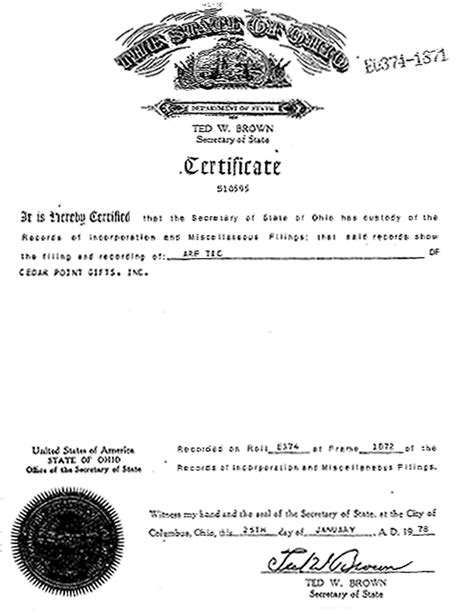

What Happens After Filing the Ohio Articles of Incorporation?

After filing the Ohio Articles of Incorporation, you will receive a Certificate of Incorporation from the Ohio Secretary of State's office. This certificate serves as proof that your corporation has been officially formed in the state of Ohio.

Conclusion

Filing the Ohio Articles of Incorporation is a critical step in incorporating a business in Ohio. By following the steps outlined in this guide, you can ensure that your corporation is properly formed and authorized to conduct business in the state of Ohio. Remember to carefully review the Ohio Revised Code and consult with an attorney or business professional if you have any questions or concerns about the incorporation process.

Benefits of Filing the Ohio Articles of Incorporation

By filing the Ohio Articles of Incorporation, your corporation will enjoy the following benefits:

- Limited liability protection for shareholders

- Tax benefits

- Increased credibility and legitimacy

- Ability to raise capital through stock sales

Common Mistakes to Avoid When Filing the Ohio Articles of Incorporation

When filing the Ohio Articles of Incorporation, it's essential to avoid common mistakes that can delay or reject your filing. Here are some common mistakes to avoid:

- Failing to provide required information

- Using a corporation name that is already in use

- Failing to have the incorporator sign the Articles of Incorporation

- Failing to pay the filing fee

Gallery of Ohio Incorporation

Ohio Incorporation Image Gallery

FAQs

Here are some frequently asked questions about filing the Ohio Articles of Incorporation:

What is the purpose of the Ohio Articles of Incorporation?

+The Ohio Articles of Incorporation serve as the foundation of a corporation, outlining its purpose, structure, and powers.

How long does it take to file the Ohio Articles of Incorporation?

+The processing time for the Ohio Articles of Incorporation typically takes 2-3 business days.

What is the filing fee for the Ohio Articles of Incorporation?

+The filing fee for the Ohio Articles of Incorporation is $125.