Intro

Discover the Assigned On Calendar Call Option, a strategic investment tool using calendar spreads, options trading, and volatility management for profitable returns.

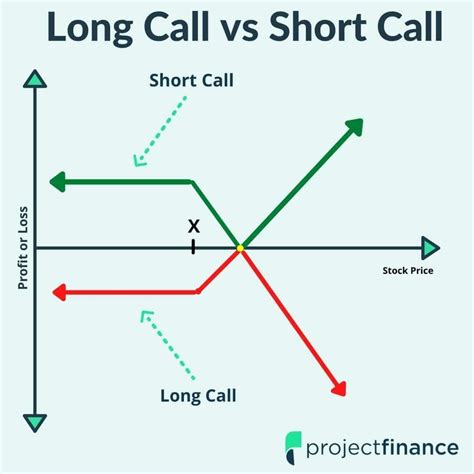

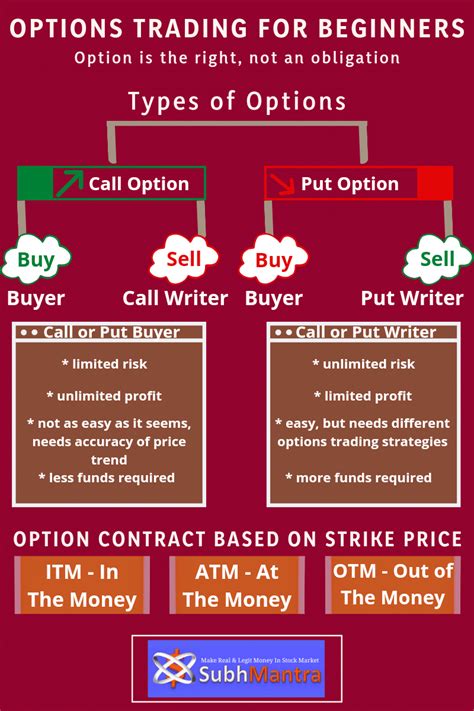

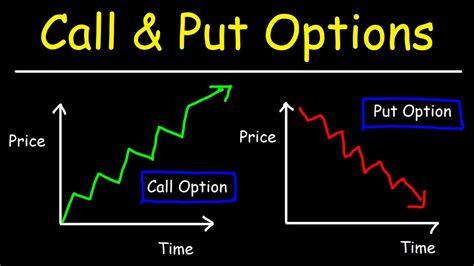

The concept of an assigned on calendar call option is a crucial aspect of financial markets, particularly in the realm of options trading. Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) before a certain date (expiration date). A call option, specifically, grants the buyer the right to buy the underlying asset. When an option is assigned, it means the seller (writer) of the option is obligated to fulfill the terms of the contract if the buyer decides to exercise their option.

Understanding the intricacies of options trading, including the assignment process, is vital for both novice and experienced traders. The strategic use of call options can provide investors with a versatile tool for managing risk, speculating on price movements, and generating income. However, the nuances of how and when options are assigned can significantly impact trading strategies and outcomes.

The process of assignment occurs when the holder of a call option decides to exercise their right to buy the underlying asset at the strike price. This decision is typically made when the market price of the underlying asset is above the strike price, making it beneficial for the buyer to purchase at the lower strike price and immediately sell at the higher market price, thereby profiting from the difference. When the buyer exercises their option, the seller (writer) of the call option is assigned and must sell the underlying asset at the strike price, regardless of the current market price.

Understanding Call Options

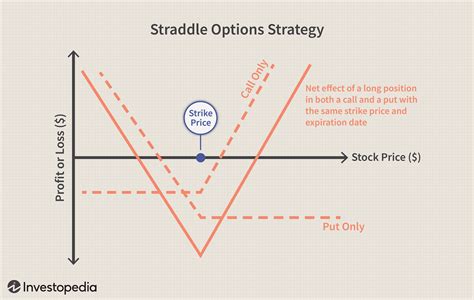

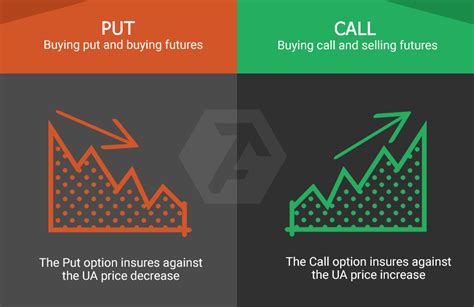

Call options are a popular financial instrument used for speculation and hedging. Speculators use call options to bet on the price increase of an asset, while investors might use them to hedge against potential losses in their portfolios. For instance, if an investor holds a significant position in a particular stock and is concerned about a potential decline in its price, they might buy a call option on a related asset or index to mitigate potential losses.

Key Components of Call Options

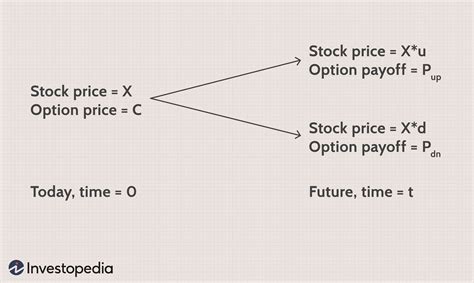

The key components of call options include the strike price, expiration date, and premium. The strike price is the predetermined price at which the buyer can buy the underlying asset. The expiration date is the last day on which the option can be exercised. The premium is the price of the option contract, which the buyer pays to the seller.Assignment Process

The assignment process in options trading is facilitated by the Options Clearing Corporation (OCC) in the United States and similar entities in other countries. These organizations act as intermediaries between buyers and sellers, ensuring that options contracts are properly executed. When a buyer exercises their call option, the OCC randomly assigns the exercise notice to a seller (or writers) of the same option series (same underlying asset, strike price, and expiration date).

Factors Influencing Assignment

Several factors can influence whether an option is assigned, including the option's liquidity, the trader's account status, and the trading system's rules. In general, options with high liquidity and those that are deeply in the money (i.e., the strike price is significantly below the current market price) are more likely to be exercised and thus assigned.Strategies for Managing Assignment Risk

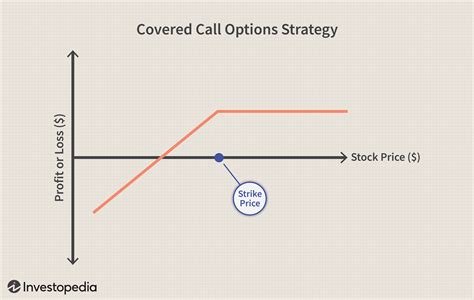

To manage the risk of assignment, option sellers can employ several strategies. One common approach is to close out the option position before expiration by buying back the option. This strategy can help avoid assignment if the trader believes the option is likely to be exercised. Another strategy is to hedge the potential assignment by holding a long position in the underlying asset, thereby covering the obligation to sell the asset if assigned.

Benefits and Risks of Selling Call Options

Selling (writing) call options can provide traders with a regular income stream from the premiums received. However, it also exposes them to the risk of assignment and potential losses if the market price of the underlying asset rises significantly above the strike price. Therefore, traders must carefully consider their risk tolerance and market outlook before engaging in call option selling.Practical Applications and Examples

To illustrate the concept of assigned on calendar call options, consider a scenario where an investor buys a call option to purchase 100 shares of XYZ stock at $50 per share, with the expiration date in three months. If, at expiration, XYZ stock is trading at $60, the buyer is likely to exercise the option, and the seller will be assigned, obligated to sell 100 shares of XYZ stock at $50, even though the market price is $60.

Statistical Data and Research

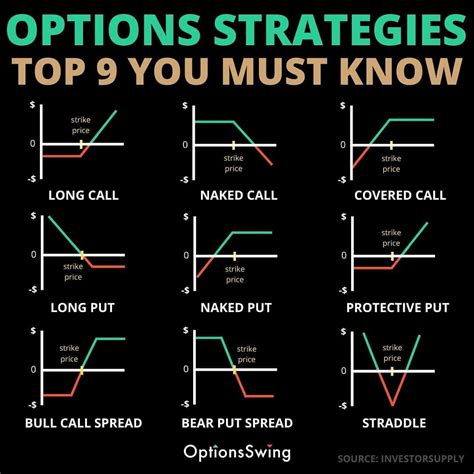

Research has shown that options trading, including the use of call options, can be an effective strategy for managing portfolio risk and generating returns. However, the success of such strategies depends on a deep understanding of options markets, volatility, and the factors that influence option pricing and assignment.Gallery of Options Trading Strategies

Options Trading Strategies Gallery

Frequently Asked Questions

What is a call option in trading?

+A call option is a financial contract that gives the buyer the right, but not the obligation, to buy an underlying asset at a specified price (strike price) before a certain date (expiration date).

How does the assignment process work in options trading?

+The assignment process occurs when the buyer of a call option exercises their right to buy the underlying asset. The seller (writer) of the option is then assigned and must sell the asset at the strike price, regardless of the current market price.

What strategies can option sellers use to manage assignment risk?

+Option sellers can manage assignment risk by closing out their option position before expiration, hedging their potential obligation by holding the underlying asset, or using other options trading strategies to mitigate risk.

In conclusion, understanding the concept of assigned on calendar call options and how they work is essential for navigating the complex world of options trading. By grasping the mechanics of call options, including the assignment process and strategies for managing risk, traders can make more informed decisions and potentially enhance their trading outcomes. Whether you are a seasoned trader or just starting to explore the world of options, delving into the intricacies of call options can provide valuable insights and opportunities for growth. We invite you to share your thoughts and experiences with options trading, and to explore further the many strategies and tools available for successfully navigating the markets.