Intro

Discover 5 ways bill sale strategies can boost cash flow, reduce invoicing headaches, and improve financial management through effective invoice discounting, factoring, and accounts receivable financing techniques.

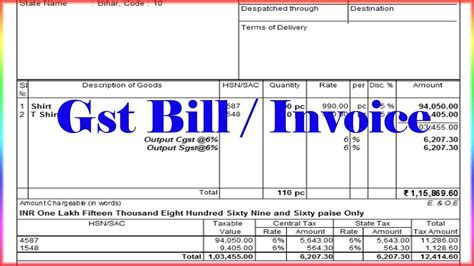

The concept of bill sales has become increasingly popular in recent years, particularly among businesses and individuals looking to manage their cash flow more effectively. At its core, a bill sale, also known as factoring, involves selling outstanding invoices or bills to a third party at a discounted rate. This practice allows businesses to receive immediate payment for their invoices, rather than waiting for the payment term to expire. In this article, we will delve into the world of bill sales, exploring what it entails, its benefits, and how it works.

Bill sales can be a lifesaver for businesses facing cash flow problems. When a company provides goods or services to its clients, it often has to wait for a considerable amount of time before receiving payment. This waiting period can put a strain on the company's finances, making it difficult to pay employees, purchase new inventory, or invest in growth opportunities. By selling their bills to a factoring company, businesses can bypass this waiting period and receive the funds they need to keep their operations running smoothly.

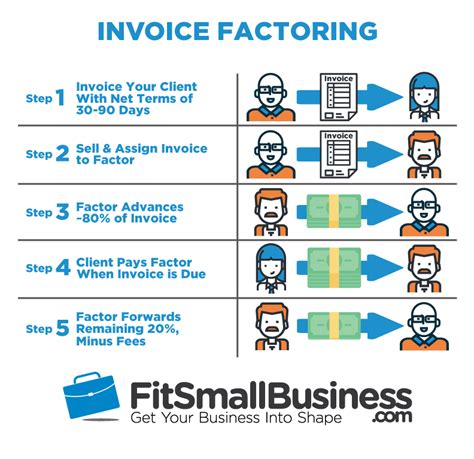

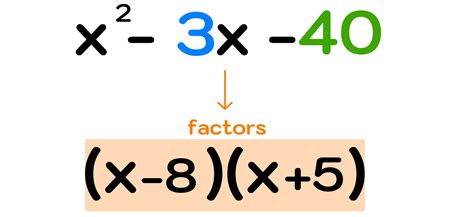

The process of selling bills is relatively straightforward. A business will typically submit its outstanding invoices to a factoring company, which will then verify the invoices and assess the creditworthiness of the clients. Once the factoring company is satisfied that the invoices are valid and the clients are creditworthy, it will purchase the invoices at a discounted rate. The discount rate will depend on various factors, including the creditworthiness of the clients, the age of the invoices, and the industry in which the business operates. The factoring company will then collect payment from the clients, providing the business with the funds it needs to continue operating.

Benefits of Bill Sales

The benefits of bill sales are numerous. For one, it provides businesses with immediate access to cash, allowing them to manage their finances more effectively. This can be particularly beneficial for businesses that have a high volume of outstanding invoices, as it enables them to free up capital that would otherwise be tied up in accounts receivable. Additionally, bill sales can help businesses to reduce their bad debt expenses, as the factoring company will typically assume the risk of non-payment. This can be a significant advantage for businesses that operate in industries with a high risk of non-payment.

Another benefit of bill sales is that it can help businesses to improve their credit rating. By selling their invoices to a factoring company, businesses can demonstrate a steady cash flow, which can improve their creditworthiness in the eyes of lenders. This can be particularly beneficial for businesses that are looking to secure funding for growth opportunities or to refinance existing debt. Furthermore, bill sales can provide businesses with the flexibility they need to respond to changing market conditions. By having access to immediate cash, businesses can quickly adapt to new opportunities or challenges, giving them a competitive edge in their industry.

How Bill Sales Work

The process of selling bills is relatively simple. Here are the steps involved: * A business will typically submit its outstanding invoices to a factoring company. * The factoring company will verify the invoices and assess the creditworthiness of the clients. * Once the factoring company is satisfied that the invoices are valid and the clients are creditworthy, it will purchase the invoices at a discounted rate. * The factoring company will then collect payment from the clients. * The business will receive the funds it needs to continue operating, minus a small fee for the factoring company's services.Types of Bill Sales

There are several types of bill sales, each with its own unique characteristics. The most common type of bill sale is known as recourse factoring. In this type of arrangement, the business selling the invoices is responsible for paying back the factoring company if the client fails to pay. This type of arrangement is typically used for businesses that have a high volume of outstanding invoices and are looking to free up capital.

Another type of bill sale is known as non-recourse factoring. In this type of arrangement, the factoring company assumes the risk of non-payment, and the business selling the invoices is not responsible for paying back the factoring company if the client fails to pay. This type of arrangement is typically used for businesses that operate in industries with a high risk of non-payment.

Benefits of Different Types of Bill Sales

The benefits of different types of bill sales will depend on the specific needs of the business. For example: * Recourse factoring can provide businesses with immediate access to cash, allowing them to manage their finances more effectively. * Non-recourse factoring can help businesses to reduce their bad debt expenses, as the factoring company will assume the risk of non-payment. *Spot factoring can provide businesses with the flexibility they need to respond to changing market conditions, as it allows them to sell individual invoices rather than a large volume of invoices.Common Mistakes to Avoid in Bill Sales

While bill sales can be a highly effective way for businesses to manage their cash flow, there are several common mistakes that businesses should avoid. One of the most common mistakes is failing to properly vet the factoring company. This can lead to businesses working with a factoring company that is not reputable or that does not have the necessary experience to handle their invoices.

Another common mistake is failing to read the fine print of the factoring agreement. This can lead to businesses being locked into a contract that is not in their best interests, or that includes hidden fees or charges. Businesses should always carefully review the terms of the factoring agreement before signing, and should seek the advice of a lawyer or financial advisor if necessary.

Best Practices for Bill Sales

To get the most out of bill sales, businesses should follow several best practices. These include: * Carefully vetting the factoring company to ensure that it is reputable and experienced. * Reading the fine print of the factoring agreement to ensure that it is in the best interests of the business. * Providing accurate and complete information about the invoices being sold. * Communicating clearly and regularly with the factoring company to ensure that the process runs smoothly.For more information on managing cash flow, check out our article on cash flow management strategies.

Real-Life Examples of Bill Sales

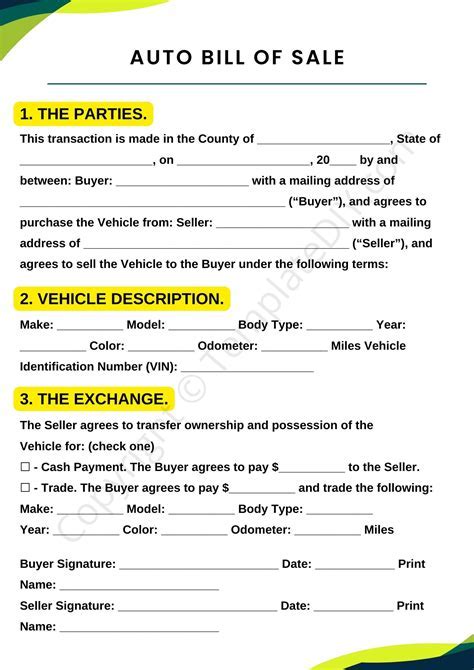

Bill sales are used by businesses of all sizes and in all industries. For example, a small business that provides consulting services to large corporations may use bill sales to manage its cash flow. The business may submit its outstanding invoices to a factoring company, which will then purchase the invoices at a discounted rate. The factoring company will then collect payment from the corporations, providing the small business with the funds it needs to continue operating.

Another example of bill sales is a large manufacturing company that sells its products to retailers. The manufacturing company may use bill sales to manage its cash flow, submitting its outstanding invoices to a factoring company and receiving immediate payment. The factoring company will then collect payment from the retailers, providing the manufacturing company with the funds it needs to continue producing products.

Case Studies of Bill Sales

Several case studies have demonstrated the effectiveness of bill sales in managing cash flow. For example: * A small business that used bill sales to manage its cash flow was able to increase its revenue by 20% within a year. * A large manufacturing company that used bill sales was able to reduce its bad debt expenses by 30%. * A business that used bill sales to manage its cash flow was able to secure funding for growth opportunities, leading to a significant increase in revenue and profitability.Bill Sales Image Gallery

What is bill sales?

+Bill sales, also known as factoring, is the process of selling outstanding invoices or bills to a third party at a discounted rate.

How does bill sales work?

+The process of selling bills involves submitting outstanding invoices to a factoring company, which will then verify the invoices and assess the creditworthiness of the clients. Once the factoring company is satisfied that the invoices are valid and the clients are creditworthy, it will purchase the invoices at a discounted rate.

What are the benefits of bill sales?

+The benefits of bill sales include immediate access to cash, reduced bad debt expenses, and improved credit rating. Additionally, bill sales can provide businesses with the flexibility they need to respond to changing market conditions.

What are the different types of bill sales?

+There are several types of bill sales, including recourse factoring, non-recourse factoring, and spot factoring. Each type of factoring has its own unique characteristics and benefits.

How can businesses get the most out of bill sales?

+To get the most out of bill sales, businesses should carefully vet the factoring company, read the fine print of the factoring agreement, and provide accurate and complete information about the invoices being sold. Additionally, businesses should communicate clearly and regularly with the factoring company to ensure that the process runs smoothly.

In conclusion, bill sales can be a highly effective way for businesses to manage their cash flow and improve their financial stability. By understanding the benefits and types of bill sales, businesses can make informed decisions about whether this financing option is right for them. We encourage readers to share their experiences with bill sales in the comments below and to reach out to us if they have any further questions. Additionally, we invite readers to share this article with their colleagues and friends who may be interested in learning more about bill sales. By working together, we can help businesses of all sizes and industries to achieve their financial goals and succeed in today's competitive market.