Intro

Maximize your Basic Housing Allowance (BAH) as a National Guard member with these expert tips. Learn how to optimize your BAH rate, navigate the BAH calculator, and understand the impact of zip code, dependency status, and rank on your allowance. Boost your benefits and make the most of your service with these 5 actionable strategies.

As a member of the National Guard, understanding how to maximize your Basic Housing Allowance (BAH) can help you make the most of your military benefits. BAH is a tax-free allowance provided to help offset the cost of housing, and with some planning and knowledge, you can use it to your advantage.

In this article, we will explore five ways to maximize your Basic Housing Allowance as a National Guard member.

Understanding Basic Housing Allowance

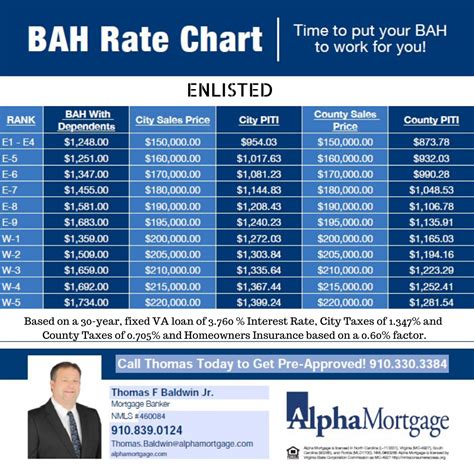

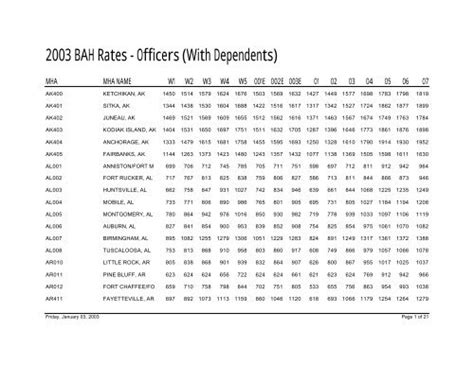

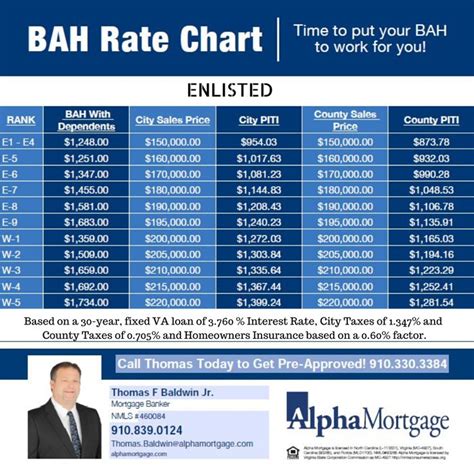

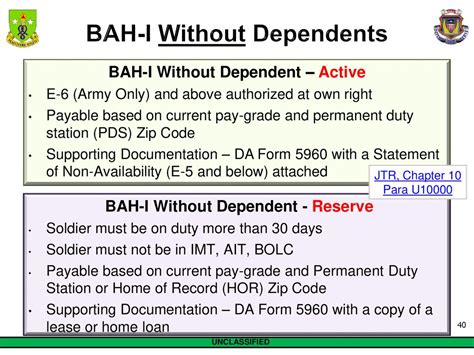

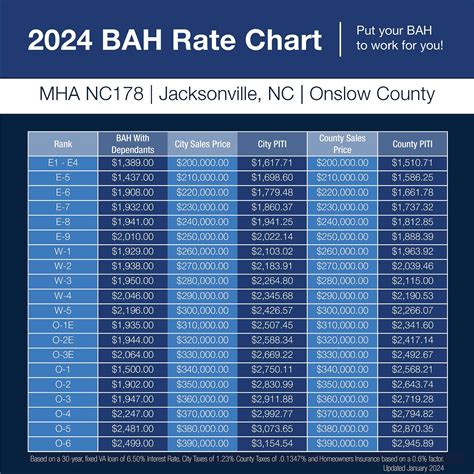

Before we dive into maximizing your BAH, it's essential to understand how it works. BAH is based on the location where you are assigned, your pay grade, and your dependency status. The allowance is intended to cover a significant portion of your housing costs, but it may not cover all of them.

To maximize your BAH, you need to understand the different rates and how they apply to your situation. The rates are adjusted annually, so it's crucial to stay up-to-date with the latest information.

1. Choose Your Housing Wisely

The first step to maximizing your BAH is to choose your housing wisely. Consider the cost of living in your area and the average rent prices. Look for housing options that fit within your BAH rate, so you're not overspending.

You can use online resources, such as the Department of Defense's BAH calculator, to determine the BAH rate for your area. This will give you an idea of how much you can afford to spend on housing.

Consider the Following Factors:

- Rent prices: Look for areas with lower rent prices to maximize your BAH.

- Location: Consider the location and proximity to your unit, work, and other essential services.

- Amenities: Think about the amenities you need, such as a yard or pool, and factor them into your decision.

2. Take Advantage of BAH Rates for Dependents

If you have dependents, you may be eligible for a higher BAH rate. The dependent rate is typically higher than the without-dependent rate, so it's essential to understand how this affects your BAH.

Make sure to update your dependent information with the National Guard to ensure you're receiving the correct BAH rate. You can also use the BAH calculator to determine the rate for your area with dependents.

What Constitutes a Dependent?

- Spouse

- Children under the age of 23

- Children with disabilities

- Other dependents, such as parents or siblings, may also be eligible

3. Use BAH to Pay Off Debt or Build Savings

If you're receiving a higher BAH rate than you need to cover your housing costs, consider using the excess funds to pay off debt or build savings. This can help you achieve financial stability and make the most of your military benefits.

Create a budget that accounts for your BAH and other income, and prioritize debt repayment or savings goals. You can also consider automating your savings or debt payments to make it easier to stick to your goals.

Benefits of Using BAH for Debt Repayment or Savings:

- Reduces debt and financial stress

- Builds savings and emergency funds

- Improves financial stability and security

4. Leverage BAH to Invest in Your Future

BAH can also be used to invest in your future, whether that's pursuing higher education or starting a business. Consider using your BAH to cover education expenses or invest in a small business venture.

You can also use tax-advantaged accounts, such as a Roth IRA or Thrift Savings Plan, to save for retirement or other long-term goals.

Benefits of Using BAH for Investing:

- Pursues higher education or career advancement

- Starts a small business or side hustle

- Builds wealth and secures financial future

5. Monitor BAH Rates and Adjust Accordingly

Finally, it's essential to monitor BAH rates and adjust your budget accordingly. Rates can change annually, so it's crucial to stay informed and adjust your spending habits to maximize your BAH.

You can use online resources, such as the Department of Defense's BAH calculator, to stay up-to-date with the latest rates and make informed decisions about your housing and finances.

Benefits of Monitoring BAH Rates:

- Stays informed about changes to BAH rates

- Adjusts budget and spending habits accordingly

- Maximizes BAH benefits and achieves financial stability

Basic Housing Allowance Gallery

How is BAH calculated?

+BAH is calculated based on the location where you are assigned, your pay grade, and your dependency status.

Can I use BAH to pay off debt?

+Yes, you can use BAH to pay off debt, such as credit cards, student loans, or mortgages.

How often do BAH rates change?

+BAH rates typically change annually, so it's essential to stay informed and adjust your budget accordingly.

Can I use BAH to invest in my future?

+Yes, you can use BAH to invest in your future, such as pursuing higher education or starting a small business.

How do I monitor BAH rates?

+You can use online resources, such as the Department of Defense's BAH calculator, to stay up-to-date with the latest rates and make informed decisions about your housing and finances.

In conclusion, maximizing your Basic Housing Allowance as a National Guard member requires understanding how BAH works, choosing your housing wisely, taking advantage of BAH rates for dependents, using BAH to pay off debt or build savings, leveraging BAH to invest in your future, and monitoring BAH rates and adjusting accordingly. By following these tips, you can make the most of your military benefits and achieve financial stability.