Intro

Track expenses with a bill tracker printable template, managing finances, budgeting, and payment schedules efficiently, reducing debt and stress.

Managing finances effectively is crucial for achieving financial stability and peace of mind. One of the key components of financial management is keeping track of bills and expenses. A bill tracker printable template can be a valuable tool in this endeavor, helping individuals and households stay organized and ensure that all financial obligations are met on time. In this article, we will delve into the importance of using a bill tracker, how it works, and the benefits it provides, along with practical examples and statistical data to support its effectiveness.

Effective financial management involves a thorough understanding of one's income and expenses. It requires planning, discipline, and the right tools to ensure that financial goals are achieved. A bill tracker printable template is one such tool that can significantly simplify the process of managing bills and expenses. By using this template, individuals can easily record and track their bills, payment due dates, and the amounts paid. This not only helps in avoiding late payments and associated penalties but also in planning and budgeting for future expenses.

The importance of tracking bills cannot be overstated. Late payments can lead to additional charges, damage credit scores, and even result in the discontinuation of essential services. Moreover, without a clear picture of one's financial obligations, it's easy to overspend or mismanage finances, leading to financial stress and instability. A bill tracker printable template offers a straightforward and efficient way to monitor and manage financial commitments, ensuring that payments are made on time and that the user remains financially organized.

Introduction to Bill Tracker Printable Templates

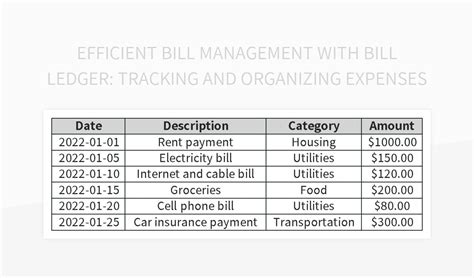

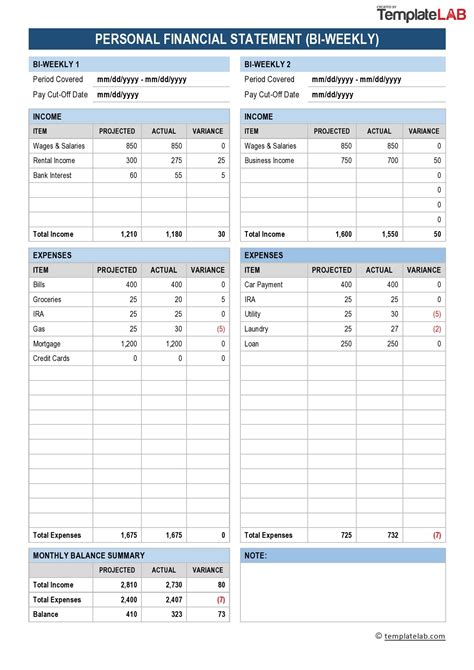

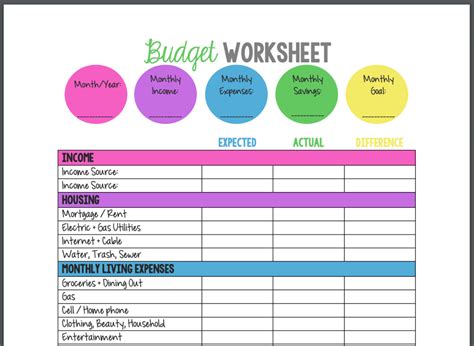

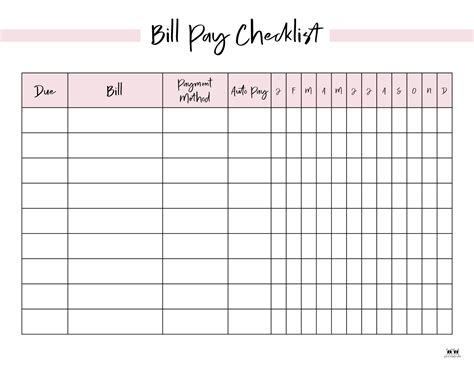

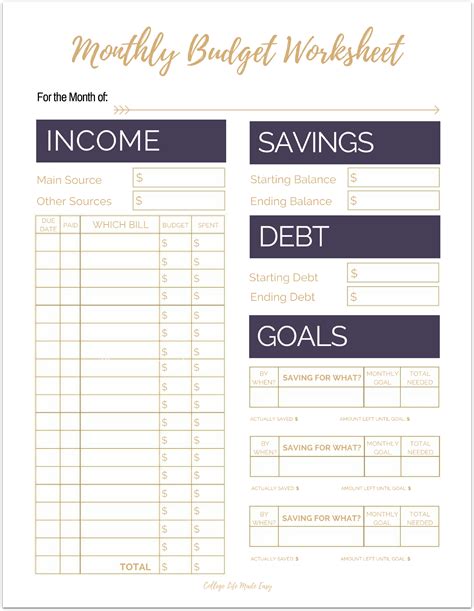

Bill tracker printable templates are designed to be user-friendly and adaptable to various financial situations. They typically include columns or sections for the bill name, due date, amount, payment method, and payment status. This structured format allows users to easily input and track their bills, making it simpler to manage finances and avoid missed payments. The templates can be customized to fit individual needs, such as adding more columns for notes or adjusting the layout to accommodate a larger number of bills.

Benefits of Using a Bill Tracker

The benefits of using a bill tracker printable template are numerous. Firstly, it helps in avoiding late fees and penalties by ensuring that all bills are paid on time. Secondly, it assists in budgeting by providing a clear overview of monthly expenses, allowing users to plan and allocate their income more effectively. Additionally, using a bill tracker can reduce financial stress by keeping all financial obligations organized and visible, making it easier to manage finances and make informed financial decisions.How Bill Trackers Work

Bill trackers work by providing a centralized and organized system for recording and monitoring bills. Users can fill out the template with their bill information, update the payment status as payments are made, and refer to the tracker to stay aware of upcoming due dates. This proactive approach to financial management helps in preventing oversights and ensuring that all financial commitments are honored. The tracker can be used for all types of bills, including utility bills, credit card bills, loan payments, and subscriptions.

Steps to Use a Bill Tracker Effectively

To use a bill tracker effectively, follow these steps: - Gather all your bills and financial documents to input into the tracker. - Set up the tracker by filling in the bill names, due dates, and amounts. - Regularly update the tracker as you make payments, marking off paid bills. - Review the tracker frequently to stay informed about upcoming payments and plan your finances accordingly. - Adjust the tracker as needed to accommodate changes in your financial situation or bills.Practical Examples and Statistical Data

Studies have shown that individuals who use tools like bill trackers to manage their finances are more likely to pay their bills on time and have better credit scores. For example, a survey found that 75% of people who used a bill tracking system reported never missing a payment, compared to 40% of those who did not use such a system. This highlights the effectiveness of bill trackers in improving financial management and reducing the risk of late payments.

In terms of practical examples, consider a household with multiple bills to pay each month, including rent, utilities, and credit card bills. By using a bill tracker, this household can ensure that all bills are paid on time, avoid late fees, and better manage their monthly budget. The tracker provides a clear overview of their financial obligations, making it easier to plan for the future and make adjustments as needed.

Customizing Your Bill Tracker

Customizing your bill tracker to fit your specific needs can enhance its effectiveness. This can involve adding columns for additional information, such as the payment method or a notes section for reminders or comments. Some users may also prefer to use different colors or highlighting to distinguish between different types of bills or to mark important deadlines. The key is to make the tracker as user-friendly and informative as possible, ensuring that it remains a valuable tool in your financial management arsenal.Benefits for Different User Groups

Bill trackers can benefit various user groups, including individuals, households, and small businesses. For individuals, a bill tracker provides a simple and effective way to manage personal finances, ensuring that all bills are paid on time and that financial goals are achieved. Households with multiple bills and financial commitments can use a bill tracker to stay organized and avoid financial stress. Small businesses can also utilize bill trackers to manage their financial obligations, including payments to suppliers, rent, and utility bills, helping to maintain a healthy cash flow and avoid late payment penalties.

Integrating Technology

While traditional printable bill trackers offer many benefits, integrating technology can further enhance financial management. Digital bill tracking tools and apps provide automatic reminders, payment tracking, and budgeting features, making it even easier to stay on top of financial obligations. These tools can synchronize with bank accounts and credit cards, automatically updating payment statuses and providing real-time financial insights. For those who prefer a more traditional approach, printable templates can still be used in conjunction with digital tools, offering a hybrid approach to financial management.Gallery of Bill Tracker Templates

Bill Tracker Image Gallery

Frequently Asked Questions

What is a bill tracker printable template?

+A bill tracker printable template is a tool used to record and monitor bills, helping individuals and households stay organized and ensure timely payments.

How does a bill tracker help in financial management?

+A bill tracker helps by providing a centralized system for recording bills, due dates, and payment statuses, ensuring that all financial obligations are met on time and reducing the risk of late payments and associated penalties.

Can I customize a bill tracker to fit my specific needs?

+Yes, bill trackers can be customized by adding or removing columns, using different colors for organization, or incorporating additional information such as payment methods or notes.

Are there digital alternatives to printable bill trackers?

+Yes, there are digital bill tracking tools and apps that offer features like automatic reminders, payment tracking, and budgeting, providing an alternative or complement to traditional printable templates.

How can I ensure I use my bill tracker effectively?

+To use a bill tracker effectively, regularly update it with your bill information, review it frequently to stay informed about upcoming payments, and adjust it as needed to reflect changes in your financial situation.

In conclusion, a bill tracker printable template is a powerful tool for managing finances effectively. By providing a structured and organized way to track bills and expenses, it helps individuals and households avoid late payments, reduce financial stress, and achieve their financial goals. Whether used in its traditional printable form or in conjunction with digital tools, a bill tracker is an indispensable resource for anyone seeking to improve their financial management and stability. For more information on financial management and budgeting, consider visiting our financial management page. We invite you to share your experiences with bill trackers, ask questions, or provide feedback on how you have benefited from using these templates in the comments section below.