Intro

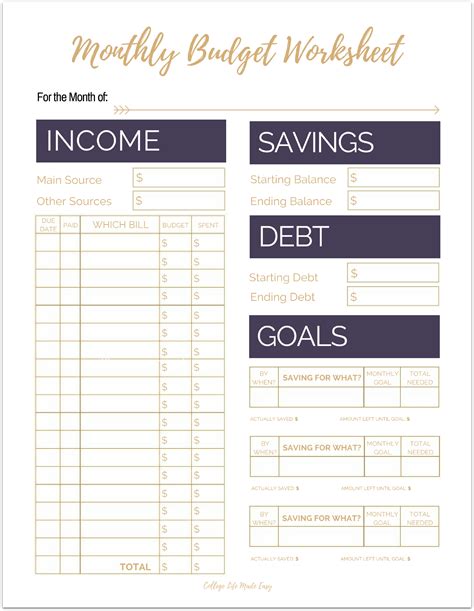

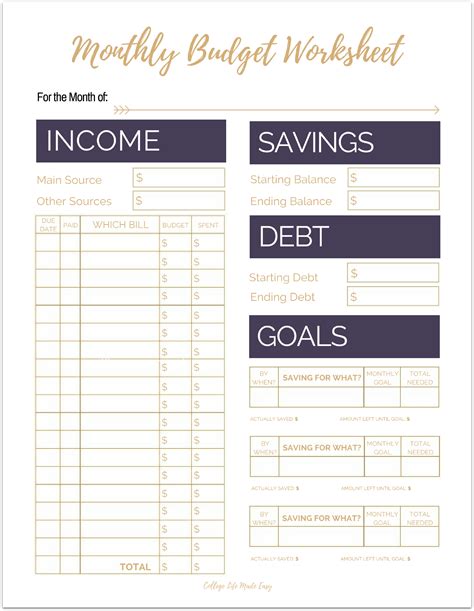

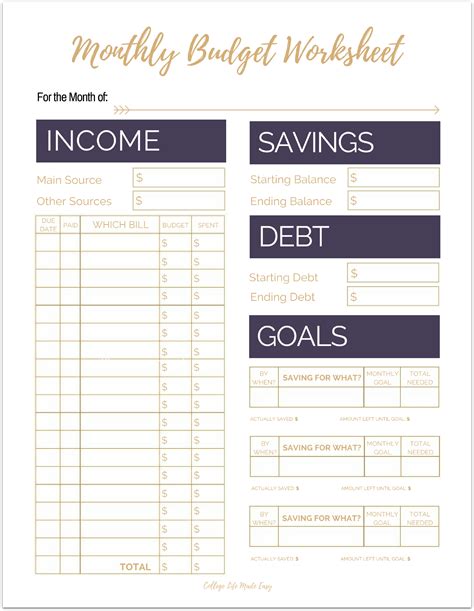

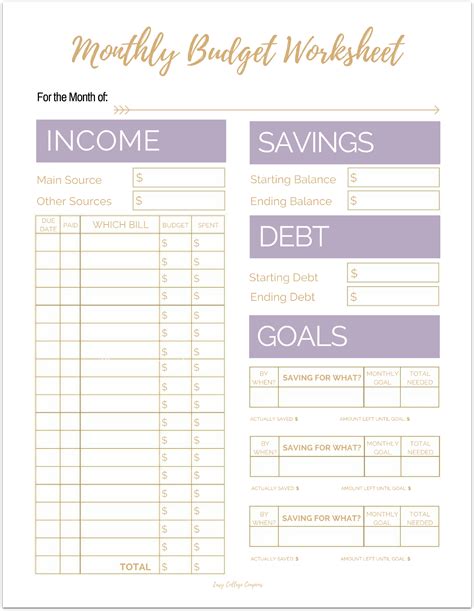

Create a personalized budget with a free budget sheet printable template, featuring expense trackers, financial planners, and budgeting worksheets to manage income, expenses, and savings effectively.

Creating a budget is an essential step in managing one's finances effectively. It helps individuals track their income and expenses, make informed financial decisions, and achieve their long-term financial goals. A budget sheet printable template is a valuable tool that can simplify the budgeting process. In this article, we will delve into the importance of budgeting, the benefits of using a budget sheet printable template, and provide guidance on how to create and use one.

Budgeting is crucial for individuals, families, and businesses alike. It allows them to allocate their financial resources efficiently, prioritize their spending, and make adjustments as needed. Without a budget, it's easy to overspend, accumulate debt, and struggle financially. A budget sheet printable template provides a structured approach to budgeting, making it easier to stay on track and achieve financial stability.

A budget sheet printable template offers several benefits. It helps individuals identify areas where they can cut back on unnecessary expenses, create a plan for saving and investing, and develop healthy financial habits. With a budget sheet printable template, users can track their income and expenses, categorize their spending, and set realistic financial goals. This template can be customized to suit individual needs, making it a versatile tool for anyone looking to improve their financial management.

Benefits of Using a Budget Sheet Printable Template

Using a budget sheet printable template offers numerous benefits. Some of the key advantages include:

- Simplified budgeting process: A budget sheet printable template provides a clear and structured approach to budgeting, making it easier to track income and expenses.

- Customization: Users can tailor the template to suit their individual needs, adding or removing categories as necessary.

- Improved financial awareness: By categorizing expenses and tracking spending, individuals can gain a better understanding of their financial habits and make informed decisions.

- Enhanced savings: A budget sheet printable template helps users identify areas where they can cut back on unnecessary expenses, allowing them to allocate more funds towards savings and investments.

- Reduced financial stress: By creating a realistic budget and sticking to it, individuals can reduce financial stress and anxiety, enjoying a more stable and secure financial future.

How to Create a Budget Sheet Printable Template

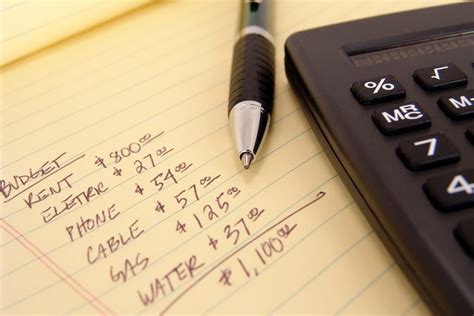

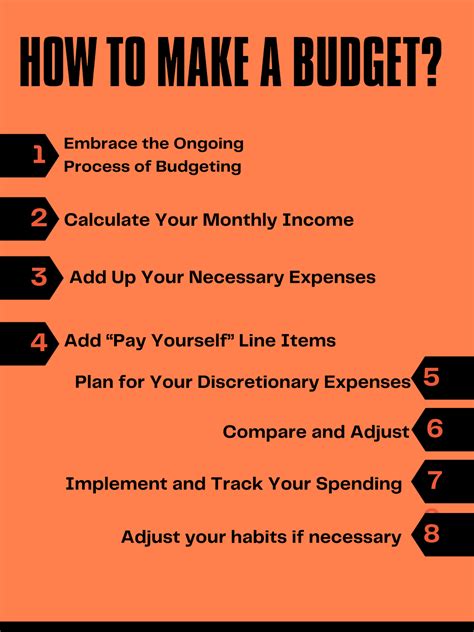

Creating a budget sheet printable template is a straightforward process. Here are the steps to follow: 1. Determine your income: Start by calculating your total monthly income from all sources. 2. Categorize expenses: Divide your expenses into categories, such as housing, transportation, food, entertainment, and savings. 3. Assign percentages: Allocate a percentage of your income to each category, based on your individual needs and priorities. 4. Set financial goals: Identify your short-term and long-term financial goals, such as paying off debt, building an emergency fund, or saving for a down payment on a house. 5. Choose a template: Select a budget sheet printable template that suits your needs, or create your own using a spreadsheet or word processing software.Using a Budget Sheet Printable Template Effectively

To get the most out of a budget sheet printable template, follow these tips:

- Review and revise regularly: Regularly review your budget to ensure you're on track to meet your financial goals, making adjustments as needed.

- Be realistic: Create a realistic budget that takes into account your individual circumstances and financial priorities.

- Prioritize needs over wants: Distinguish between essential expenses and discretionary spending, prioritizing needs over wants.

- Automate savings: Set up automatic transfers from your checking account to your savings or investment accounts.

- Monitor progress: Track your progress towards your financial goals, celebrating successes and addressing setbacks.

Common Budgeting Mistakes to Avoid

When using a budget sheet printable template, it's essential to avoid common budgeting mistakes. These include: * Failing to account for irregular expenses: Make sure to include expenses that occur irregularly, such as car maintenance or property taxes. * Not prioritizing needs over wants: Distinguish between essential expenses and discretionary spending, prioritizing needs over wants. * Underestimating expenses: Be realistic when estimating expenses, taking into account potential fluctuations in costs. * Failing to review and revise: Regularly review your budget to ensure you're on track to meet your financial goals, making adjustments as needed.Customizing Your Budget Sheet Printable Template

A budget sheet printable template can be customized to suit individual needs. Here are some ways to tailor your template:

- Add or remove categories: Modify the template to include categories that are relevant to your financial situation, removing those that are not.

- Adjust percentages: Allocate a percentage of your income to each category, based on your individual needs and priorities.

- Include irregular expenses: Make sure to account for expenses that occur irregularly, such as car maintenance or property taxes.

- Set financial goals: Identify your short-term and long-term financial goals, such as paying off debt, building an emergency fund, or saving for a down payment on a house.

Using a Budget Sheet Printable Template for Long-Term Financial Planning

A budget sheet printable template is not only useful for short-term financial management but also for long-term financial planning. Here are some ways to use your template for long-term planning: * Set realistic goals: Identify your long-term financial goals, such as retirement savings, buying a house, or funding your children's education. * Create a timeline: Develop a timeline for achieving your long-term financial goals, breaking down larger goals into smaller, manageable steps. * Prioritize needs over wants: Distinguish between essential expenses and discretionary spending, prioritizing needs over wants. * Automate savings: Set up automatic transfers from your checking account to your savings or investment accounts.Budgeting for Irregular Expenses

Irregular expenses can be challenging to budget for, but there are strategies to help you manage these costs. Here are some tips:

- Identify irregular expenses: Make a list of expenses that occur irregularly, such as car maintenance, property taxes, or holiday expenses.

- Estimate costs: Estimate the cost of each irregular expense, taking into account potential fluctuations in costs.

- Allocate funds: Allocate a percentage of your income to each irregular expense, based on your individual needs and priorities.

- Review and revise: Regularly review your budget to ensure you're on track to meet your financial goals, making adjustments as needed.

Using a Budget Sheet Printable Template for Business Budgeting

A budget sheet printable template can also be used for business budgeting. Here are some ways to adapt your template for business use: * Categorize expenses: Divide your business expenses into categories, such as salaries, rent, marketing, and equipment. * Assign percentages: Allocate a percentage of your business income to each category, based on your individual needs and priorities. * Set financial goals: Identify your short-term and long-term financial goals, such as increasing revenue, reducing costs, or expanding your business. * Monitor progress: Track your progress towards your financial goals, celebrating successes and addressing setbacks.Conclusion and Next Steps

In conclusion, a budget sheet printable template is a valuable tool for managing your finances effectively. By following the tips and strategies outlined in this article, you can create a personalized budget that helps you achieve your financial goals. For more information on budgeting and personal finance, check out our internal link to another post. Remember to review and revise your budget regularly, making adjustments as needed to ensure you're on track to meet your financial objectives.

Final Thoughts

Creating a budget sheet printable template is an essential step in taking control of your finances. By using this template and following the tips and strategies outlined in this article, you can simplify the budgeting process, make informed financial decisions, and achieve financial stability. Don't forget to check out our other articles on personal finance and budgeting for more tips and advice.Budget Sheet Printable Template Image Gallery

What is a budget sheet printable template?

+A budget sheet printable template is a tool used to help individuals manage their finances effectively by tracking income and expenses, categorizing spending, and setting financial goals.

How do I create a budget sheet printable template?

+To create a budget sheet printable template, determine your income, categorize expenses, assign percentages, set financial goals, and choose a template or create your own using a spreadsheet or word processing software.

What are the benefits of using a budget sheet printable template?

+The benefits of using a budget sheet printable template include simplified budgeting, customization, improved financial awareness, enhanced savings, and reduced financial stress.

Can I use a budget sheet printable template for business budgeting?

+Yes, a budget sheet printable template can be used for business budgeting by categorizing expenses, assigning percentages, setting financial goals, and monitoring progress.

How often should I review and revise my budget?

+It's essential to review and revise your budget regularly, ideally every month, to ensure you're on track to meet your financial goals and make adjustments as needed.

We hope this article has provided you with valuable insights and practical tips on using a budget sheet printable template. If you have any further questions or would like to share your experiences with budgeting, please don't hesitate to comment below. Don't forget to share this article with friends and family who may benefit from learning more about budgeting and personal finance.