Intro

Boost business finances with Navy Federal Business Credit Card, offering rewards, cashback, and low APR, ideal for business owners seeking credit card solutions with flexible payment terms and robust benefits.

As a business owner, managing finances effectively is crucial for the success and growth of your company. One of the key tools that can help you achieve this goal is a business credit card. Among the various options available, the Navy Federal Business Credit Card stands out for its unique benefits and features tailored to meet the financial needs of businesses. Whether you're a small business owner, an entrepreneur, or a manager of a large corporation, understanding the advantages and how to leverage a business credit card like the one offered by Navy Federal can significantly enhance your financial management capabilities.

The importance of a business credit card cannot be overstated. It provides a convenient and efficient way to manage business expenses, offering a clear distinction between personal and business finances. This separation is not only beneficial for accounting and tax purposes but also helps in building business credit, which is essential for future loans or credit lines. Furthermore, business credit cards often come with rewards, cashback, or travel points that can be redeemed to offset business expenses or used as incentives for employees.

For businesses associated with the military, veterans, or the Department of Defense, Navy Federal Credit Union offers a range of financial products, including business credit cards. These cards are designed to provide flexible financing options, competitive rates, and exclusive rewards that cater to the unique financial challenges and opportunities faced by these groups. By leveraging the Navy Federal Business Credit Card, businesses can enjoy benefits such as low interest rates, no foreign transaction fees, and generous credit limits, all of which can contribute to improved cash flow and financial stability.

Benefits of the Navy Federal Business Credit Card

The Navy Federal Business Credit Card is packed with benefits that make it an attractive option for businesses. One of the primary advantages is the low interest rate, which can help reduce the cost of borrowing. Additionally, the absence of foreign transaction fees makes it ideal for businesses that operate internationally or have global suppliers. The generous credit limits provided can also support large purchases or manage cash flow during periods of high demand. Moreover, the rewards program offers cashback or points on purchases, which can be redeemed for travel, merchandise, or statement credits, further enhancing the card's value proposition.

Key Features of the Navy Federal Business Credit Card

Some of the key features of the Navy Federal Business Credit Card include:

- Competitive APRs that help keep interest payments low

- No annual fee for the first year, and a competitive fee structure thereafter

- Generous rewards program with cashback or travel points

- No foreign transaction fees, making international transactions cost-effective

- Access to exclusive business services and financial tools

- Enhanced security features to protect against fraud and unauthorized transactions

How to Apply for the Navy Federal Business Credit Card

Applying for the Navy Federal Business Credit Card involves several steps. First, ensure your business meets the eligibility criteria set by Navy Federal Credit Union, which typically includes being a member of the credit union. Membership is open to all Department of Defense and Coast Guard Active Duty, civilian, and contractor personnel, as well as their families. Next, gather the required documents, which may include your business's financial statements, tax returns, and identification documents. You can apply online through the Navy Federal Credit Union website, by phone, or by visiting a branch in person. The application will be reviewed based on your business and personal credit history, and once approved, you'll receive your card and can start using it for your business expenses.

Tips for Using the Navy Federal Business Credit Card Effectively

To get the most out of the Navy Federal Business Credit Card, consider the following tips:

- Use the card for all eligible business expenses to maximize rewards and keep personal and business finances separate.

- Pay your balance in full each month to avoid interest charges and late fees.

- Take advantage of the credit limit to manage cash flow, but avoid over-extending your credit.

- Monitor your credit score regularly to ensure it remains healthy and to qualify for better rates in the future.

- Utilize the card's security features, such as fraud alerts and transaction monitoring, to protect your business from financial loss.

Managing Business Finances with the Navy Federal Business Credit Card

Effective financial management is crucial for the sustainability and growth of any business. The Navy Federal Business Credit Card can be a valuable tool in this endeavor, offering a comprehensive way to track, manage, and control business expenses. By using the card for all business-related purchases, you can easily monitor spending patterns, identify areas for cost reduction, and make informed financial decisions. Additionally, the card's online management tools allow for easy tracking of transactions, payment due dates, and rewards balances, all from a single platform.

Best Practices for Business Credit Card Management

Best practices for managing a business credit card include:

- Setting a budget and sticking to it to avoid overspending.

- Implementing a system for tracking and categorizing expenses.

- Paying bills on time to avoid late fees and negative impacts on credit scores.

- Regularly reviewing credit limits and adjusting as necessary to reflect business growth or changes in financial circumstances.

- Educating employees on the proper use of the business credit card, if they are authorized users.

Navy Federal Business Credit Card Rewards and Benefits

The rewards and benefits associated with the Navy Federal Business Credit Card are designed to provide tangible value back to your business. The cashback program offers a percentage of your purchases back as a statement credit, which can be used to offset future expenses. Travel points can be redeemed for flights, hotel stays, or other travel-related expenses, making business travel more affordable. Additionally, the card may offer exclusive discounts or promotions with certain merchants, further enhancing its value proposition. By maximizing these rewards, businesses can reduce their expenses and allocate more resources towards growth initiatives.

Maximizing Rewards with the Navy Federal Business Credit Card

To maximize rewards, consider the following strategies:

- Use the card for all business purchases, including everyday expenses like office supplies and fuel.

- Take advantage of bonus categories that offer higher rewards rates for specific types of purchases.

- Plan business travel strategically to redeem travel points for flights, hotels, or car rentals.

- Consider adding employee cards to earn rewards on their business expenses as well.

- Regularly review your rewards balance and redeem points before they expire.

Security Features of the Navy Federal Business Credit Card

The security of your business's financial information is paramount, and the Navy Federal Business Credit Card includes several features to protect against fraud and unauthorized transactions. These include zero liability protection, which means you won't be held responsible for unauthorized charges, and advanced fraud monitoring systems that detect and alert you to suspicious activity. Additionally, the card is equipped with chip technology, providing an extra layer of security for in-person transactions. By leveraging these security features, businesses can minimize the risk of financial loss due to fraud.

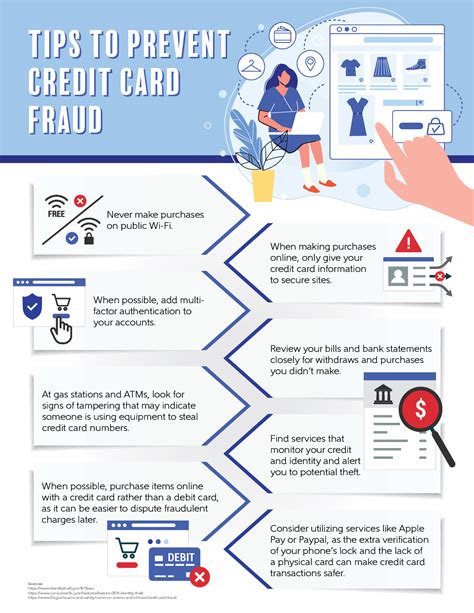

Protecting Your Business from Financial Fraud

To further protect your business from financial fraud:

- Regularly review your statement for any unauthorized transactions.

- Set up fraud alerts and notifications to stay informed of suspicious activity.

- Use strong, unique passwords for online account access.

- Educate employees on the importance of financial security and the steps to take in case of suspected fraud.

- Consider implementing a two-factor authentication process for sensitive financial transactions.

Customer Service and Support for Navy Federal Business Credit Card

Navy Federal Credit Union is known for its commitment to customer service, offering comprehensive support for its business credit card holders. This includes 24/7 phone support, online chat, and access to branch locations for in-person assistance. The credit union also provides online resources and tools to help manage your account, track expenses, and make payments. By having access to reliable and responsive customer service, businesses can quickly resolve any issues that may arise with their credit card, ensuring minimal disruption to their financial operations.

Getting Help When You Need It

For assistance with your Navy Federal Business Credit Card:

- Visit the Navy Federal Credit Union website for FAQs, user guides, and contact information.

- Call the dedicated customer service number for immediate support.

- Use the online chat feature for quick questions or concerns.

- Visit a branch in person for more complex issues or to speak with a financial advisor.

- Take advantage of educational resources and workshops offered by Navy Federal to improve your financial literacy and management skills.

Navy Federal Business Credit Card Image Gallery

What are the eligibility criteria for the Navy Federal Business Credit Card?

+Eligibility for the Navy Federal Business Credit Card typically requires membership in Navy Federal Credit Union, which is open to all Department of Defense and Coast Guard Active Duty, civilian, and contractor personnel, as well as their families.

How do I apply for the Navy Federal Business Credit Card?

+You can apply for the Navy Federal Business Credit Card online through the Navy Federal Credit Union website, by phone, or by visiting a branch in person. You will need to provide your business's financial information and personal identification documents as part of the application process.

What are the benefits of using the Navy Federal Business Credit Card for my business expenses?

+The Navy Federal Business Credit Card offers a range of benefits, including low interest rates, no foreign transaction fees, generous credit limits, and a rewards program that can help offset business expenses. It also provides a convenient way to separate personal and business finances and build business credit.

In conclusion, the Navy Federal Business Credit Card is a valuable financial tool designed to meet the unique needs of businesses, especially those associated with the military and Department of Defense. By understanding the benefits, features, and best practices for using this card, businesses can better manage their finances, reduce costs, and capitalize on rewards. Whether you're looking to streamline your expense management, build business credit, or simply need a reliable credit solution, the Navy Federal Business Credit Card is definitely worth considering. We invite you to share your experiences with business credit cards, ask questions, or explore how the Navy Federal Business Credit Card can support your business goals.