Intro

Boost financial organization with 5 finance calendar tips, including budgeting, expense tracking, and bill reminders, to streamline personal finance management and achieve fiscal stability.

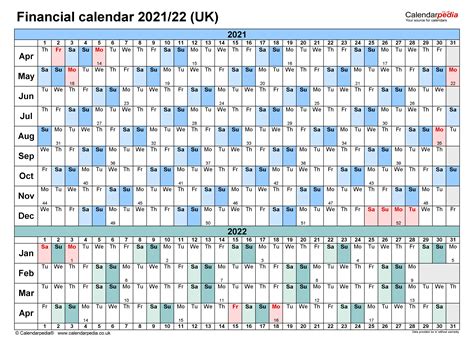

Managing personal finances effectively is crucial for achieving financial stability and security. One often overlooked tool that can significantly impact financial management is a finance calendar. A finance calendar is a schedule that outlines important financial deadlines, tasks, and events throughout the year. It helps individuals stay on top of their financial obligations, make informed decisions, and plan for the future. In this article, we will delve into the importance of using a finance calendar and provide five valuable tips on how to maximize its benefits.

Creating and maintaining a finance calendar can seem like a daunting task, especially for those who are new to personal finance management. However, with the right approach, it can become an indispensable tool for navigating the complexities of financial planning. A well-structured finance calendar can help individuals keep track of bill due dates, payment schedules, investment deadlines, and tax filing requirements, among other financial tasks. By having a clear overview of their financial commitments and milestones, individuals can avoid late fees, penalties, and missed opportunities, ultimately leading to better financial health.

The benefits of using a finance calendar extend beyond just keeping track of deadlines. It also enables individuals to plan and prepare for significant financial events, such as buying a house, retirement, or funding a child's education. By mapping out financial goals and objectives on a calendar, individuals can create a roadmap for achieving these milestones, breaking down larger goals into smaller, manageable tasks. This not only makes the goal-achieving process less overwhelming but also increases the likelihood of success. Furthermore, a finance calendar can serve as a valuable resource for identifying areas where financial adjustments can be made, such as reducing unnecessary expenses or allocating more funds towards savings and investments.

Understanding the Basics of a Finance Calendar

Before diving into the tips for using a finance calendar, it's essential to understand its basic components. A finance calendar typically includes a list of recurring financial tasks, such as paying bills, reviewing budgets, and checking credit reports. It may also highlight significant financial events, like tax deadlines, insurance renewals, and investment opportunities. The calendar can be tailored to fit individual financial needs and goals, making it a highly personalized tool.

Customizing Your Finance Calendar

Customizing a finance calendar to suit individual needs is crucial for its effectiveness. This involves identifying personal financial goals, tracking income and expenses, and scheduling financial tasks accordingly. For instance, if saving for a down payment on a house is a priority, the calendar should reflect milestones and deadlines related to this goal, such as researching mortgage options, improving credit scores, and accumulating the necessary funds.Tip 1: Set Financial Goals and Objectives

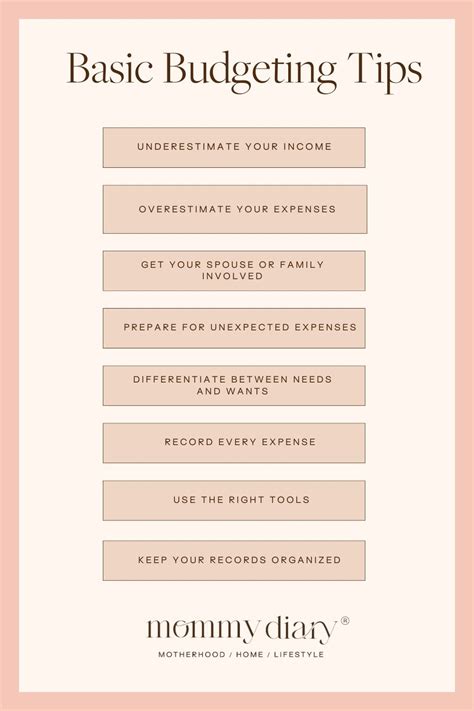

The first step in maximizing the benefits of a finance calendar is to set clear financial goals and objectives. These goals can range from short-term targets, like paying off debt or building an emergency fund, to long-term aspirations, such as retirement planning or buying a vacation home. By defining what you want to achieve, you can tailor your finance calendar to support these objectives, ensuring that every financial decision and action aligns with your overall financial strategy.

Breaking Down Large Goals into Smaller Tasks

Large financial goals can be overwhelming, making it challenging to know where to start. A finance calendar helps by breaking down these goals into smaller, manageable tasks. For example, if the goal is to save $10,000 for a down payment on a house within the next two years, the calendar can outline monthly savings targets, deadlines for researching and applying for mortgages, and reminders for regular budget reviews to ensure savings goals are on track.Tip 2: Track Income and Expenses

Tracking income and expenses is fundamental to effective financial management. A finance calendar can include space for recording monthly income and expenses, helping individuals understand where their money is going and identify areas for cost reduction. This information is invaluable for creating a realistic budget that supports financial goals and ensures that there is enough money set aside for savings, investments, and debt repayment.

Using Budgeting Apps for Enhanced Tracking

To enhance the tracking of income and expenses, individuals can utilize budgeting apps that integrate with their finance calendar. These apps can automatically categorize transactions, provide spending insights, and offer alerts for unusual account activity, making it easier to stay on top of financial transactions and make informed decisions.Tip 3: Schedule Regular Budget Reviews

Scheduling regular budget reviews is a critical component of maintaining a finance calendar. These reviews provide an opportunity to assess progress towards financial goals, identify any discrepancies between planned and actual spending, and make necessary adjustments to the budget. Regular reviews also help in anticipating and preparing for financial challenges, such as unexpected expenses or changes in income.

Adjusting the Budget Based on Review Findings

The findings from budget reviews should be used to adjust the budget and finance calendar as needed. This might involve reallocating funds from one category to another, setting new savings targets, or exploring ways to reduce expenses. By regularly reviewing and adjusting the budget, individuals can ensure that their financial plan remains aligned with their changing needs and goals.Tip 4: Plan for Significant Financial Events

Planning for significant financial events, such as weddings, buying a house, or retirement, is essential for achieving long-term financial stability. A finance calendar can help individuals prepare for these events by outlining the necessary steps and deadlines. For example, if planning to retire in 10 years, the calendar can include reminders for increasing retirement savings contributions, researching retirement income options, and planning for healthcare costs.

Creating a Timeline for Major Purchases

For major purchases like a house or a car, a finance calendar can include a timeline that outlines the preparation and purchasing process. This might include saving for a down payment, improving credit scores, researching financing options, and scheduling viewings or test drives. By having a clear timeline, individuals can ensure they are adequately prepared for the purchase and make informed decisions along the way.Tip 5: Monitor and Adjust

The final tip for using a finance calendar effectively is to continuously monitor financial progress and adjust the calendar as needed. Financial situations can change rapidly due to unforeseen expenses, changes in income, or shifts in financial goals. Regular monitoring ensures that the finance calendar remains relevant and effective in supporting financial objectives.

Staying Flexible with Financial Planning

Flexibility is key when it comes to financial planning. A finance calendar should not be seen as a rigid plan but rather as a dynamic tool that can be adjusted to reflect changing financial circumstances. By staying open to adjustments and being willing to adapt the finance calendar, individuals can better navigate financial challenges and stay on track towards achieving their financial goals.Finance Calendar Image Gallery

What is a finance calendar, and how does it help with financial management?

+A finance calendar is a tool used to track and manage financial tasks, deadlines, and events throughout the year. It helps individuals stay organized, avoid late fees and penalties, and make informed financial decisions.

How do I create a personalized finance calendar?

+To create a personalized finance calendar, start by identifying your financial goals and tasks, such as bill due dates, savings targets, and investment deadlines. Then, use a calendar or planner to schedule these tasks and set reminders as needed.

What are some common financial tasks that should be included in a finance calendar?

+Common financial tasks to include in a finance calendar are paying bills, reviewing budgets, checking credit reports, scheduling investment contributions, and planning for significant financial events like retirement or buying a house.

Incorporating a finance calendar into your financial management strategy can have a profound impact on your ability to achieve financial stability and success. By following the five tips outlined in this article—setting financial goals, tracking income and expenses, scheduling regular budget reviews, planning for significant financial events, and monitoring and adjusting your financial plan—you can maximize the benefits of a finance calendar and take significant steps towards securing your financial future. Remember, financial planning is a journey, and having the right tools and strategies in place can make all the difference. Share your experiences with using a finance calendar, and let's work together to build a community that supports and encourages each other in achieving financial wellness.