Intro

Calculate Navy Federal CD rates with our calculator. Compare certificate of deposit yields, terms, and interest rates to maximize savings with Navy Federal Credit Unions competitive CD rates and flexible terms.

The importance of understanding interest rates and calculating returns on investments cannot be overstated, especially when it comes to certificates of deposit (CDs). CDs are a type of savings account offered by banks and credit unions with a fixed interest rate and maturity date. They tend to be low-risk investments, making them attractive to those seeking stable returns. Navy Federal Credit Union, one of the largest credit unions in the world, offers a variety of CDs with competitive rates, making it a popular choice for individuals looking to grow their savings.

For those considering opening a CD with Navy Federal, understanding how to calculate the potential earnings is crucial. This involves looking at the principal amount (the initial amount of money), the interest rate offered by the CD, the compounding frequency (how often the interest is added to the principal), and the term length (the duration of the CD). The Navy Federal CD calculator is a tool that simplifies this process, allowing potential investors to input their specific details and receive an estimate of their total balance at maturity.

Navy Federal's commitment to providing its members with a range of financial tools and resources, including calculators for various financial products, demonstrates its dedication to empowering individuals to make informed financial decisions. By utilizing these tools, members can better navigate the world of personal finance, making choices that align with their financial goals and risk tolerance.

Understanding Navy Federal CD Rates

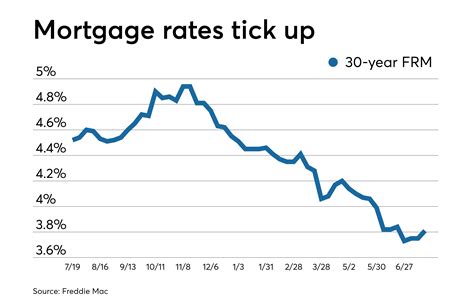

Navy Federal CD rates are competitive and vary based on the term length of the CD. Generally, longer terms offer higher interest rates, but they also require the investor to keep their money locked in the CD for a longer period. This makes it essential for individuals to consider their financial needs and goals before selecting a CD term. The rates are subject to change and may be influenced by market conditions, so it's always a good idea to check the current rates on Navy Federal's website or by visiting a branch.

Benefits of Using a CD Calculator

The benefits of using a CD calculator, such as the one provided by Navy Federal, are numerous. It allows users to: - Estimate potential earnings based on current rates. - Compare different term lengths and their respective interest rates. - Plan their savings strategy more effectively. - Make informed decisions about their investments.How to Use the Navy Federal CD Calculator

Using the Navy Federal CD calculator is straightforward. Users typically need to input the following information:

- The principal amount they wish to invest.

- The desired term length of the CD.

- The interest rate for the selected term (usually provided within the calculator based on current rates).

After inputting this information, the calculator will provide an estimate of the total interest earned and the total balance at maturity. This tool is invaluable for planning and can help individuals understand the potential growth of their savings over time.

Considerations Before Opening a CD

Before deciding on a CD, it's crucial to consider a few key factors: - **Term Length:** Longer terms generally offer higher rates but tie up your money for an extended period. - **Interest Rate:** Look for the highest rate available for your desired term length. - **Penalties for Early Withdrawal:** Most CDs come with penalties for withdrawing your money before the maturity date. - **Minimum Deposit Requirements:** Some CDs may require a minimum amount to open or to avoid monthly maintenance fees.Navy Federal CD Types

Navy Federal offers a variety of CDs to cater to different financial goals and strategies. These include:

- Standard CDs: Traditional CDs with fixed rates and terms ranging from a few months to several years.

- Jumbo CDs: Require a higher minimum deposit but often offer higher interest rates.

- Special CDs: May offer higher rates for specific term lengths or have unique features such as the ability to add funds during the term.

Maximizing Your CD Earnings

To maximize earnings from a CD: - **Choose the Right Term:** Align the term length with your financial goals and when you'll need access to your money. - **Consider Laddering:** Investing in multiple CDs with staggered maturity dates to maintain liquidity and potentially earn higher rates over time. - **Take Advantage of High-Yield Options:** If available, high-yield CDs or special promotional rates can offer significantly higher returns.CD Calculator Benefits for Financial Planning

The CD calculator is not just a tool for estimating earnings; it's also a valuable resource for broader financial planning. By understanding how different CDs can perform, individuals can integrate CDs into their overall investment strategy, potentially reducing risk and increasing returns.

Integrating CDs into Your Investment Portfolio

CDs can be a solid addition to a diversified investment portfolio, offering a low-risk component that can help balance out higher-risk investments. When integrating CDs: - **Diversify:** Spread investments across different asset classes to manage risk. - **Align with Goals:** Use CDs for specific, savings-oriented goals, like down payments on a house or a car. - **Review and Adjust:** Periodically review your portfolio and adjust as necessary to ensure it remains aligned with your financial objectives.Conclusion and Next Steps

In conclusion, utilizing a CD calculator, such as the one offered by Navy Federal, can be a powerful step in planning your financial future. By understanding the potential earnings of CDs and how they can fit into your broader financial strategy, you can make more informed decisions about your savings and investments.

Final Considerations

Before making any financial decisions, consider consulting with a financial advisor to ensure that your choices align with your overall financial health and goals. Remember, CDs are just one tool among many in the world of personal finance, and their suitability depends on your individual circumstances.Navy Federal CD Calculator Image Gallery

What is the minimum deposit required for a Navy Federal CD?

+The minimum deposit can vary depending on the type of CD. For standard CDs, it's often $1,000, but this can be higher for jumbo CDs or lower for certain special CDs.

Can I withdraw my money from a CD at any time?

+While it's technically possible to withdraw your money from a CD before its maturity date, doing so usually results in early withdrawal penalties, which can significantly reduce your earnings.

How do I choose the right CD term for my financial goals?

+Consider when you'll need access to your money and your financial goals. Longer terms often offer higher rates but require you to keep your money locked in the CD for an extended period.

We invite you to share your thoughts on using CD calculators for financial planning and your experiences with Navy Federal CDs in the comments below. If you found this article helpful, consider sharing it with others who might benefit from learning more about CDs and how to maximize their savings. By taking the time to understand and utilize tools like the Navy Federal CD calculator, you can make more informed decisions about your financial future and work towards achieving your long-term goals.