Intro

Discover the CFPB review of Navy Federal Credit Union, covering consumer complaints, financial practices, and regulatory oversight, shedding light on credit union operations and member protections.

The Consumer Financial Protection Bureau (CFPB) is a regulatory agency responsible for overseeing consumer financial products and services, including those offered by credit unions like Navy Federal Credit Union. As one of the largest credit unions in the United States, Navy Federal Credit Union provides a wide range of financial services to its members, including banking, lending, and investment products. In this article, we will delve into the CFPB review of Navy Federal Credit Union, exploring the agency's findings, concerns, and recommendations for improvement.

The CFPB's review of Navy Federal Credit Union is part of its broader effort to ensure that consumer financial institutions operate fairly, transparently, and in compliance with federal regulations. The agency's examination process involves a thorough review of a credit union's policies, procedures, and practices to identify potential risks to consumers and ensure that the institution is meeting its regulatory obligations. Navy Federal Credit Union, as a large and complex credit union, is subject to regular examinations by the CFPB to ensure that it is operating in a safe and sound manner and providing fair treatment to its members.

Introduction to Navy Federal Credit Union

Navy Federal Credit Union is a not-for-profit, member-owned financial cooperative that serves the military and their families. With over 10 million members and $150 billion in assets, it is one of the largest credit unions in the United States. Navy Federal Credit Union offers a wide range of financial products and services, including checking and savings accounts, credit cards, mortgages, and investment products. The credit union is headquartered in Vienna, Virginia, and operates over 300 branches worldwide.

CFPB Review Process

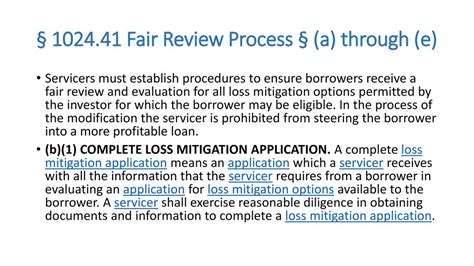

The CFPB's review process involves a thorough examination of a credit union's policies, procedures, and practices to identify potential risks to consumers and ensure that the institution is meeting its regulatory obligations. The agency's examiners review a credit union's compliance with federal regulations, including the Truth in Lending Act, the Equal Credit Opportunity Act, and the Real Estate Settlement Procedures Act. The CFPB also reviews a credit union's consumer complaint handling processes, its advertising and marketing practices, and its overall risk management framework.

CFPB Findings and Concerns

The CFPB's review of Navy Federal Credit Union has identified several areas of concern, including issues related to the credit union's lending practices, consumer complaint handling, and advertising and marketing practices. For example, the CFPB has found that Navy Federal Credit Union has engaged in practices that may be deceptive or unfair, such as failing to clearly disclose the terms and conditions of its credit products or making false or misleading statements about its services. The agency has also identified concerns related to the credit union's risk management framework, including inadequate oversight of its third-party vendors and insufficient controls to prevent and detect fraud.

Recommendations for Improvement

The CFPB has made several recommendations to Navy Federal Credit Union to address the concerns and findings identified during the review process. These recommendations include: * Implementing more robust risk management controls to prevent and detect fraud and other forms of misconduct * Enhancing its consumer complaint handling processes to ensure that complaints are handled fairly and promptly * Improving its advertising and marketing practices to ensure that they are clear, accurate, and not misleading * Providing more transparent and detailed disclosures about its credit products and services * Strengthening its oversight of third-party vendors to ensure that they are operating in compliance with federal regulationsBenefits of CFPB Review

The CFPB's review of Navy Federal Credit Union provides several benefits to consumers and the credit union itself. For consumers, the review process helps to ensure that the credit union is operating fairly and transparently, and that its products and services are safe and sound. The review process also helps to identify and address potential risks and concerns, which can help to prevent harm to consumers. For Navy Federal Credit Union, the review process provides an opportunity to identify areas for improvement and to make changes to its policies, procedures, and practices to ensure that it is meeting its regulatory obligations and providing fair treatment to its members.

Best Practices for Credit Unions

The CFPB's review of Navy Federal Credit Union highlights the importance of implementing best practices in consumer financial protection. Credit unions can learn from the CFPB's findings and recommendations by implementing the following best practices:

- Developing and implementing robust risk management controls to prevent and detect fraud and other forms of misconduct

- Enhancing consumer complaint handling processes to ensure that complaints are handled fairly and promptly

- Improving advertising and marketing practices to ensure that they are clear, accurate, and not misleading

- Providing transparent and detailed disclosures about credit products and services

- Strengthening oversight of third-party vendors to ensure that they are operating in compliance with federal regulations

Gallery of CFPB Review

CFPB Review Image Gallery

FAQs

What is the purpose of the CFPB review of Navy Federal Credit Union?

+The purpose of the CFPB review is to ensure that Navy Federal Credit Union is operating fairly, transparently, and in compliance with federal regulations.

What are some of the concerns identified by the CFPB during its review of Navy Federal Credit Union?

+The CFPB has identified concerns related to Navy Federal Credit Union's lending practices, consumer complaint handling, and advertising and marketing practices.

What are some of the recommendations made by the CFPB to Navy Federal Credit Union?

+The CFPB has made recommendations to Navy Federal Credit Union to implement more robust risk management controls, enhance its consumer complaint handling processes, and improve its advertising and marketing practices.

In conclusion, the CFPB review of Navy Federal Credit Union highlights the importance of consumer financial protection and the need for credit unions to implement best practices in this area. By following the recommendations made by the CFPB, Navy Federal Credit Union can improve its operations and provide fair treatment to its members. We invite readers to share their thoughts and comments on this article, and to learn more about the CFPB review process and its importance in protecting consumers.