Intro

Explore the fragile state of Chinas economy, on the brink of collapse? Discover the warning signs, including rising debt, slowing growth, and trade tensions. Can China overcome its economic challenges or is a collapse imminent? Dive into the complexities of Chinas economic crisis and understand the implications for the global market.

The Chinese economy has been a topic of discussion in recent years, with many experts and analysts speculating about its future. Some have predicted that the Chinese economy is on the brink of collapse, while others have argued that it is simply experiencing a slowdown. But what is the reality of the situation? In this article, we will delve into the current state of the Chinese economy and explore the reasons behind the concerns about its collapse.

The Rise of the Chinese Economy

In the past few decades, China has experienced unprecedented economic growth, with its GDP rising from $150 billion in 1978 to over $14 trillion in 2020. This rapid growth has been driven by a combination of factors, including large-scale investments in infrastructure, a massive workforce, and a favorable business environment. China's economic rise has been so significant that it has become the second-largest economy in the world, surpassing Japan and Germany.

However, in recent years, the Chinese economy has started to show signs of slowing down. The country's GDP growth rate has been declining, and the government has been struggling to maintain high levels of economic growth. This has led to concerns about the sustainability of China's economic model and the potential for a collapse.

Reasons Behind the Concerns

So, what are the reasons behind the concerns about China's economic collapse? Here are a few possible explanations:

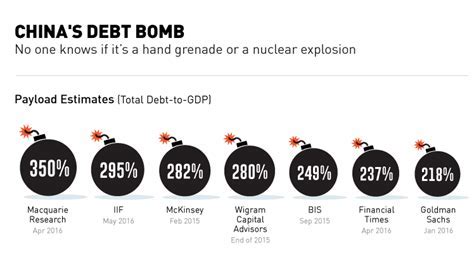

Debt Levels

One of the main concerns about the Chinese economy is its high levels of debt. China's debt-to-GDP ratio has risen significantly in recent years, from around 150% in 2008 to over 250% in 2020. This has led to concerns about the country's ability to service its debt and the potential for a debt crisis.

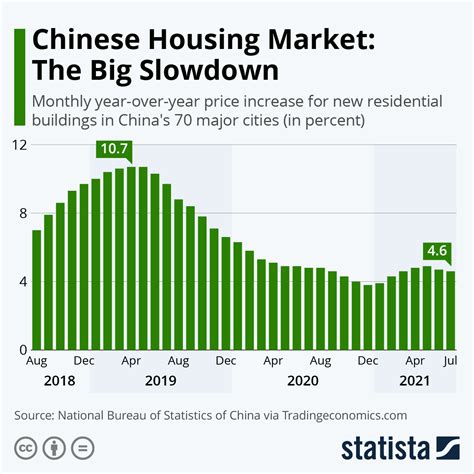

Property Market Bubble

Another concern is the property market bubble in China. The country's property market has experienced rapid growth in recent years, with prices rising significantly in cities such as Shanghai and Shenzhen. However, this growth has been driven by speculation and has led to concerns about a potential property market bubble.

Decline in Exports

China's economy has traditionally been driven by exports, but in recent years, the country has experienced a decline in exports. This has been driven by a combination of factors, including a rise in protectionism and a decline in global demand.

Lack of Structural Reforms

Finally, there are concerns about the lack of structural reforms in China. The country's economy is still dominated by state-owned enterprises, and there is a need for further reforms to increase competition and improve efficiency.

Impact of a Potential Collapse

So, what would be the impact of a potential collapse of the Chinese economy? Here are a few possible scenarios:

Global Economic Consequences

A collapse of the Chinese economy would have significant consequences for the global economy. China is a major trading partner for many countries, and a decline in its economy would lead to a decline in global trade and economic growth.

Social Unrest

A collapse of the Chinese economy could also lead to social unrest. China has a large and growing middle class, and a decline in the economy could lead to widespread unemployment and social unrest.

Political Instability

Finally, a collapse of the Chinese economy could lead to political instability. The Chinese Communist Party has traditionally maintained its power through economic growth, and a decline in the economy could lead to a decline in its legitimacy and a rise in opposition.

Is a Collapse Really On the Brink?

So, is a collapse of the Chinese economy really on the brink? While there are certainly concerns about the sustainability of China's economic model, it is unlikely that the country is on the brink of a collapse.

Government Intervention

The Chinese government has a range of tools at its disposal to intervene in the economy and prevent a collapse. The government has already implemented a range of measures to stimulate economic growth, including cutting interest rates and increasing government spending.

Economic Diversification

China's economy is also becoming increasingly diversified, with a growing services sector and a decline in the importance of manufacturing. This diversification will help to reduce the country's reliance on exports and make it more resilient to external shocks.

Long-term Prospects

Finally, while the short-term prospects for the Chinese economy may be uncertain, the long-term prospects are more positive. China has a large and growing population, and its economy is likely to continue to grow in the long term.

Conclusion

In conclusion, while there are certainly concerns about the sustainability of China's economic model, it is unlikely that the country is on the brink of a collapse. The government has a range of tools at its disposal to intervene in the economy, and the country's economy is becoming increasingly diversified. While the short-term prospects for the Chinese economy may be uncertain, the long-term prospects are more positive.

Gallery of China Economy Collapse

China Economy Collapse Image Gallery

Frequently Asked Questions

What are the main concerns about the Chinese economy?

+The main concerns about the Chinese economy include high levels of debt, a property market bubble, a decline in exports, and a lack of structural reforms.

What would be the impact of a potential collapse of the Chinese economy?

+A collapse of the Chinese economy would have significant consequences for the global economy, including a decline in global trade and economic growth, social unrest, and political instability.

Is a collapse of the Chinese economy really on the brink?

+While there are certainly concerns about the sustainability of China's economic model, it is unlikely that the country is on the brink of a collapse. The government has a range of tools at its disposal to intervene in the economy, and the country's economy is becoming increasingly diversified.