Intro

Warning signs of a potential US dollar collapse are emerging. Learn the 5 key indicators that signal a possible crash, including rising debt, inflation, and currency devaluation. Discover how a weakening dollar could impact your finances and what you can do to prepare for a potential economic downturn.

The value of the US dollar has been a topic of interest for many economists and financial experts in recent years. With the increasing national debt, trade deficits, and monetary policy changes, some experts believe that the collapse of the US dollar is near. But what are the signs that indicate the collapse of the US dollar is imminent? In this article, we will explore five signs that suggest the US dollar collapse is near.

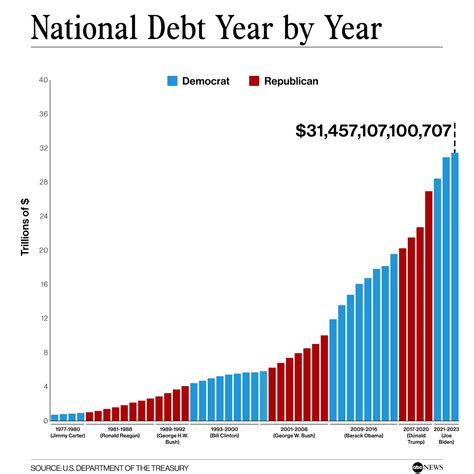

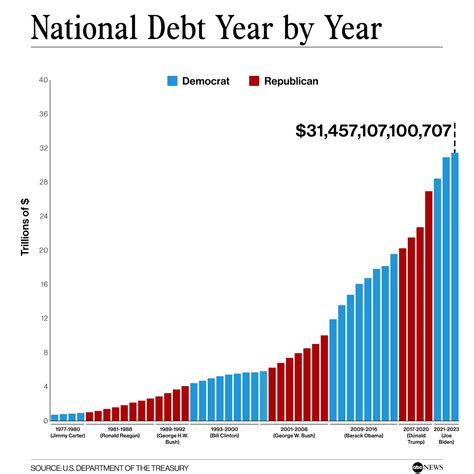

Sign 1: Increasing National Debt

The national debt of the United States has been increasing rapidly over the past few decades. The current national debt stands at over $28 trillion, which is more than 130% of the country's GDP. This level of debt is unsustainable and can lead to a loss of confidence in the US dollar. When investors lose confidence in the dollar, they may start to sell their dollar holdings, which can lead to a sharp decline in the value of the dollar.

Consequences of High National Debt

High national debt can have serious consequences for the US economy. It can lead to higher interest rates, which can increase the cost of borrowing for consumers and businesses. This can reduce economic growth and increase the risk of recession. Additionally, high national debt can lead to a decline in the value of the dollar, which can make imports more expensive and reduce the purchasing power of consumers.

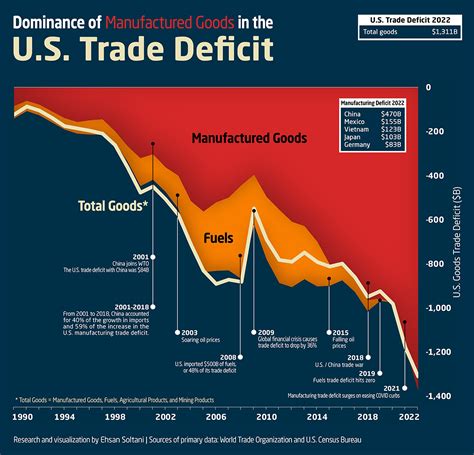

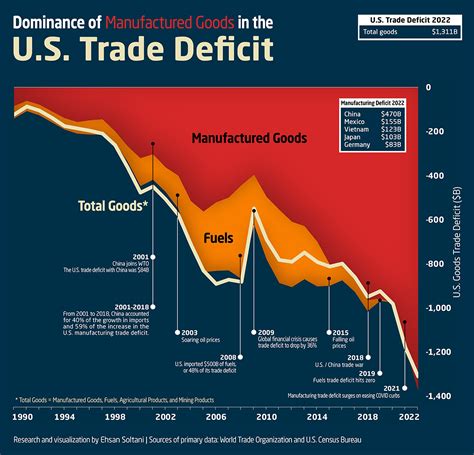

Sign 2: Trade Deficits

The US has been running trade deficits for several decades, which means that the country imports more goods and services than it exports. This can lead to a decline in the value of the dollar, as foreign investors may lose confidence in the dollar and start to sell their dollar holdings. Trade deficits can also lead to higher interest rates, which can increase the cost of borrowing for consumers and businesses.

Causes of Trade Deficits

Trade deficits can be caused by a variety of factors, including a strong dollar, which can make imports cheaper and reduce the competitiveness of US exports. Additionally, trade deficits can be caused by a decline in domestic manufacturing, which can reduce the country's ability to produce goods and services for export.

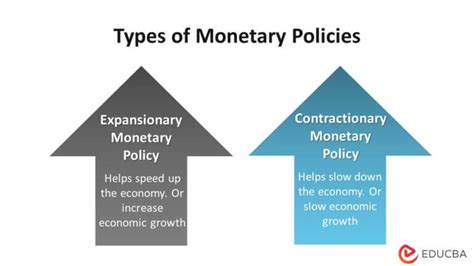

Sign 3: Monetary Policy Changes

The Federal Reserve, the central bank of the United States, has been using monetary policy to stimulate economic growth. However, this can lead to a decline in the value of the dollar, as an increase in the money supply can lead to inflation. Additionally, the Fed's decision to keep interest rates low for an extended period can lead to a decline in the value of the dollar, as investors may seek higher returns in other currencies.

Consequences of Monetary Policy Changes

Monetary policy changes can have serious consequences for the US economy. An increase in the money supply can lead to inflation, which can reduce the purchasing power of consumers. Additionally, low interest rates can lead to a decline in the value of the dollar, which can make imports more expensive and reduce the competitiveness of US exports.

Sign 4: Decline in Dollar's Value

The value of the dollar has been declining in recent years, which can be a sign that the collapse of the US dollar is near. A decline in the value of the dollar can make imports more expensive and reduce the purchasing power of consumers. Additionally, a decline in the value of the dollar can reduce the competitiveness of US exports, which can lead to a decline in economic growth.

Causes of Decline in Dollar's Value

A decline in the value of the dollar can be caused by a variety of factors, including a decline in confidence in the dollar, an increase in the money supply, and a decline in interest rates. Additionally, a decline in the value of the dollar can be caused by a strong euro or other currencies, which can make imports cheaper and reduce the competitiveness of US exports.

Sign 5: Increase in Gold Prices

Gold prices have been increasing in recent years, which can be a sign that the collapse of the US dollar is near. Gold is often seen as a safe-haven asset, and an increase in gold prices can indicate that investors are losing confidence in the dollar. Additionally, an increase in gold prices can be a sign that inflation is increasing, which can reduce the purchasing power of consumers.

Consequences of Increase in Gold Prices

An increase in gold prices can have serious consequences for the US economy. An increase in gold prices can lead to higher inflation, which can reduce the purchasing power of consumers. Additionally, an increase in gold prices can reduce the competitiveness of US exports, which can lead to a decline in economic growth.

Gallery of Signs of US Dollar Collapse

What are the signs of a US dollar collapse?

+The signs of a US dollar collapse include increasing national debt, trade deficits, monetary policy changes, decline in dollar's value, and increase in gold prices.

What is the impact of a US dollar collapse on the economy?

+A US dollar collapse can lead to higher inflation, higher interest rates, and a decline in economic growth. It can also lead to a decline in the standard of living and a reduction in the purchasing power of consumers.

What can be done to prevent a US dollar collapse?

+To prevent a US dollar collapse, the government can reduce the national debt, reduce trade deficits, and implement monetary policies that promote economic growth and stability.

What are the consequences of a US dollar collapse on international trade?

+A US dollar collapse can lead to a decline in international trade, as a decline in the value of the dollar can make imports more expensive and reduce the competitiveness of US exports.

What is the impact of a US dollar collapse on the stock market?

+A US dollar collapse can lead to a decline in the stock market, as a decline in the value of the dollar can reduce investor confidence and lead to a decline in stock prices.

In conclusion, the collapse of the US dollar is a serious issue that can have far-reaching consequences for the economy and international trade. The signs of a US dollar collapse include increasing national debt, trade deficits, monetary policy changes, decline in dollar's value, and increase in gold prices. To prevent a US dollar collapse, the government can reduce the national debt, reduce trade deficits, and implement monetary policies that promote economic growth and stability.