Intro

Discover the key differences between combat pay and hazard pay, two critical components of military compensation. Learn how these payments vary in purpose, eligibility, and tax implications, and understand the distinct benefits and entitlements associated with each. Get clarity on your military pay entitlements and make informed decisions.

Members of the military, as well as civilians working in high-risk jobs, are often entitled to special forms of compensation for their service. Two types of pay that are commonly confused with one another are combat pay and hazard pay. While both forms of pay are designed to compensate individuals for the risks they take on the job, there are significant differences between the two. In this article, we will explore the six key differences between combat pay and hazard pay.

1. Purpose

Purpose of Combat Pay

Combat pay is a form of special pay that is provided to military personnel who are serving in combat zones or hazardous duty areas. The primary purpose of combat pay is to compensate military personnel for the extreme risks they take while serving in these areas. Combat pay is also known as "hostile fire pay" or "imminent danger pay."

Purpose of Hazard Pay

Hazard pay, on the other hand, is a form of special pay that is provided to both military and civilian personnel who are working in hazardous conditions. The primary purpose of hazard pay is to compensate individuals for the risks they take on the job, regardless of whether they are serving in a combat zone or not.

2. Eligibility

Eligibility for Combat Pay

To be eligible for combat pay, military personnel must be serving in a combat zone or hazardous duty area. This can include areas such as Iraq, Afghanistan, or Syria, where military personnel are at risk of being injured or killed by enemy fire.

Eligibility for Hazard Pay

To be eligible for hazard pay, individuals must be working in hazardous conditions. This can include jobs such as firefighting, law enforcement, or working with hazardous materials. Hazard pay is not limited to military personnel and can be provided to civilians who work in high-risk jobs.

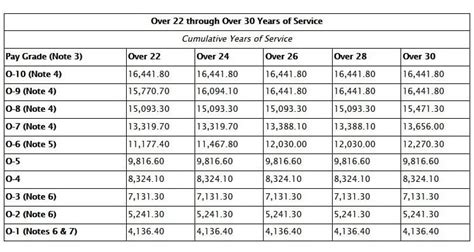

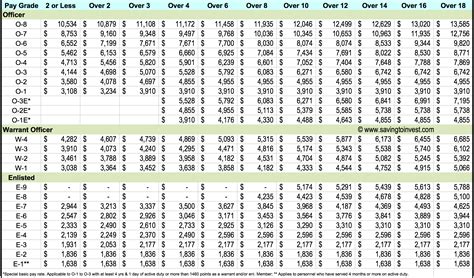

3. Amount of Pay

Amount of Combat Pay

The amount of combat pay that military personnel receive can vary depending on their location and the level of risk they are facing. In general, combat pay is a flat rate of $225 per month.

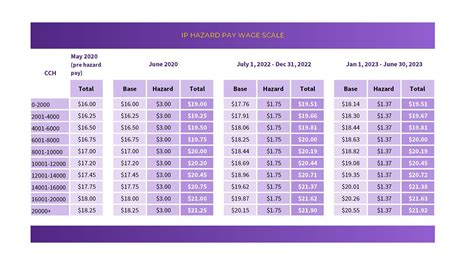

Amount of Hazard Pay

The amount of hazard pay that individuals receive can vary widely depending on their job, location, and level of risk. Hazard pay can be a flat rate or a percentage of the individual's regular pay.

4. Duration of Pay

Duration of Combat Pay

Combat pay is typically provided to military personnel for as long as they are serving in a combat zone or hazardous duty area. This can be for several months or even years, depending on the individual's deployment.

Duration of Hazard Pay

Hazard pay can be provided to individuals for as long as they are working in hazardous conditions. This can be for a few hours, days, or even weeks, depending on the job and the level of risk.

5. Taxation

Taxation of Combat Pay

Combat pay is exempt from federal income tax, but it is subject to Social Security tax and Medicare tax.

Taxation of Hazard Pay

Hazard pay is subject to federal income tax, as well as Social Security tax and Medicare tax.

6. Administration

Administration of Combat Pay

Combat pay is administered by the military and is typically paid to military personnel through their regular paychecks.

Administration of Hazard Pay

Hazard pay is typically administered by the individual's employer and can be paid through regular paychecks or as a separate payment.

Combat Pay and Hazard Pay Image Gallery

Frequently Asked Questions

What is the difference between combat pay and hazard pay?

+Combat pay is a form of special pay provided to military personnel serving in combat zones or hazardous duty areas, while hazard pay is a form of special pay provided to both military and civilian personnel working in hazardous conditions.

How much combat pay do military personnel receive?

+Military personnel receive a flat rate of $225 per month in combat pay.

Is hazard pay taxable?

+Yes, hazard pay is subject to federal income tax, as well as Social Security tax and Medicare tax.

Final Thoughts

In conclusion, while both combat pay and hazard pay are forms of special pay designed to compensate individuals for the risks they take on the job, there are significant differences between the two. Combat pay is provided to military personnel serving in combat zones or hazardous duty areas, while hazard pay is provided to both military and civilian personnel working in hazardous conditions. Understanding the differences between combat pay and hazard pay can help individuals make informed decisions about their careers and compensation.