Intro

Discover how to accurately calculate DOD civilian overseas pay with our expert guide. Learn the 5 essential methods to determine your compensation, including base pay, allowances, and benefits. Understand COLA, post allowances, and other factors affecting your overseas pay. Get the most out of your international assignment with our comprehensive and easy-to-follow calculations.

Receiving a job offer as a civilian employee of the Department of Defense (DoD) can be an exciting opportunity, especially if it involves an overseas assignment. However, understanding the compensation package can be complex, especially when it comes to calculating overseas pay. In this article, we will break down the five ways to calculate DoD civilian overseas pay, helping you make an informed decision about your career.

Understanding Overseas Pay

Before we dive into the calculations, it's essential to understand the basics of overseas pay. As a DoD civilian employee, you are entitled to receive a salary that reflects the cost of living in your assigned location. This includes base pay, allowances, and other benefits that help offset the expenses of living abroad.

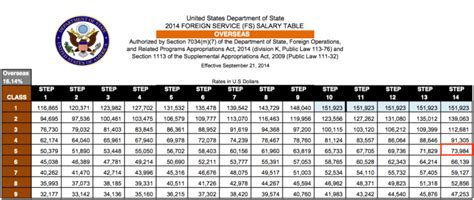

1. Base Pay

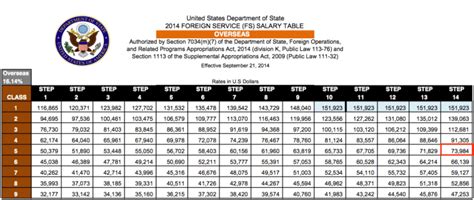

Base pay is the foundation of your salary, and it's calculated based on your grade level and step within the federal government's pay scale. To calculate your base pay, you'll need to refer to the Office of Personnel Management's (OPM) pay tables, which outline the salaries for each grade level and step.

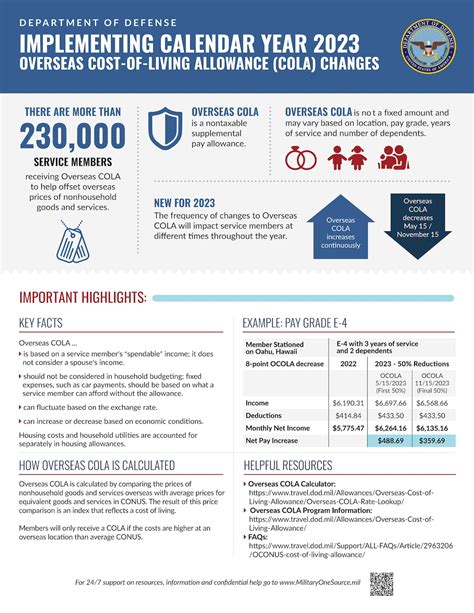

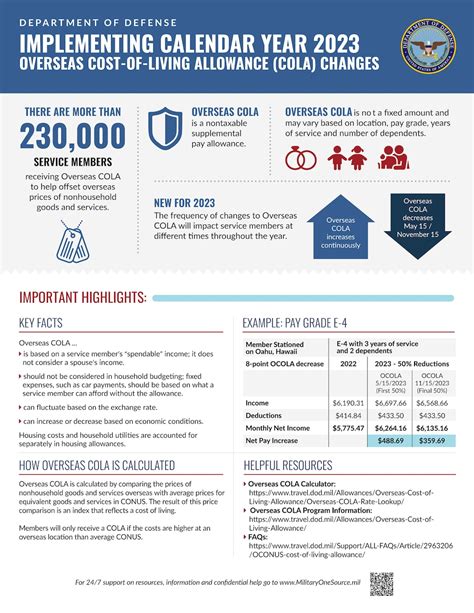

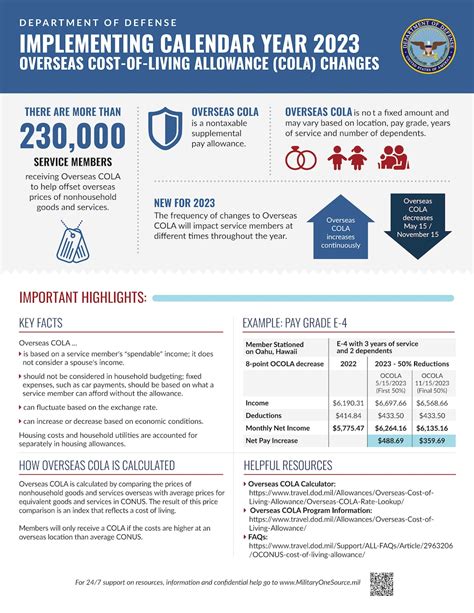

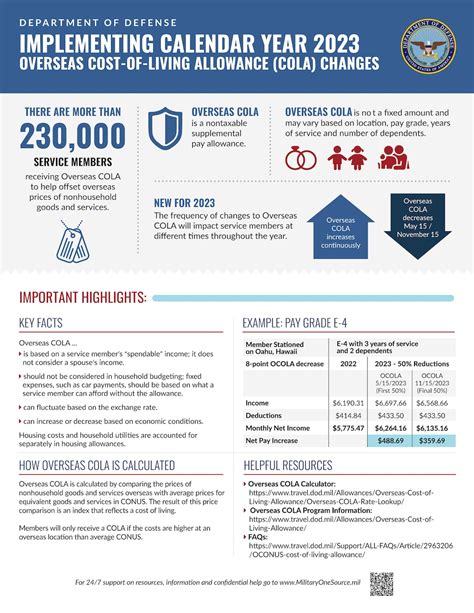

2. Cost of Living Allowance (COLA)

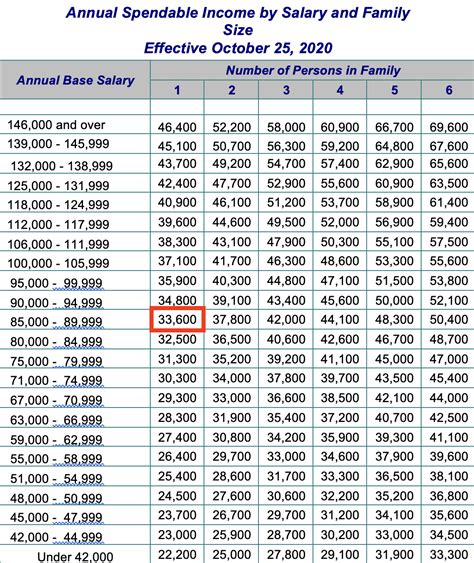

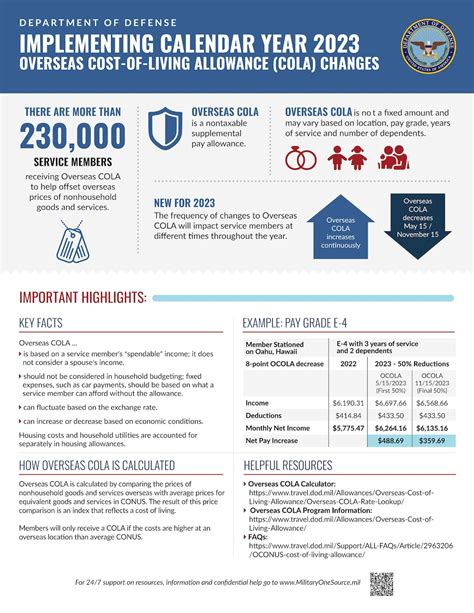

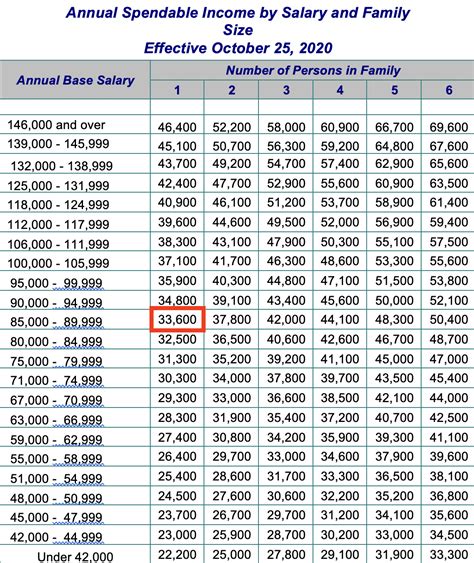

COLA is a tax-free allowance designed to help offset the higher cost of living in certain locations. As a DoD civilian employee, you may be eligible to receive COLA if you're assigned to a location with a high cost of living. The amount of COLA you receive will depend on your location, grade level, and family size.

To calculate COLA, you'll need to use the DoD's COLA calculator, which takes into account the cost of living index for your assigned location. The calculator will provide you with a percentage of your base pay that you can expect to receive as COLA.

3. Overseas Housing Allowance (OHA)

OHA is another tax-free allowance designed to help offset the cost of housing in your assigned location. As a DoD civilian employee, you may be eligible to receive OHA if you're assigned to a location with a high cost of housing. The amount of OHA you receive will depend on your location, grade level, and family size.

To calculate OHA, you'll need to use the DoD's OHA calculator, which takes into account the cost of housing in your assigned location. The calculator will provide you with a monthly allowance that you can expect to receive as OHA.

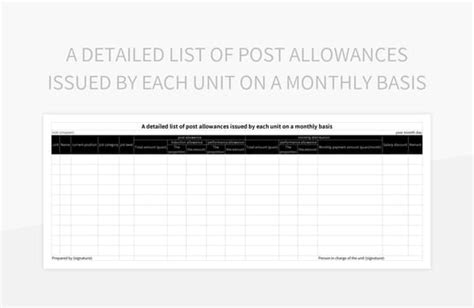

4. Post Allowance

Post allowance is a tax-free allowance designed to help offset the cost of living in certain locations. As a DoD civilian employee, you may be eligible to receive post allowance if you're assigned to a location with a high cost of living. The amount of post allowance you receive will depend on your location, grade level, and family size.

To calculate post allowance, you'll need to use the DoD's post allowance calculator, which takes into account the cost of living index for your assigned location. The calculator will provide you with a monthly allowance that you can expect to receive as post allowance.

5. Hardship Duty Pay

Hardship duty pay is a special allowance designed to compensate DoD civilian employees for the hardships they face while serving in certain locations. As a DoD civilian employee, you may be eligible to receive hardship duty pay if you're assigned to a location with a high level of hardship.

To calculate hardship duty pay, you'll need to use the DoD's hardship duty pay calculator, which takes into account the level of hardship in your assigned location. The calculator will provide you with a monthly allowance that you can expect to receive as hardship duty pay.

Example Calculation

Let's say you're a DoD civilian employee assigned to a location in Europe. Your grade level is GS-12, step 5, and you have a family of four. Using the OPM pay tables, your base pay would be $83,887 per year.

Using the DoD's COLA calculator, you determine that you're eligible to receive a COLA of 25% of your base pay, which would be $20,972 per year.

Using the DoD's OHA calculator, you determine that you're eligible to receive an OHA of $2,500 per month, which would be $30,000 per year.

Using the DoD's post allowance calculator, you determine that you're eligible to receive a post allowance of $500 per month, which would be $6,000 per year.

Finally, using the DoD's hardship duty pay calculator, you determine that you're eligible to receive a hardship duty pay of $200 per month, which would be $2,400 per year.

Your total overseas pay would be:

$83,887 (base pay) + $20,972 (COLA) + $30,000 (OHA) + $6,000 (post allowance) + $2,400 (hardship duty pay) = $143,259 per year

Gallery of DoD Civilian Overseas Pay

Gallery of DoD Civilian Overseas Pay Images

DoD Civilian Overseas Pay Image Gallery

FAQs

What is the difference between COLA and OHA?

+COLA (Cost of Living Allowance) is a tax-free allowance designed to help offset the higher cost of living in certain locations, while OHA (Overseas Housing Allowance) is a tax-free allowance designed to help offset the cost of housing in your assigned location.

How is hardship duty pay calculated?

+Hardship duty pay is calculated based on the level of hardship in your assigned location, using the DoD's hardship duty pay calculator.

Can I receive both COLA and OHA?

+Yes, you may be eligible to receive both COLA and OHA, depending on your location and grade level.

We hope this article has helped you understand the five ways to calculate DoD civilian overseas pay. Remember to use the DoD's calculators and consult with a financial advisor to ensure you're receiving the correct amount of pay and allowances. If you have any questions or concerns, please don't hesitate to comment below.