Intro

Unlock the role of a financial manager with these 8 key duties. From budgeting and forecasting to financial reporting and risk management, discover the essential responsibilities of a financial manager. Learn how they drive business growth, optimize resource allocation, and inform strategic decisions with data-driven insights, financial planning, and analysis.

The role of a financial manager is crucial in ensuring the financial health and stability of an organization. As a key member of the management team, a financial manager is responsible for overseeing the financial activities of the company, making strategic decisions, and driving business growth. In this article, we will explore the 8 key duties of a financial manager and how they contribute to the success of an organization.

1. Financial Planning and Budgeting

Financial planning and budgeting are critical components of a financial manager's role. They must develop and implement financial plans, budgets, and forecasts that align with the organization's strategic objectives. This involves analyzing financial data, identifying areas for cost reduction, and allocating resources effectively.

- Developing financial models and forecasts to predict future financial performance

- Creating and managing budgets to ensure effective resource allocation

- Analyzing financial data to identify trends, risks, and opportunities

Key Skills: Financial analysis, budgeting, forecasting, financial modeling

2. Financial Reporting and Compliance

Financial managers are responsible for ensuring that the organization's financial reports are accurate, timely, and compliant with regulatory requirements. They must also ensure that the organization is in compliance with relevant laws, regulations, and standards.

- Preparing and presenting financial reports to stakeholders, including management, board of directors, and investors

- Ensuring compliance with financial regulations, laws, and standards

- Maintaining accurate and complete financial records

Key Skills: Financial reporting, compliance, regulatory requirements, financial record-keeping

3. Investment and Funding

Financial managers are responsible for identifying and securing funding opportunities to support the organization's growth and development. They must also manage investments to ensure that they align with the organization's strategic objectives.

- Identifying and securing funding opportunities, including loans, grants, and investments

- Managing investments to ensure alignment with organizational objectives

- Evaluating and mitigating investment risks

Key Skills: Investment analysis, funding, risk management, financial modeling

4. Risk Management

Financial managers must identify, assess, and mitigate financial risks that could impact the organization's financial performance. This includes managing market risk, credit risk, liquidity risk, and operational risk.

- Identifying and assessing financial risks

- Developing and implementing risk mitigation strategies

- Monitoring and reporting on risk management activities

Key Skills: Risk management, risk assessment, risk mitigation, financial modeling

5. Financial Analysis and Decision-Making

Financial managers must analyze financial data to inform business decisions and drive strategic growth. They must also evaluate the financial implications of different business scenarios and make recommendations to management.

- Analyzing financial data to inform business decisions

- Evaluating the financial implications of different business scenarios

- Making recommendations to management on financial matters

Key Skills: Financial analysis, financial modeling, decision-making, strategic planning

6. Treasury Management

Financial managers are responsible for managing the organization's cash and liquidity to ensure that it meets its financial obligations. They must also manage the organization's banking relationships and negotiate favorable terms.

- Managing cash and liquidity to meet financial obligations

- Negotiating favorable banking terms and managing banking relationships

- Maintaining accurate and complete financial records

Key Skills: Treasury management, cash management, liquidity management, banking relationships

7. Financial Systems and Technology

Financial managers must evaluate and implement financial systems and technology that support the organization's financial management processes. They must also ensure that financial systems are integrated with other business systems.

- Evaluating and implementing financial systems and technology

- Ensuring integration with other business systems

- Maintaining accurate and complete financial records

Key Skills: Financial systems, financial technology, system implementation, integration

8. Team Management and Development

Financial managers are responsible for leading and developing a team of financial professionals. They must also ensure that the team has the necessary skills and knowledge to perform their duties effectively.

- Leading and developing a team of financial professionals

- Ensuring that the team has the necessary skills and knowledge to perform their duties effectively

- Coaching and mentoring team members to improve performance

Key Skills: Team management, leadership, coaching, mentoring, staff development

In conclusion, the role of a financial manager is multifaceted and requires a range of skills and expertise. By understanding the 8 key duties of a financial manager, organizations can ensure that their financial management processes are effective, efficient, and aligned with their strategic objectives.

We would love to hear from you! Do you have any questions or comments about the role of a financial manager? Please share your thoughts in the comments section below.

Gallery of Financial Manager Responsibilities

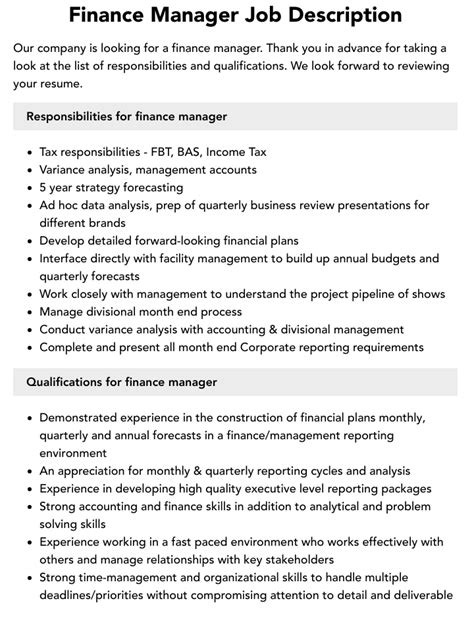

Financial Manager Responsibilities

Frequently Asked Questions

What are the key responsibilities of a financial manager?

+The key responsibilities of a financial manager include financial planning and budgeting, financial reporting and compliance, investment and funding, risk management, financial analysis and decision-making, treasury management, financial systems and technology, and team management and development.

What skills are required to be a successful financial manager?

+A successful financial manager requires a range of skills, including financial analysis, financial modeling, decision-making, strategic planning, risk management, financial reporting, and team management.

What is the role of a financial manager in a company?

+The role of a financial manager is to oversee the financial activities of the company, make strategic decisions, and drive business growth. They are responsible for ensuring that the company's financial management processes are effective, efficient, and aligned with its strategic objectives.