Intro

Unlock the details of National Guard E-5 pay with our expert guide. Discover the 5 key facts you need to know, including pay scales, allowances, and benefits. Get insider knowledge on sergeant pay, drill pay, and special duty pay. Learn how rank and time-in-service impact your paycheck and plan your financial future with confidence.

National Guard E-5 Pay: Understanding Your Compensation

As a National Guard member, your pay is an essential aspect of your service. If you're an E-5, also known as a Sergeant, it's crucial to understand how your pay is structured and what factors affect your compensation. In this article, we'll delve into the key facts about National Guard E-5 pay, helping you make informed decisions about your military career.

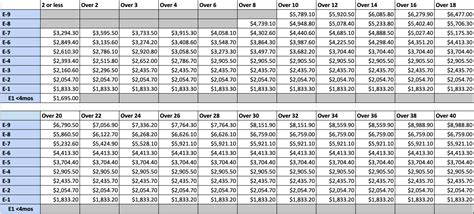

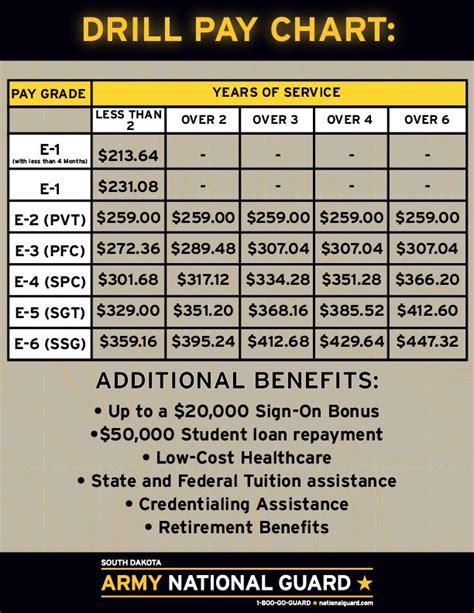

Fact #1: Base Pay vs. Drill Pay

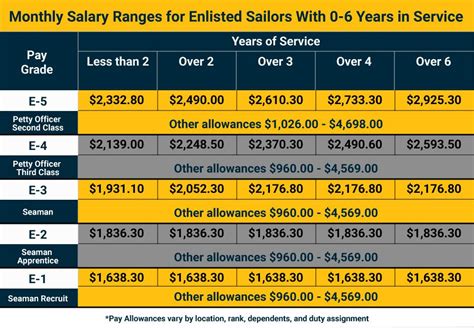

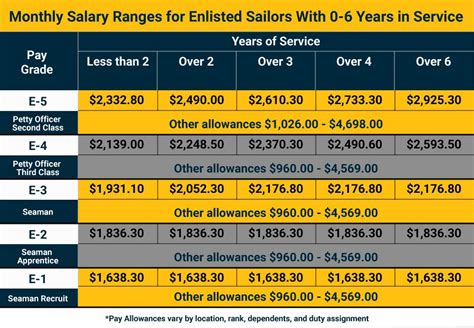

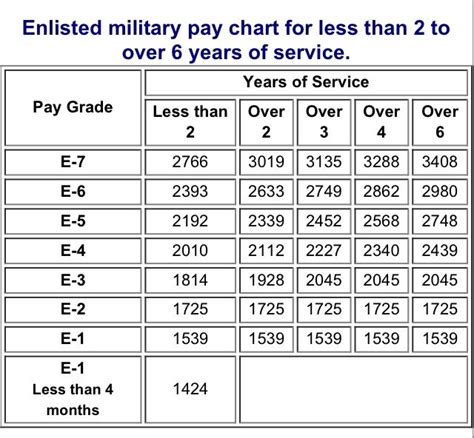

National Guard members receive two types of pay: base pay and drill pay. Base pay is the monthly salary you receive for your service, while drill pay is the compensation you receive for attending drills and training exercises. As an E-5, your base pay is determined by your time in service and your rank. According to the 2022 military pay charts, the base pay for an E-5 with 4-6 years of service is $2,654.90 per month. Drill pay, on the other hand, is calculated based on your rank and the number of drills you attend.

Drill Pay Calculator

To give you a better idea of your drill pay, here's a breakdown of the calculation:

- 1 drill = 4 hours of pay

- 1 weekend drill = 8 hours of pay (2 days x 4 hours)

- 1 annual training (AT) = 14-15 days of pay (varies depending on the length of AT)

Assuming you attend 1 drill per month and 1 AT per year, your drill pay would be:

- 1 drill/month x 12 months = 12 drills/year

- 12 drills/year x 4 hours/drill = 48 hours/year

- 48 hours/year x $45/hour (E-5 pay rate) = $2,160/year

Fact #2: Allowances and Special Pays

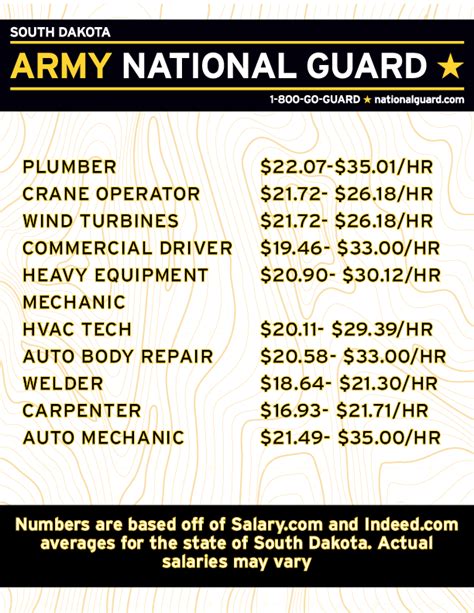

In addition to base pay and drill pay, National Guard members may be eligible for various allowances and special pays. These can include:

- Basic Allowance for Housing (BAH): a monthly allowance to help cover housing costs

- Basic Allowance for Subsistence (BAS): a monthly allowance to help cover food costs

- Special Duty Pay: additional pay for performing special duties, such as recruiting or serving as a drill instructor

- Hazardous Duty Pay: additional pay for performing duties that involve hazardous conditions

These allowances and special pays can significantly impact your overall compensation. For example, if you receive BAH and BAS, your monthly pay could increase by $500-$1,000.

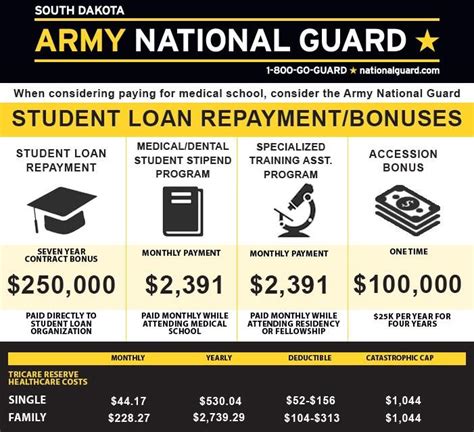

Fact #3: Education Benefits

The National Guard offers several education benefits to help you further your education and career. These benefits include:

- Tuition Assistance: up to $4,500 per year in tuition assistance for college courses

- Student Loan Repayment Program: up to $50,000 in student loan repayment assistance

- Montgomery GI Bill: up to $373 per month in education benefits for college courses

- State-specific education benefits: many states offer additional education benefits for National Guard members

These education benefits can help you pay for college courses, vocational training, or other education expenses.

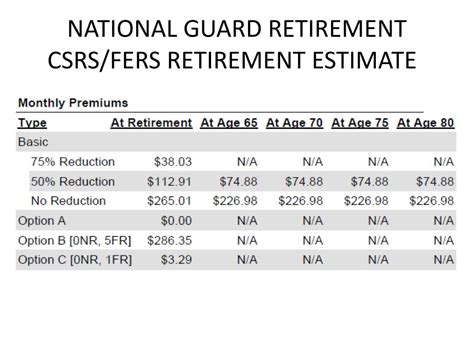

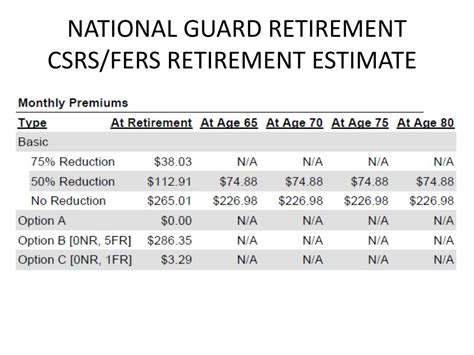

Fact #4: Retirement Benefits

As a National Guard member, you're eligible for retirement benefits after 20 years of service. The National Guard offers two retirement plans: the High-3 Retirement Plan and the REDUX Retirement Plan. The High-3 plan is the most common plan, which calculates your retirement pay based on your highest 3 years of base pay.

Here's an example of how your retirement pay would be calculated:

- Average of highest 3 years of base pay: $3,500/month

- Multiplier: 2.5% per year of service (20 years x 2.5% = 50%)

- Retirement pay: $1,750/month (50% x $3,500/month)

Fact #5: Tax Benefits

As a National Guard member, you may be eligible for tax benefits, including:

- Tax-free allowances: BAH, BAS, and other allowances are tax-free

- Tax-free education benefits: education benefits, such as the Montgomery GI Bill, are tax-free

- State tax benefits: many states offer tax benefits for National Guard members, including exemptions from state income tax

These tax benefits can help reduce your tax liability and increase your take-home pay.

Gallery of National Guard E-5 Pay

National Guard E-5 Pay Image Gallery

Frequently Asked Questions

How is my National Guard pay calculated?

+Your National Guard pay is calculated based on your rank, time in service, and the number of drills you attend. You'll receive base pay, drill pay, and possibly allowances and special pays.

What are the education benefits for National Guard members?

+The National Guard offers several education benefits, including tuition assistance, student loan repayment, and the Montgomery GI Bill.

How does retirement pay work for National Guard members?

+Retirement pay for National Guard members is calculated based on your highest 3 years of base pay. You'll be eligible for retirement benefits after 20 years of service.

We hope this article has provided you with a comprehensive understanding of National Guard E-5 pay. Remember to take advantage of the education benefits, allowances, and special pays available to you. If you have any further questions or concerns, don't hesitate to reach out to your unit's personnel office or a financial advisor.