Intro

Boost stock picks with 5 Earnings Whisper Tips, leveraging earnings estimates, analyst expectations, and market sentiment to inform investment decisions and maximize returns.

The world of investing is complex and ever-changing, with numerous factors influencing the performance of stocks and the overall market. One key aspect that can significantly impact investment decisions is earnings whispers. Earnings whispers refer to the unofficial, pre-announcement hints or expectations about a company's upcoming earnings report. These whispers can come from various sources, including analysts, investors, and even the companies themselves, and can greatly affect stock prices and investor confidence. Understanding and utilizing earnings whispers effectively can be a powerful tool in an investor's arsenal, providing valuable insights into potential market movements and helping to guide investment strategies.

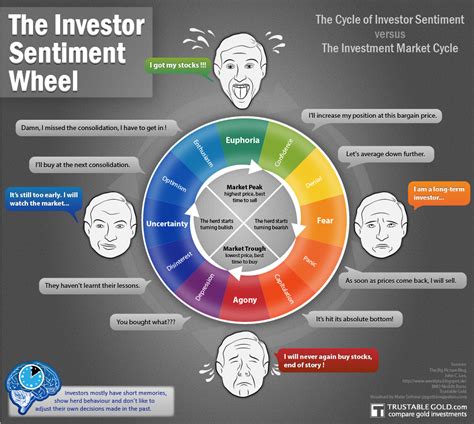

Earnings whispers are not just mere rumors or speculation; they are often based on detailed analysis, insider information, and market trends. Analysts and financial experts spend considerable time and effort analyzing companies' financial health, industry trends, and market conditions to predict future earnings. These predictions can influence investor sentiment, leading to increased buying or selling activity before the official earnings announcement. Therefore, being aware of earnings whispers and understanding how to interpret them can provide investors with a competitive edge in the market.

The importance of earnings whispers lies in their ability to anticipate market reactions. When earnings whispers are positive, indicating that a company is expected to exceed earnings expectations, it can lead to a surge in the stock's price before the official announcement. Conversely, negative whispers can cause a stock's price to plummet. By tapping into these whispers, investors can make more informed decisions about buying, holding, or selling stocks. However, it's crucial to approach earnings whispers with a critical eye, considering the source, methodology, and potential biases behind the predictions.

Earnings Whisper Basics

To effectively utilize earnings whispers, it's essential to understand the basics. This includes knowing how earnings whispers are generated, the sources of these whispers, and how they are disseminated. Earnings whispers can originate from a variety of sources, including financial analysts, company guidance, and market trends. Financial analysts play a significant role in creating earnings whispers through their forecasts and recommendations. Companies themselves may also provide guidance that influences earnings expectations. Additionally, overall market trends and the performance of similar companies within the same industry can contribute to the formation of earnings whispers.

Key Sources of Earnings Whispers

- Financial Analysts: Their forecasts and recommendations are closely watched by investors. - Company Guidance: Official statements from companies about their expected performance. - Market Trends: The overall direction and sentiment of the market.Utilizing Earnings Whispers for Investment Decisions

Utilizing earnings whispers for investment decisions requires a strategic approach. Investors should consider the credibility of the source, the methodology used to arrive at the earnings prediction, and any potential biases. It's also important to look at the consensus among different analysts and sources, as a broad agreement can indicate a higher likelihood of the prediction being accurate. Furthermore, understanding the historical accuracy of earnings whispers for a particular company can provide valuable context.

Strategies for Using Earnings Whispers

1. **Diversify Sources**: Consider whispers from multiple sources to get a well-rounded view. 2. **Analyze Historical Accuracy**: Look at how accurate whispers have been for the company in the past. 3. **Consider Consensus**: A consensus among analysts can strengthen the reliability of the whisper.Challenges and Risks Associated with Earnings Whispers

While earnings whispers can be a valuable tool, they also come with challenges and risks. One of the primary concerns is the potential for misinformation or manipulation. Companies or individuals may spread false or misleading information to influence stock prices for personal gain. Additionally, relying too heavily on earnings whispers can lead to overreaction or impulsive decisions, which can negatively impact investment portfolios.

Mitigating Risks

- **Verify Information**: Always try to verify the information through multiple sources. - **Stay Informed**: Keep up-to-date with the latest news and developments. - **Diversify Investments**: Spread investments to minimize the impact of any single stock's performance.Advanced Earnings Whisper Strategies

For seasoned investors, advanced strategies can further enhance the utility of earnings whispers. This includes using technical analysis to identify patterns in stock prices that may correlate with earnings whispers, and fundamental analysis to deeply understand the financial and operational health of companies. Additionally, options trading strategies can be employed to capitalize on the potential volatility surrounding earnings announcements.

Technical and Fundamental Analysis

- **Technical Analysis**: Study charts and patterns to predict price movements. - **Fundamental Analysis**: Examine a company's financial statements and health.Real-World Applications of Earnings Whispers

In real-world scenarios, earnings whispers play a crucial role in investment decisions. For instance, if a company like Apple is expected to announce earnings and there are positive whispers about exceeding expectations, investors might buy the stock in anticipation of a price increase. Conversely, if whispers are negative, investors might sell to avoid potential losses. The ability to interpret and act upon these whispers can significantly impact investment outcomes.

Case Studies

- **Successful Investments**: Examples where earnings whispers led to profitable investments. - **Lessons Learned**: Instances where whispers were misleading, and how to avoid similar mistakes.Earnings Whisper Image Gallery

What are earnings whispers, and how do they impact investment decisions?

+Earnings whispers are unofficial predictions about a company's upcoming earnings report. They can significantly impact investment decisions by influencing investor sentiment and stock prices before the official announcement.

How can investors verify the accuracy of earnings whispers?

+Investors can verify the accuracy of earnings whispers by considering the source, looking at historical data, and analyzing the consensus among different analysts and sources.

What are the risks associated with relying on earnings whispers for investment decisions?

+The risks include the potential for misinformation, overreaction to whispers, and making impulsive decisions based on unverified information. It's essential to approach earnings whispers with a critical and informed perspective.

In conclusion, earnings whispers are a powerful tool that can provide investors with valuable insights into potential market movements and guide investment strategies. By understanding the basics of earnings whispers, utilizing them effectively, and being aware of the challenges and risks, investors can make more informed decisions. Whether you're a seasoned investor or just starting out, incorporating earnings whispers into your investment approach can help you navigate the complex world of finance with greater confidence and potentially lead to more successful investment outcomes. We invite you to share your thoughts and experiences with earnings whispers in the comments below and look forward to continuing the conversation on how to leverage these whispers for investment success.