Intro

Warning signs of an economic collapse are increasingly evident. Learn the key indicators, including rising national debt, inflation, and market volatility, to prepare for potential financial disaster. Understand the implications of a collapse on your wealth and discover expert strategies for protecting your assets amidst economic uncertainty.

The threat of economic collapse has been a pressing concern for many individuals and nations in recent years. As the global economy becomes increasingly interconnected, the risk of a collapse affecting multiple countries and industries has grown. In this article, we will explore the warning signs of an economic collapse, and what you can do to prepare and protect yourself.

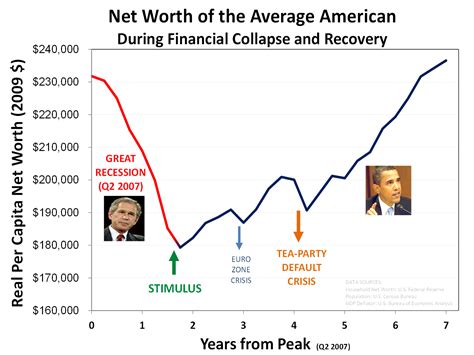

Understanding Economic Collapse

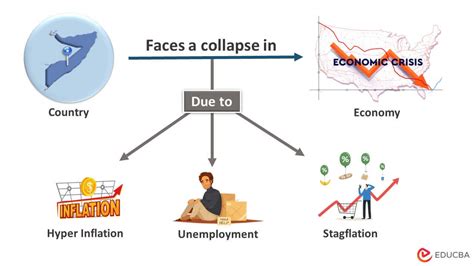

Before we dive into the warning signs, it's essential to understand what an economic collapse is. An economic collapse refers to a sudden and significant decline in the value of a country's or region's economy, leading to widespread poverty, unemployment, and social unrest. This can be caused by various factors, including excessive debt, inflation, currency devaluation, and trade wars.

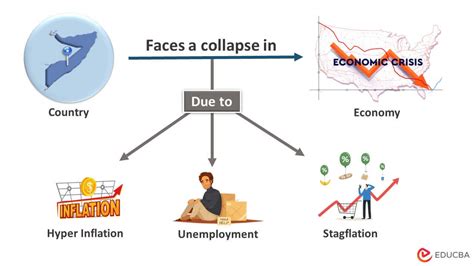

Causes of Economic Collapse

To identify the warning signs of an economic collapse, it's crucial to understand the underlying causes. Some of the most common causes include:

- Excessive debt: When governments, businesses, and individuals take on too much debt, it can lead to a debt bubble that eventually bursts, causing a collapse.

- Inflation: High inflation can erode the value of currency, leading to a decrease in purchasing power and a subsequent economic collapse.

- Currency devaluation: A sharp decline in the value of a currency can make imports more expensive, leading to inflation and economic instability.

- Trade wars: Tariffs and trade restrictions can disrupt global supply chains, leading to economic instability and collapse.

Warning Signs of Economic Collapse

Now that we understand the causes of economic collapse, let's explore the warning signs. These signs can be categorized into economic, financial, and social indicators.

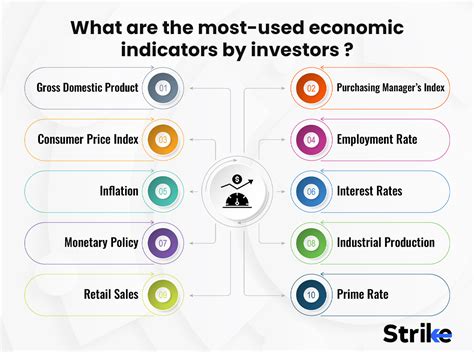

Economic Indicators

Economic indicators can provide valuable insights into the health of an economy. Some warning signs include:

- Slowing economic growth: A decline in economic growth can indicate a looming collapse.

- Increasing unemployment: Rising unemployment rates can signal a collapse in the job market.

- Decreasing consumer spending: A decline in consumer spending can indicate a lack of confidence in the economy.

- Increasing poverty rates: Rising poverty rates can signal a collapse in the standard of living.

Financial Indicators

Financial indicators can provide insights into the stability of the financial system. Some warning signs include:

- Stock market volatility: Increased stock market volatility can signal a collapse in investor confidence.

- Bond market instability: A decline in bond prices can indicate a collapse in the bond market.

- Currency fluctuations: Sharp declines in currency value can signal a collapse in the foreign exchange market.

- Banking system instability: A decline in bank deposits or a rise in bank failures can signal a collapse in the banking system.

Social Indicators

Social indicators can provide insights into the well-being of a society. Some warning signs include:

- Increasing social unrest: Rising social unrest can signal a collapse in social cohesion.

- Decreasing trust in institutions: A decline in trust in institutions can signal a collapse in confidence in the system.

- Increasing poverty and inequality: Rising poverty and inequality can signal a collapse in the standard of living.

Preparing for Economic Collapse

While no one can predict with certainty when an economic collapse will occur, there are steps you can take to prepare and protect yourself.

Building an Emergency Fund

Building an emergency fund can provide a financial safety net in the event of an economic collapse. Aim to save 3-6 months' worth of living expenses in a easily accessible savings account.

Diversifying Your Investments

Diversifying your investments can help reduce your risk exposure in the event of an economic collapse. Consider investing in a mix of stocks, bonds, and alternative assets such as gold or real estate.

Developing a Skills-Based Income

Developing a skills-based income can provide a sense of security in the event of an economic collapse. Consider developing skills that are in high demand and can be monetized.

Conclusion

The threat of economic collapse is a pressing concern for many individuals and nations. By understanding the warning signs and taking steps to prepare and protect yourself, you can reduce your risk exposure and increase your resilience in the face of economic uncertainty.

Economic Collapse Image Gallery

What are the warning signs of economic collapse?

+The warning signs of economic collapse include slowing economic growth, increasing unemployment, decreasing consumer spending, and increasing poverty rates.

How can I prepare for economic collapse?

+You can prepare for economic collapse by building an emergency fund, diversifying your investments, and developing a skills-based income.

What should I do in the event of an economic collapse?

+In the event of an economic collapse, it's essential to remain calm and have a plan in place. Consider diversifying your assets, reducing debt, and developing a skills-based income.