Intro

Unlock financial literacy and maximize education tax credits with our expert guide. Learn how to claim Education Duty For Dollars, optimizing tax refunds and planning for higher education expenses. Discover LIF, RESP, and CESG benefits, and get tips on tuition tax credits, student loan interest, and education-related deductions.

Education is the key to unlocking a brighter financial future. It's a crucial aspect of personal development, enabling individuals to make informed decisions about their money and create a more stable financial foundation. In this article, we'll delve into the concept of financial literacy, its importance, and how education can empower individuals to manage their finances effectively.

Financial literacy is the ability to understand and manage personal finances effectively. It encompasses knowledge of basic financial concepts, such as budgeting, saving, investing, and managing debt. With the increasing complexity of financial markets and products, financial literacy has become an essential life skill. According to a report by the Financial Industry Regulatory Authority (FINRA), nearly two-thirds of Americans struggle with financial literacy, making it a pressing concern for individuals, communities, and the nation as a whole.

The consequences of poor financial literacy are far-reaching. Individuals who lack basic financial knowledge may struggle to manage their finances, leading to debt accumulation, financial stress, and reduced economic opportunities. Furthermore, financial illiteracy can perpetuate cycles of poverty and inequality, as individuals without access to financial resources and knowledge may be more vulnerable to financial exploitation.

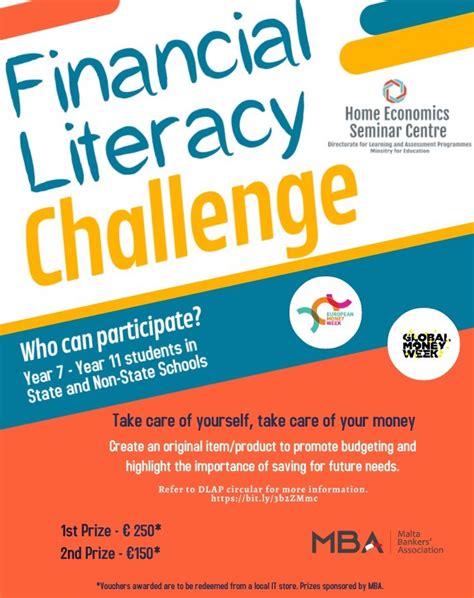

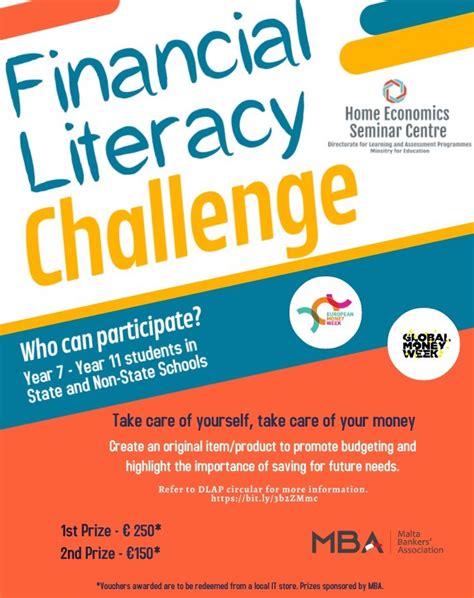

Education plays a vital role in promoting financial literacy. By incorporating financial education into school curricula, educators can equip students with essential skills and knowledge to navigate the financial world. Research has shown that financial education can have a positive impact on financial behavior, with studies indicating that students who receive financial education are more likely to save, invest, and manage debt effectively.

Benefits of Financial Education

Financial education offers numerous benefits, both for individuals and society as a whole. Some of the key advantages of financial education include:

- Improved financial decision-making: Financial education empowers individuals to make informed decisions about their money, reducing the risk of financial mistakes and promoting financial stability.

- Increased financial inclusion: Financial education can help bridge the financial literacy gap, promoting financial inclusion and reducing economic inequality.

- Better financial management: Financial education teaches individuals how to manage their finances effectively, reducing debt accumulation and promoting long-term financial stability.

- Enhanced economic opportunities: Financial education can increase economic opportunities, enabling individuals to invest in their future and achieve their financial goals.

Key Components of Financial Education

Effective financial education should cover a range of topics, including:

- Budgeting and saving: Understanding the importance of budgeting and saving, and how to create a budget and savings plan.

- Investing and risk management: Understanding the basics of investing, including risk management and asset allocation.

- Debt management: Understanding how to manage debt effectively, including strategies for debt reduction and credit management.

- Financial planning: Understanding how to create a financial plan, including setting financial goals and developing a plan to achieve them.

Implementing Financial Education

Implementing financial education requires a multi-faceted approach, involving educators, policymakers, and financial institutions. Some strategies for implementing financial education include:

- Integrating financial education into school curricula: Incorporating financial education into school curricula, starting from a young age, can help promote financial literacy and create a financially literate population.

- Providing financial education resources: Providing access to financial education resources, such as online courses and financial literacy programs, can help individuals develop their financial knowledge and skills.

- Promoting financial literacy programs: Promoting financial literacy programs, such as financial counseling and coaching, can help individuals develop personalized financial plans and achieve their financial goals.

Challenges and Limitations

While financial education is essential for promoting financial literacy, there are several challenges and limitations to its implementation. Some of the key challenges include:

- Limited access to financial education: Many individuals lack access to financial education, particularly in low-income and marginalized communities.

- Limited financial resources: Financial education programs often require significant financial resources, which can be a barrier to implementation.

- Competeting priorities: Financial education may not be a priority for educators or policymakers, particularly in the face of competing demands and limited resources.

Conclusion and Call to Action

Financial education is a critical aspect of promoting financial literacy and creating a more stable financial future. By understanding the importance of financial education, individuals can take the first step towards achieving financial stability and security. We urge policymakers, educators, and financial institutions to prioritize financial education, providing access to financial education resources and promoting financial literacy programs. Together, we can create a more financially literate population, equipped to manage their finances effectively and achieve their financial goals.

Take Action

- Seek out financial education resources: Take advantage of online courses, financial literacy programs, and other resources to develop your financial knowledge and skills.

- Support financial education initiatives: Advocate for financial education in your community, supporting initiatives that promote financial literacy and inclusion.

- Share your financial knowledge: Share your financial knowledge with others, helping to create a more financially literate population.

Gallery of Financial Education Images

Financial Education Image Gallery

FAQs

What is financial education?

+Financial education is the process of acquiring knowledge and skills necessary to manage personal finances effectively.

Why is financial education important?

+Financial education is essential for promoting financial literacy, reducing financial stress, and creating a more stable financial future.

How can I access financial education resources?

+There are many online resources, financial literacy programs, and financial education courses available to help you develop your financial knowledge and skills.