Intro

Get organized with 5 free budget sheets, featuring expense trackers, financial planners, and budget templates to manage income, savings, and debt, simplifying personal finance and money management.

Creating and managing a budget is a crucial step towards achieving financial stability and security. With the numerous expenses that individuals and families face on a daily basis, it can be challenging to keep track of where money is going and how it can be optimized. One of the most effective tools for managing finances is a budget sheet. A budget sheet is a document that outlines projected income and expenses, helping individuals to plan and control their financial resources. In this article, we will explore five free budget sheets that can be used to manage personal finances effectively.

Budgeting is essential for several reasons. Firstly, it helps individuals to understand their spending habits and identify areas where they can cut back on unnecessary expenses. Secondly, it enables them to prioritize their spending, ensuring that essential expenses such as rent, utilities, and food are covered before discretionary spending. Lastly, budgeting helps individuals to save money, which can be used for long-term investments, emergency funds, or achieving specific financial goals. By using a budget sheet, individuals can take control of their finances, reduce financial stress, and work towards achieving financial stability.

Effective budgeting requires a thorough understanding of one's income and expenses. It involves tracking every single transaction, from income to expenses, and categorizing them into different groups such as housing, transportation, food, and entertainment. A budget sheet provides a structured format for recording and analyzing financial data, making it easier to identify trends, patterns, and areas for improvement. With the numerous budgeting templates available online, individuals can choose a budget sheet that suits their needs and preferences.

Introduction to Budget Sheets

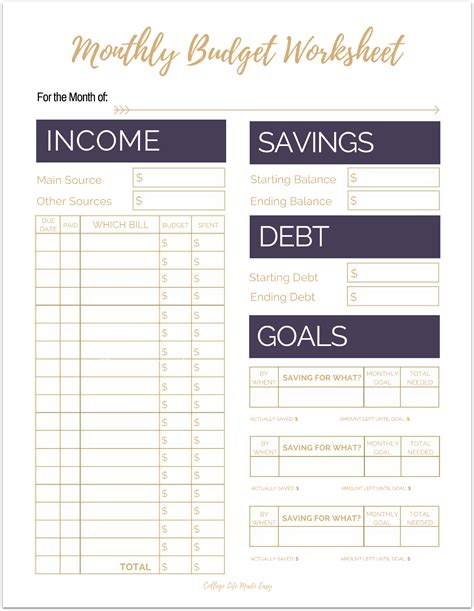

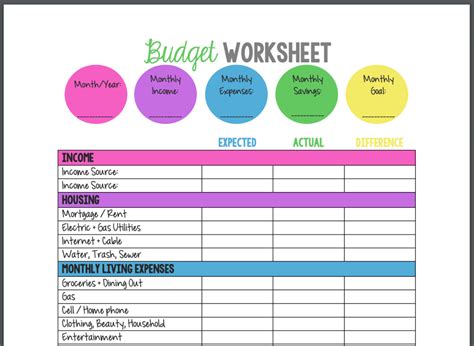

A budget sheet typically consists of several columns and rows, with headings such as income, fixed expenses, variable expenses, and savings. The income section outlines the projected income from various sources, such as salary, investments, and freelance work. The fixed expenses section includes essential expenses such as rent, utilities, and loan repayments, while the variable expenses section covers discretionary spending such as entertainment, hobbies, and travel. The savings section outlines the amount allocated for short-term and long-term savings goals.

Benefits of Using Budget Sheets

Using a budget sheet offers several benefits, including: * Improved financial awareness and control * Enhanced budgeting and planning * Increased savings and investment * Reduced financial stress and anxiety * Better decision-making and prioritization5 Free Budget Sheets

Here are five free budget sheets that can be used to manage personal finances:

- Microsoft Excel Budget Template: This template is available for free download and provides a comprehensive format for tracking income and expenses. It includes columns for income, fixed expenses, variable expenses, and savings, as well as formulas for calculating totals and percentages.

- Google Sheets Budget Template: This template is available for free and provides a customizable format for tracking finances. It includes columns for income, expenses, and savings, as well as formulas for calculating totals and percentages.

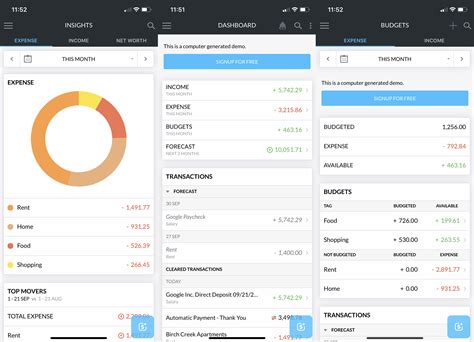

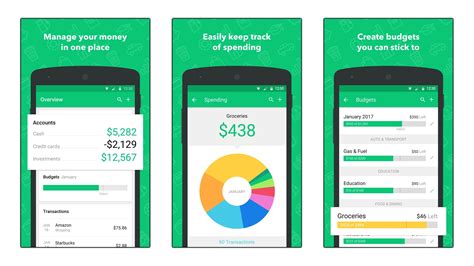

- Mint Budget Template: This template is available for free and provides a comprehensive format for tracking income and expenses. It includes columns for income, fixed expenses, variable expenses, and savings, as well as tools for setting financial goals and tracking progress.

- Personal Budget Worksheet: This template is available for free and provides a simple format for tracking income and expenses. It includes columns for income, fixed expenses, variable expenses, and savings, as well as space for noting financial goals and objectives.

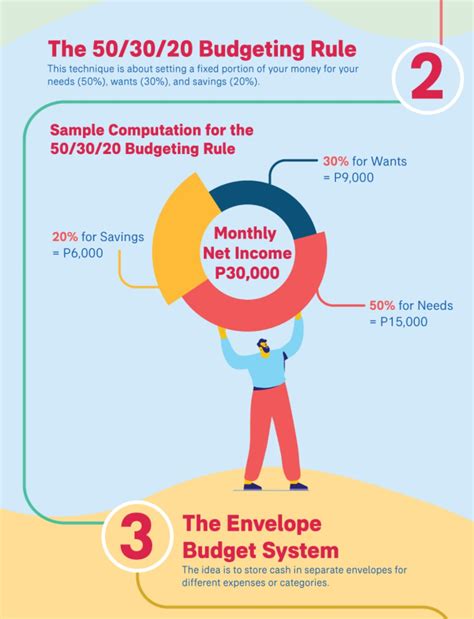

- 50/30/20 Budget Template: This template is available for free and provides a format for allocating income into three categories: essential expenses (50%), discretionary spending (30%), and savings (20%). It includes columns for income, expenses, and savings, as well as tools for tracking progress and staying on track.

How to Use Budget Sheets

Using a budget sheet is a straightforward process that involves the following steps: * Download and print the budget sheet * Fill in the income section with projected income from various sources * Fill in the fixed expenses section with essential expenses such as rent and utilities * Fill in the variable expenses section with discretionary spending such as entertainment and hobbies * Fill in the savings section with amounts allocated for short-term and long-term savings goals * Review and update the budget sheet regularly to track progress and make adjustments as neededTips for Effective Budgeting

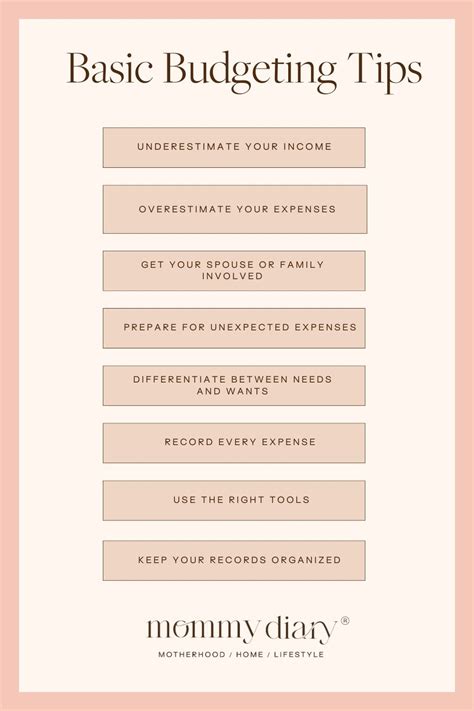

Here are some tips for effective budgeting:

- Track every single transaction, no matter how small

- Categorize expenses into different groups such as housing, transportation, and food

- Prioritize essential expenses such as rent and utilities

- Use the 50/30/20 rule to allocate income into essential expenses, discretionary spending, and savings

- Review and update the budget regularly to track progress and make adjustments as needed

Common Budgeting Mistakes

Here are some common budgeting mistakes to avoid: * Failing to track expenses * Not prioritizing essential expenses * Overspending on discretionary items * Not saving enough for short-term and long-term goals * Not reviewing and updating the budget regularlyConclusion and Next Steps

In conclusion, using a budget sheet is an effective way to manage personal finances and achieve financial stability. By downloading and using one of the five free budget sheets outlined in this article, individuals can take control of their finances, reduce financial stress, and work towards achieving their financial goals. Remember to track every single transaction, prioritize essential expenses, and review and update the budget regularly to ensure success.

For more information on budgeting and personal finance, check out our article on financial planning.

Budgeting Image Gallery

What is a budget sheet?

+A budget sheet is a document that outlines projected income and expenses, helping individuals to plan and control their financial resources.

Why is budgeting important?

+Budgeting is important because it helps individuals to understand their spending habits, prioritize their spending, and save money for long-term investments and emergency funds.

How do I use a budget sheet?

+Using a budget sheet involves filling in the income section with projected income, filling in the fixed expenses section with essential expenses, filling in the variable expenses section with discretionary spending, and filling in the savings section with amounts allocated for short-term and long-term savings goals.

What are some common budgeting mistakes?

+Common budgeting mistakes include failing to track expenses, not prioritizing essential expenses, overspending on discretionary items, not saving enough for short-term and long-term goals, and not reviewing and updating the budget regularly.

Where can I find free budget sheets?

+Free budget sheets can be found online, including Microsoft Excel Budget Template, Google Sheets Budget Template, Mint Budget Template, Personal Budget Worksheet, and 50/30/20 Budget Template.

We hope this article has provided you with the information and resources you need to manage your finances effectively. Remember to track every single transaction, prioritize essential expenses, and review and update your budget regularly to ensure success. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them achieve financial stability and security.