Intro

Discover Navy Federal HELOC loan options, offering flexible home equity lines of credit with competitive rates, loan terms, and borrowing limits, ideal for homeowners seeking financing solutions, refinancing, or debt consolidation with low interest rates.

The world of home equity loans can be complex and overwhelming, especially for those who are new to the concept of borrowing against their home's value. However, with the right guidance and information, homeowners can unlock the full potential of their property and achieve their financial goals. One popular option for those looking to tap into their home's equity is the Navy Federal HELOC loan. As one of the largest and most reputable credit unions in the United States, Navy Federal offers a range of loan options that cater to different needs and financial situations. In this article, we will delve into the world of Navy Federal HELOC loan options, exploring the benefits, features, and requirements of these loans.

For many homeowners, their property is their most valuable asset, and leveraging its equity can be a smart financial move. A Home Equity Line of Credit (HELOC) allows borrowers to access a line of credit based on the value of their home, using it as collateral. This type of loan offers flexibility and convenience, as borrowers can draw upon the credit line as needed, repay the balance, and reuse the credit line. Navy Federal's HELOC loan options are designed to provide homeowners with a reliable and affordable way to borrow against their home's equity, whether it's for home improvements, debt consolidation, or other major expenses.

Navy Federal HELOC Loan Options

Navy Federal offers several HELOC loan options, each with its own set of features and benefits. These options include fixed-rate and variable-rate loans, as well as loans with different repayment terms and credit limits. By understanding the different options available, homeowners can choose the loan that best suits their needs and financial situation. Some of the key features of Navy Federal's HELOC loan options include competitive interest rates, flexible repayment terms, and low or no closing costs. Additionally, Navy Federal members can enjoy discounts on interest rates and other perks, making their HELOC loan options even more attractive.

Types of Navy Federal HELOC Loans

Navy Federal offers two main types of HELOC loans: fixed-rate and variable-rate loans. Fixed-rate loans offer a fixed interest rate for the life of the loan, providing borrowers with predictable monthly payments and protection against rising interest rates. Variable-rate loans, on the other hand, offer a lower initial interest rate that may adjust over time based on market conditions. While variable-rate loans may offer lower monthly payments, they also come with the risk of increasing interest rates, which can impact the overall cost of the loan.Benefits of Navy Federal HELOC Loans

There are several benefits to choosing a Navy Federal HELOC loan, including competitive interest rates, flexible repayment terms, and low or no closing costs. Additionally, Navy Federal members can enjoy discounts on interest rates and other perks, making their HELOC loan options even more attractive. Some of the key benefits of Navy Federal HELOC loans include:

- Competitive interest rates: Navy Federal offers competitive interest rates on its HELOC loans, helping borrowers save money on interest payments.

- Flexible repayment terms: Navy Federal's HELOC loans offer flexible repayment terms, allowing borrowers to choose a repayment schedule that works for them.

- Low or no closing costs: Navy Federal's HELOC loans often come with low or no closing costs, saving borrowers money upfront.

- Discounts for members: Navy Federal members can enjoy discounts on interest rates and other perks, making their HELOC loan options even more attractive.

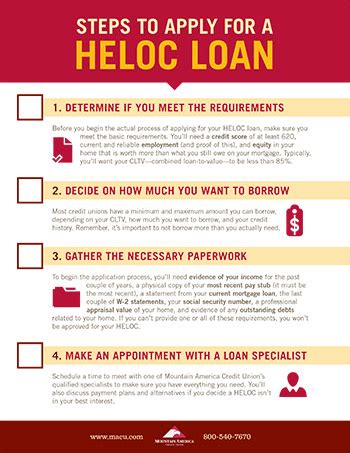

How to Apply for a Navy Federal HELOC Loan

Applying for a Navy Federal HELOC loan is a straightforward process that can be completed online, by phone, or in person at a Navy Federal branch. To apply, borrowers will need to provide personal and financial information, including income verification, credit history, and property value. Navy Federal will also require an appraisal of the property to determine its value and the amount of credit available. Once the application is submitted, Navy Federal will review the borrower's creditworthiness and property value to determine the loan amount and interest rate.Navy Federal HELOC Loan Requirements

To qualify for a Navy Federal HELOC loan, borrowers must meet certain requirements, including:

- Membership: Borrowers must be members of Navy Federal Credit Union to apply for a HELOC loan.

- Credit score: Navy Federal requires a minimum credit score of 620 to qualify for a HELOC loan.

- Income: Borrowers must have a stable income and a debt-to-income ratio that meets Navy Federal's requirements.

- Property value: The property must have a sufficient value to secure the loan, and borrowers must have a minimum of 20% equity in the property.

- Appraisal: An appraisal of the property may be required to determine its value and the amount of credit available.

Navy Federal HELOC Loan Rates and Terms

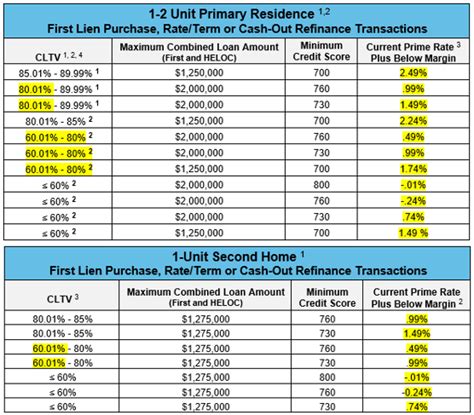

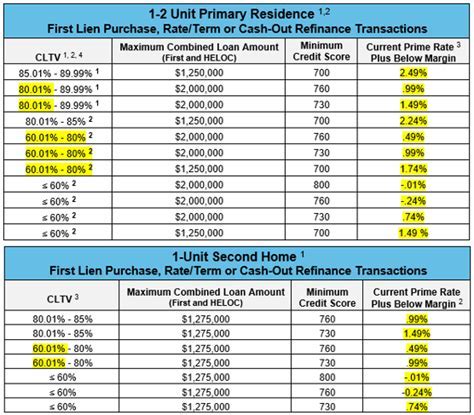

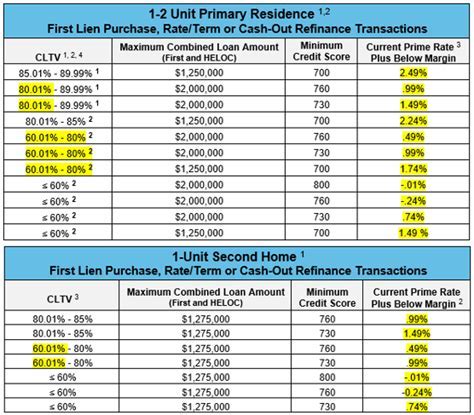

Navy Federal's HELOC loan rates and terms vary depending on the type of loan and the borrower's creditworthiness. Fixed-rate loans offer a fixed interest rate for the life of the loan, while variable-rate loans offer a lower initial interest rate that may adjust over time. Repayment terms also vary, with borrowers able to choose from a range of repayment schedules. Some of the key rates and terms to consider include: * Interest rates: Navy Federal's HELOC loan interest rates range from 4.00% to 18.00% APR, depending on the type of loan and the borrower's creditworthiness. * Repayment terms: Repayment terms range from 5 to 20 years, depending on the loan amount and the borrower's financial situation. * Credit limits: Credit limits range from $10,000 to $500,000, depending on the property value and the borrower's creditworthiness.Navy Federal HELOC Loan Calculator

To help borrowers determine how much they can borrow and what their monthly payments will be, Navy Federal offers a HELOC loan calculator. This tool allows borrowers to input their property value, credit score, and other financial information to estimate their loan amount and interest rate. The calculator also provides an estimate of the monthly payments and the total cost of the loan over its lifetime. By using the calculator, borrowers can get a better understanding of their loan options and make informed decisions about their financial situation.

Navy Federal HELOC Loan Reviews

Navy Federal's HELOC loans have received positive reviews from borrowers, who praise the credit union's competitive interest rates, flexible repayment terms, and low or no closing costs. Some borrowers have also reported a smooth and efficient application process, with helpful and knowledgeable loan officers guiding them through the process. However, some borrowers have reported difficulties with the appraisal process, and others have noted that the credit union's requirements can be strict. Overall, Navy Federal's HELOC loans are a popular choice among homeowners who are looking for a reliable and affordable way to borrow against their home's equity.Gallery of Navy Federal HELOC Loan Options

Navy Federal HELOC Loan Options Image Gallery

Frequently Asked Questions

What is a Navy Federal HELOC loan?

+A Navy Federal HELOC loan is a type of loan that allows homeowners to borrow against the equity in their home, using it as collateral.

What are the benefits of a Navy Federal HELOC loan?

+The benefits of a Navy Federal HELOC loan include competitive interest rates, flexible repayment terms, and low or no closing costs.

How do I apply for a Navy Federal HELOC loan?

+To apply for a Navy Federal HELOC loan, borrowers can visit the credit union's website, call the loan department, or visit a branch in person.

What are the requirements for a Navy Federal HELOC loan?

+The requirements for a Navy Federal HELOC loan include membership in the credit union, a minimum credit score of 620, and a sufficient property value to secure the loan.

How long does it take to process a Navy Federal HELOC loan application?

+The processing time for a Navy Federal HELOC loan application can vary, but most applications are processed within 2-4 weeks.

In conclusion, Navy Federal's HELOC loan options offer a reliable and affordable way for homeowners to borrow against their home's equity. With competitive interest rates, flexible repayment terms, and low or no closing costs, these loans are an attractive choice for those looking to tap into their property's value. By understanding the different types of HELOC loans available, the benefits and requirements of these loans, and the application process, homeowners can make informed decisions about their financial situation and achieve their goals. Whether you're looking to finance home improvements, consolidate debt, or cover other major expenses, a Navy Federal HELOC loan may be the right choice for you. We encourage you to share your thoughts and experiences with Navy Federal HELOC loans in the comments below, and to explore other resources and articles on our website for more information on this topic.