Intro

Discover the MEPS process in 5 straightforward steps. Learn how to navigate the Military Entrance Processing Station, from initial application to enlistment. Understand the role of ASVAB tests, medical screenings, and background checks. Get expert insights into the MEPS process timeline and what to expect. Start your military career with confidence.

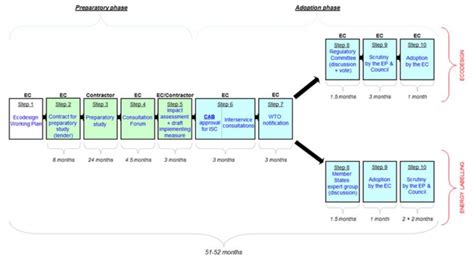

In the ever-evolving world of commerce, one crucial aspect that has seen significant transformations is the payment processing industry. The Multi-Entry Payment System (MEPS) is one such development that has revolutionized the way merchants and financial institutions handle transactions. In this article, we will delve into the intricacies of the MEPS process, breaking down its 5 key steps and exploring its benefits, working mechanisms, and more.

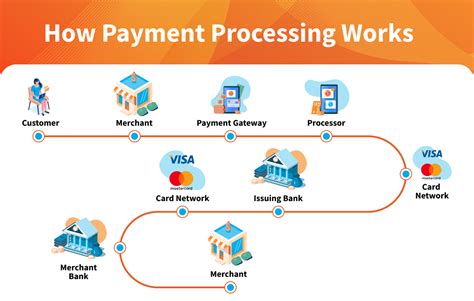

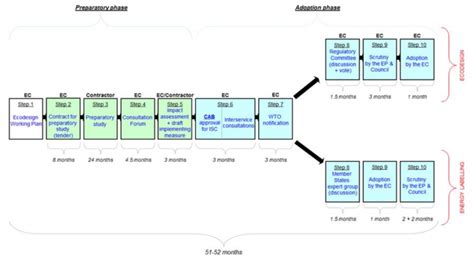

To grasp the significance of MEPS, it is essential to understand the challenges it aims to address. Traditional payment processing systems often involve multiple intermediaries, leading to increased transaction costs, reduced security, and slower processing times. MEPS, on the other hand, streamlines the payment process, reducing the number of intermediaries and enabling faster, more secure, and cost-effective transactions.

What is the MEPS Process?

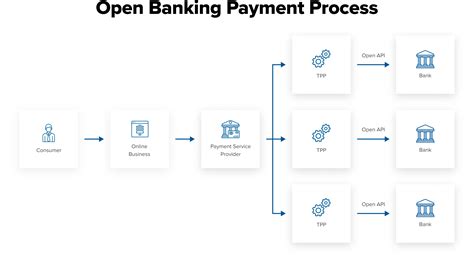

The MEPS process is a type of payment processing system that enables multiple entries and exits within a single transaction. This means that a single transaction can involve multiple participants, such as merchants, banks, and payment processors, without the need for intermediaries. The MEPS process is designed to provide a faster, more secure, and cost-effective way of processing transactions.

Key Benefits of the MEPS Process

Before we dive into the 5 steps of the MEPS process, let's explore its key benefits:

- Faster Processing Times: MEPS enables faster transaction processing, reducing the time it takes for merchants to receive payments.

- Improved Security: The MEPS process reduces the risk of fraud and data breaches by minimizing the number of intermediaries involved.

- Cost-Effective: MEPS reduces transaction costs by eliminating the need for intermediaries and reducing the complexity of the payment process.

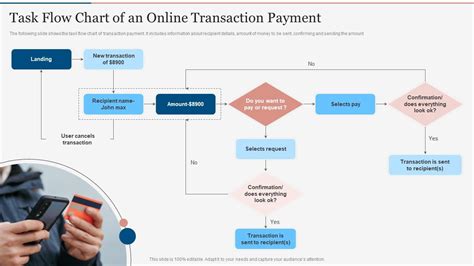

Step 1: Transaction Initiation

The first step in the MEPS process is transaction initiation. This involves the merchant initiating a transaction with the customer, either online or offline. The merchant provides the customer with a payment link or a payment terminal, and the customer enters their payment details.

Key Players Involved

- Merchant: The merchant initiates the transaction and provides the customer with a payment link or terminal.

- Customer: The customer enters their payment details and authorizes the transaction.

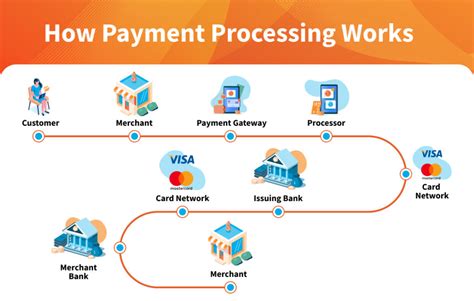

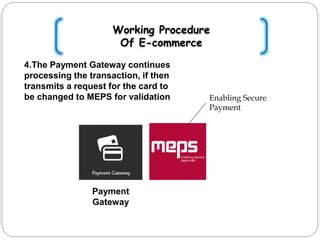

Step 2: Payment Processing

Once the transaction is initiated, the payment processing step begins. This involves the payment processor verifying the customer's payment details and checking for sufficient funds. The payment processor then sends a request to the customer's bank to authorize the transaction.

Key Players Involved

- Payment Processor: The payment processor verifies the customer's payment details and checks for sufficient funds.

- Customer's Bank: The customer's bank authorizes the transaction and releases the funds.

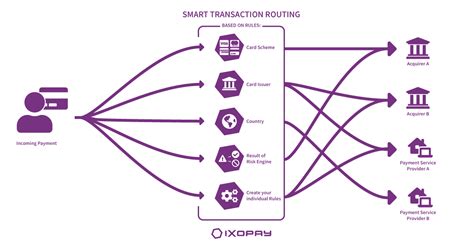

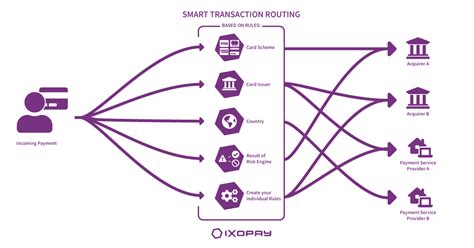

Step 3: Transaction Routing

After the transaction is authorized, the transaction routing step begins. This involves the payment processor routing the transaction to the merchant's bank. The merchant's bank then verifies the transaction and updates the merchant's account.

Key Players Involved

- Payment Processor: The payment processor routes the transaction to the merchant's bank.

- Merchant's Bank: The merchant's bank verifies the transaction and updates the merchant's account.

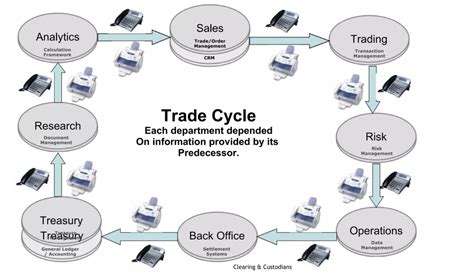

Step 4: Settlement

The settlement step involves the merchant's bank settling the transaction with the customer's bank. This involves the transfer of funds from the customer's account to the merchant's account.

Key Players Involved

- Merchant's Bank: The merchant's bank settles the transaction with the customer's bank.

- Customer's Bank: The customer's bank transfers the funds to the merchant's account.

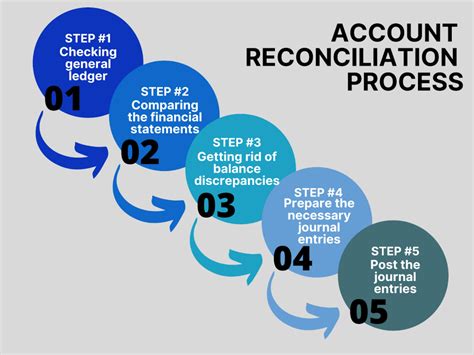

Step 5: Reconciliation

The final step in the MEPS process is reconciliation. This involves the merchant's bank reconciling the transaction with the payment processor and the customer's bank. This step ensures that all parties are in agreement and that the transaction is complete.

Key Players Involved

- Merchant's Bank: The merchant's bank reconciles the transaction with the payment processor and the customer's bank.

- Payment Processor: The payment processor verifies the transaction and ensures that all parties are in agreement.

MEPS Process Image Gallery

What is the MEPS process?

+The MEPS process is a type of payment processing system that enables multiple entries and exits within a single transaction.

What are the key benefits of the MEPS process?

+The key benefits of the MEPS process include faster processing times, improved security, and cost-effectiveness.

Who are the key players involved in the MEPS process?

+The key players involved in the MEPS process include the merchant, payment processor, customer's bank, and merchant's bank.

In conclusion, the MEPS process is a revolutionary payment processing system that streamlines the transaction process, reducing the number of intermediaries and enabling faster, more secure, and cost-effective transactions. By understanding the 5 key steps of the MEPS process, merchants and financial institutions can harness its benefits and improve their payment processing capabilities.

Share your thoughts on the MEPS process and its benefits in the comments section below!