Intro

Discover the ins and outs of Backbone price dynamics. Learn how to navigate the complex world of Backbone valuation, including key factors influencing price, market trends, and expert predictions. Get the inside scoop on Backbones current and future value, and make informed decisions with our comprehensive guide to Backbone price.

Backbone price is a critical concept in the world of finance, particularly in the context of investment and portfolio management. Understanding backbone price is essential for investors, financial analysts, and anyone looking to make informed decisions about their investments. In this article, we will delve into the concept of backbone price, its importance, and how it affects investment decisions.

What is Backbone Price?

Backbone price refers to the intrinsic value of a security, such as a stock or bond, based on its underlying fundamentals. It represents the true worth of the investment, stripped of market volatility and external influences. In other words, backbone price is the price at which a security would trade if all market participants had perfect information and were acting rationally.

Importance of Backbone Price

Backbone price is crucial in investment analysis because it provides a benchmark for evaluating the fairness of market prices. By comparing the market price to the backbone price, investors can determine whether a security is overvalued or undervalued. This information can inform investment decisions, such as whether to buy, sell, or hold a particular security.

How is Backbone Price Calculated?

Calculating backbone price involves analyzing various fundamental factors, including:

- Financial statements: Income statements, balance sheets, and cash flow statements provide insights into a company's financial health and performance.

- Industry trends: Understanding the trends and outlook for the industry in which the company operates can help estimate future growth prospects.

- Competitive analysis: Comparing the company's financials and market position to those of its peers can help identify areas of strength and weakness.

- Management team: The quality and track record of the management team can impact the company's future prospects.

By analyzing these factors, investors can estimate the intrinsic value of a security, which represents the backbone price.

Why is Backbone Price Important for Investors?

Backbone price is essential for investors because it:

- Helps identify mispricings: By comparing the market price to the backbone price, investors can identify mispricings in the market, which can inform investment decisions.

- Provides a basis for valuation: Backbone price provides a basis for evaluating the fairness of market prices, helping investors make informed decisions.

- Reduces risk: By investing in securities with a lower market price than their backbone price, investors can reduce their risk of losses.

How to Use Backbone Price in Investment Decisions

Backbone price can be used in various ways to inform investment decisions, including:

- Value investing: Investors can look for securities with a market price lower than their backbone price, indicating a potential buying opportunity.

- Growth investing: Investors can use backbone price to evaluate the growth prospects of a company and determine whether the market price reflects those prospects.

- Risk management: Investors can use backbone price to identify potential risks and adjust their portfolios accordingly.

Common Misconceptions about Backbone Price

There are several common misconceptions about backbone price, including:

- Backbone price is the same as market price: While market price and backbone price are related, they are not the same thing. Market price is influenced by external factors, such as market sentiment and news, whereas backbone price is based on fundamental analysis.

- Backbone price is a guarantee of returns: While backbone price can provide insights into the intrinsic value of a security, it is not a guarantee of returns. Other factors, such as market volatility and external influences, can impact actual returns.

Best Practices for Using Backbone Price

To get the most out of backbone price, investors should:

- Use a range of fundamental analysis techniques: No single technique is perfect, so using a range of techniques can help provide a more accurate estimate of backbone price.

- Stay up-to-date with market news and trends: Market news and trends can impact the backbone price, so staying informed can help investors make more informed decisions.

- Use backbone price in conjunction with other investment tools: Backbone price should be used in conjunction with other investment tools, such as technical analysis and risk management techniques.

Conclusion

Backbone price is a critical concept in investment analysis, providing a benchmark for evaluating the fairness of market prices. By understanding backbone price, investors can make more informed decisions and reduce their risk of losses. While there are common misconceptions about backbone price, using a range of fundamental analysis techniques and staying up-to-date with market news and trends can help investors get the most out of this powerful investment tool.

How to Calculate Backbone Price

Calculating backbone price involves analyzing various fundamental factors, including financial statements, industry trends, competitive analysis, and management team. By analyzing these factors, investors can estimate the intrinsic value of a security, which represents the backbone price.

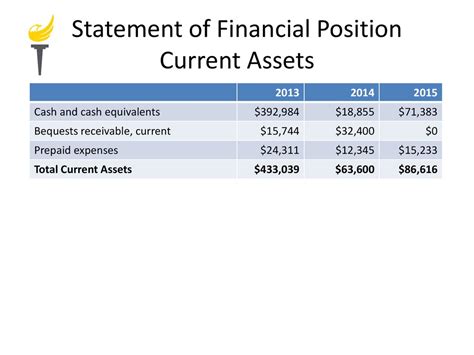

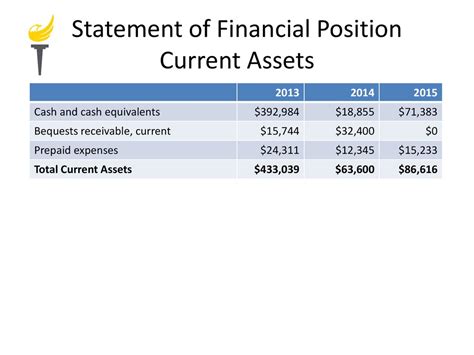

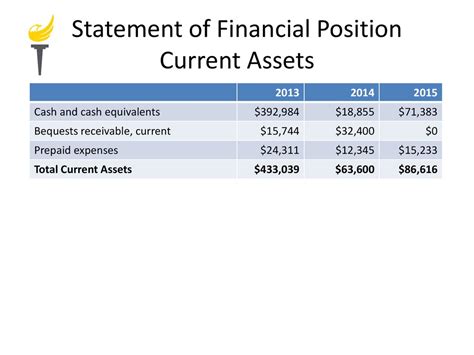

Financial Statements

Financial statements, such as income statements, balance sheets, and cash flow statements, provide insights into a company's financial health and performance. By analyzing these statements, investors can estimate the company's future growth prospects and calculate its backbone price.

Industry Trends

Understanding the trends and outlook for the industry in which the company operates can help estimate future growth prospects. By analyzing industry trends, investors can determine whether the company is well-positioned for future growth and calculate its backbone price.

Gallery of Backbone Price Images

Backbone Price Image Gallery

What is backbone price?

+Backbone price refers to the intrinsic value of a security, such as a stock or bond, based on its underlying fundamentals.

Why is backbone price important for investors?

+Backbone price is important for investors because it provides a benchmark for evaluating the fairness of market prices, helping investors make informed decisions.

How is backbone price calculated?

+Backbone price is calculated by analyzing various fundamental factors, including financial statements, industry trends, competitive analysis, and management team.