Intro

Discover the 7 types of combat pay explained in detail. Learn about Hostile Fire Pay, Hazardous Duty Pay, and other special pays for military personnel serving in combat zones. Understand how Imminent Danger Pay, Combat Zone Tax Exclusion, and other benefits support soldiers in high-risk areas. Get informed about your military pay entitlements.

As a member of the military, you may be eligible for various types of combat pay, which can provide a significant boost to your overall compensation. However, understanding the different types of combat pay and their eligibility requirements can be complex. In this article, we will break down seven types of combat pay, explaining what they are, how they work, and who is eligible.

Understanding Combat Pay

Combat pay is a type of special pay provided to military personnel who are serving in hazardous or combat-related situations. The purpose of combat pay is to compensate military members for the risks and hardships they face while serving in these challenging environments. There are several types of combat pay, each with its own eligibility requirements and payment rates.

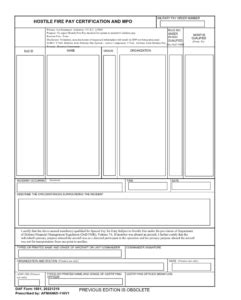

1. Hostile Fire Pay (HFP)

Hostile Fire Pay is a type of combat pay that is paid to military personnel who are exposed to hostile fire or are in a combat zone. This type of pay is intended to compensate military members for the risks they face while serving in a combat environment.

Eligibility Requirements:

To be eligible for Hostile Fire Pay, military personnel must be serving in a combat zone or be exposed to hostile fire. This includes serving in a designated combat zone, being engaged in combat, or being subjected to hostile fire.

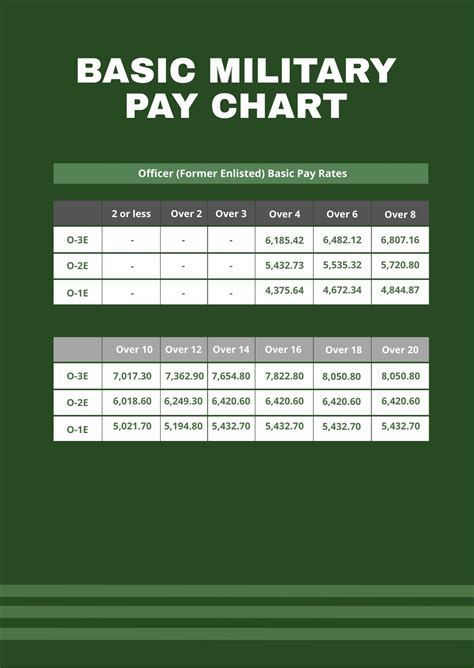

Payment Rate:

The payment rate for Hostile Fire Pay is $225 per month.

2. Hazardous Duty Pay (HDP)

Hazardous Duty Pay is a type of combat pay that is paid to military personnel who are serving in hazardous or high-risk situations. This type of pay is intended to compensate military members for the risks they face while serving in these challenging environments.

Eligibility Requirements:

To be eligible for Hazardous Duty Pay, military personnel must be serving in a hazardous or high-risk situation. This includes serving in a combat zone, participating in parachute or flight operations, or serving on a submarine.

Payment Rate:

The payment rate for Hazardous Duty Pay varies depending on the specific situation. For example, military personnel serving in a combat zone may receive $150 per month, while those participating in parachute operations may receive $250 per month.

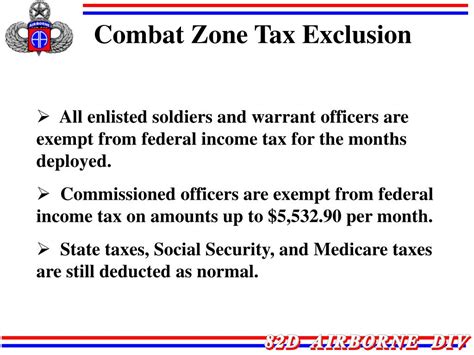

3. Combat Zone Tax Exclusion (CZTE)

Combat Zone Tax Exclusion is a type of combat pay that excludes certain types of income from taxation. This type of pay is intended to provide tax relief to military personnel serving in combat zones.

Eligibility Requirements:

To be eligible for Combat Zone Tax Exclusion, military personnel must be serving in a combat zone. This includes serving in a designated combat zone or being engaged in combat.

Payment Rate:

The payment rate for Combat Zone Tax Exclusion varies depending on the individual's tax situation. However, it can result in significant tax savings for military personnel serving in combat zones.

4. Imminent Danger Pay (IDP)

Imminent Danger Pay is a type of combat pay that is paid to military personnel who are serving in situations where they are at risk of imminent danger. This type of pay is intended to compensate military members for the risks they face while serving in these challenging environments.

Eligibility Requirements:

To be eligible for Imminent Danger Pay, military personnel must be serving in a situation where they are at risk of imminent danger. This includes serving in a combat zone, participating in parachute or flight operations, or serving on a submarine.

Payment Rate:

The payment rate for Imminent Danger Pay is $225 per month.

5. Dive Duty Pay (DDP)

Dive Duty Pay is a type of combat pay that is paid to military personnel who are serving in diving operations. This type of pay is intended to compensate military members for the risks they face while serving in these challenging environments.

Eligibility Requirements:

To be eligible for Dive Duty Pay, military personnel must be serving in diving operations. This includes serving on a submarine or participating in diving operations.

Payment Rate:

The payment rate for Dive Duty Pay varies depending on the specific situation. For example, military personnel serving on a submarine may receive $100 per month, while those participating in diving operations may receive $150 per month.

6. Flight Pay (FP)

Flight Pay is a type of combat pay that is paid to military personnel who are serving in flight operations. This type of pay is intended to compensate military members for the risks they face while serving in these challenging environments.

Eligibility Requirements:

To be eligible for Flight Pay, military personnel must be serving in flight operations. This includes serving on an aircraft or participating in flight operations.

Payment Rate:

The payment rate for Flight Pay varies depending on the specific situation. For example, military personnel serving on an aircraft may receive $150 per month, while those participating in flight operations may receive $200 per month.

7. Special Duty Pay (SDP)

Special Duty Pay is a type of combat pay that is paid to military personnel who are serving in special duty assignments. This type of pay is intended to compensate military members for the risks they face while serving in these challenging environments.

Eligibility Requirements:

To be eligible for Special Duty Pay, military personnel must be serving in a special duty assignment. This includes serving in a combat zone or participating in hazardous operations.

Payment Rate:

The payment rate for Special Duty Pay varies depending on the specific situation. For example, military personnel serving in a combat zone may receive $100 per month, while those participating in hazardous operations may receive $150 per month.

Combat Pay Image Gallery

What is combat pay?

+Combat pay is a type of special pay provided to military personnel who are serving in hazardous or combat-related situations.

How many types of combat pay are there?

+There are seven types of combat pay: Hostile Fire Pay, Hazardous Duty Pay, Combat Zone Tax Exclusion, Imminent Danger Pay, Dive Duty Pay, Flight Pay, and Special Duty Pay.

Who is eligible for combat pay?

+Eligibility for combat pay varies depending on the specific type of pay and the individual's circumstances. However, in general, military personnel serving in combat zones or hazardous situations are eligible for combat pay.

As a military member, it's essential to understand the different types of combat pay and their eligibility requirements. By knowing what you're eligible for, you can ensure that you receive the compensation you deserve for your service.