Intro

Resolve tax debt with ease! Learn the 7 ways to pay back taxes, including installment agreements, offer in compromise, and more. Discover how to settle tax liabilities, avoid penalties, and reduce interest. Get expert guidance on tax debt relief and take control of your financial future with this comprehensive guide.

Owing back taxes to the government can be a stressful and overwhelming experience. The good news is that there are several options available to help you pay back taxes and get back on track. In this article, we will explore seven ways to pay back taxes, including payment plans, offers in compromise, and more.

Understanding the Consequences of Unpaid Back Taxes

Before we dive into the ways to pay back taxes, it's essential to understand the consequences of not paying your tax debt. The Internal Revenue Service (IRS) can impose penalties, interest, and even take collection actions such as wage garnishment, bank levies, and liens on your property. Additionally, unpaid back taxes can also affect your credit score and make it harder to get loans or credit cards in the future.

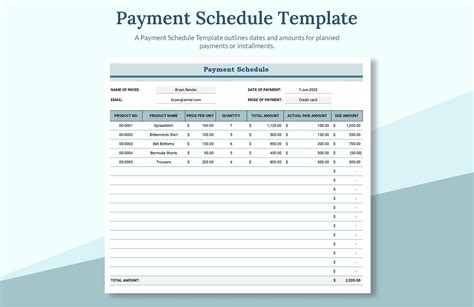

1. Payment Plans

One of the most common ways to pay back taxes is through a payment plan. The IRS offers several types of payment plans, including installment agreements and partial payment installment agreements. To qualify for a payment plan, you must owe $50,000 or less in combined tax, interest, and penalties, and you must have filed all required tax returns.

Types of Payment Plans

- Installment Agreement: This plan allows you to make monthly payments towards your tax debt over a period of up to 72 months.

- Partial Payment Installment Agreement: This plan allows you to make monthly payments towards your tax debt, but only a portion of the total amount owed.

2. Offers in Compromise

An Offer in Compromise (OIC) is an agreement between you and the IRS to settle your tax debt for less than the full amount owed. To qualify for an OIC, you must meet one of the following conditions:

- Doubt as to liability: You dispute the amount of tax debt owed.

- Doubt as to collectibility: You don't have the ability to pay the full amount owed.

- Effective tax administration: Payment of the full amount would cause economic hardship or would be unfair and inequitable.

How to Apply for an OIC

- File Form 656, Offer in Compromise.

- Pay the required application fee.

- Provide financial documentation, including income, expenses, and assets.

3. Currently Not Collectible

If the IRS determines that you are currently not collectible, they will temporarily suspend collection activities. This status is typically granted when you are experiencing financial hardship or when the IRS determines that you don't have the ability to pay.

How to Apply for Currently Not Collectible Status

- Contact the IRS and provide financial documentation.

- File Form 433-A, Collection Information Statement.

4. Innocent Spouse Relief

If you are married and your spouse is responsible for the tax debt, you may be eligible for innocent spouse relief. This relief is granted when you can prove that you had no knowledge of the tax debt and that it would be unfair to hold you responsible.

How to Apply for Innocent Spouse Relief

- File Form 8857, Request for Innocent Spouse Relief.

- Provide documentation, including tax returns and proof of income.

5. Tax Debt Settlement

Tax debt settlement is a process where you negotiate with the IRS to settle your tax debt for less than the full amount owed. This option is typically used when you are unable to pay the full amount and are facing financial hardship.

How to Apply for Tax Debt Settlement

- Contact a tax professional or attorney.

- Provide financial documentation and negotiate with the IRS.

6. Tax Amnesty Programs

Tax amnesty programs are offered by the IRS to encourage taxpayers to come forward and pay their tax debt. These programs typically offer reduced penalties and interest in exchange for payment of the tax debt.

How to Apply for Tax Amnesty Programs

- Contact the IRS and provide financial documentation.

- File the required tax returns and pay the tax debt.

7. Tax Forgiveness

Tax forgiveness is a rare occurrence where the IRS forgives a portion or all of the tax debt. This option is typically granted when you are experiencing extreme financial hardship or when the IRS determines that you are unable to pay.

How to Apply for Tax Forgiveness

- Contact the IRS and provide financial documentation.

- File Form 433-A, Collection Information Statement.

Back Taxes Image Gallery

What happens if I don't pay my back taxes?

+If you don't pay your back taxes, the IRS can impose penalties, interest, and even take collection actions such as wage garnishment, bank levies, and liens on your property.

How do I apply for an Offer in Compromise?

+To apply for an Offer in Compromise, file Form 656, Offer in Compromise, and pay the required application fee. You will also need to provide financial documentation, including income, expenses, and assets.

What is tax forgiveness?

+Tax forgiveness is a rare occurrence where the IRS forgives a portion or all of the tax debt. This option is typically granted when you are experiencing extreme financial hardship or when the IRS determines that you are unable to pay.

If you are struggling with back taxes, it's essential to take action as soon as possible. The longer you wait, the more penalties and interest you will accrue. Consider consulting with a tax professional or attorney to determine the best course of action for your specific situation. Remember, there are options available to help you pay back taxes and get back on track.