Intro

Discover 7 effective ways to pay for college tuition without breaking the bank. Explore financial aid options, scholarships, grants, and student loans to fund your higher education. Learn how to reduce college costs, optimize your financial aid package, and make informed decisions about paying for college.

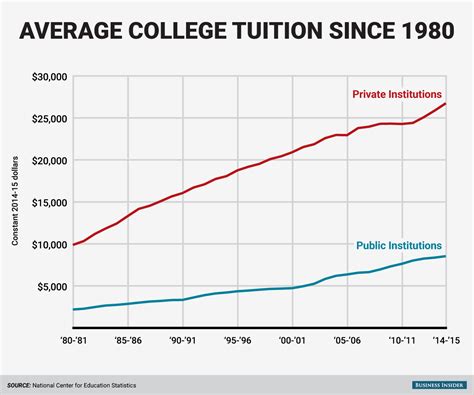

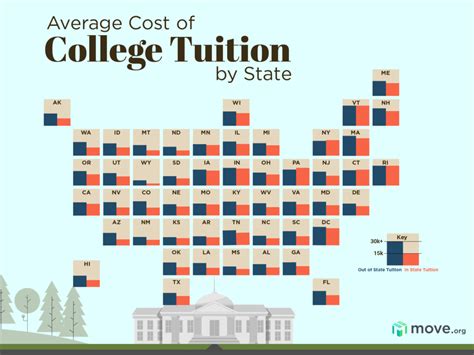

Paying for college tuition can be a daunting task for many students and their families. The rising costs of higher education can be overwhelming, leaving many to wonder how they will afford the expenses. However, there are several ways to pay for college tuition, and with some planning and research, it is possible to find a solution that works for you.

In this article, we will explore seven ways to pay for college tuition, including scholarships, grants, student loans, work-study programs, and more. Whether you are a high school student, a college freshman, or a returning student, there are options available to help you pay for your education.

1. Scholarships

Scholarships are a great way to pay for college tuition without taking on debt. There are thousands of scholarships available, ranging from small awards to full-ride scholarships. To find scholarships, you can search online, check with your college or university, or look for local organizations that offer awards.

Some popular types of scholarships include:

- Merit-based scholarships: awarded to students who demonstrate academic excellence or achievement in a particular field.

- Need-based scholarships: awarded to students who demonstrate financial need.

- Talent-based scholarships: awarded to students who demonstrate exceptional talent in a particular area, such as music, art, or athletics.

How to Find Scholarships

To find scholarships, you can:

- Search online using scholarship search engines, such as Fastweb or Scholarships.com.

- Check with your college or university to see what scholarships are available.

- Look for local organizations that offer scholarships, such as Rotary clubs or community foundations.

- Check with your employer or your parents' employer to see if they offer any scholarships.

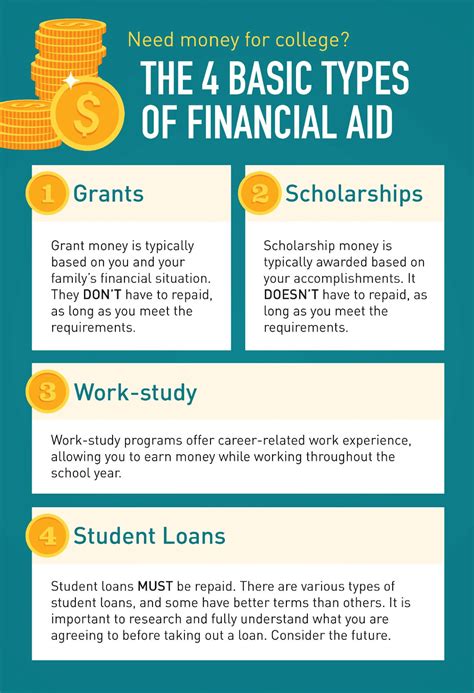

2. Grants

Grants are another type of financial aid that can help you pay for college tuition. Unlike loans, grants do not need to be repaid. There are several types of grants available, including:

- Federal Pell Grants: awarded to undergraduate students who demonstrate financial need.

- Federal Supplemental Educational Opportunity Grants (FSEOG): awarded to undergraduate students who demonstrate exceptional financial need.

- State-based grants: awarded to students who attend college in their home state.

How to Apply for Grants

To apply for grants, you will need to complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is a form that collects information about your financial situation and is used to determine your eligibility for federal and state financial aid.

3. Student Loans

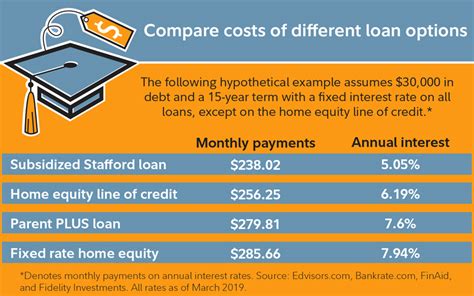

Student loans are a popular way to pay for college tuition. There are two main types of student loans: federal loans and private loans.

- Federal loans: offered by the federal government and include subsidized and unsubsidized loans.

- Private loans: offered by banks and other lenders and are not subsidized by the federal government.

How to Apply for Student Loans

To apply for student loans, you will need to complete the FAFSA. You can also check with your college or university to see what loan options are available.

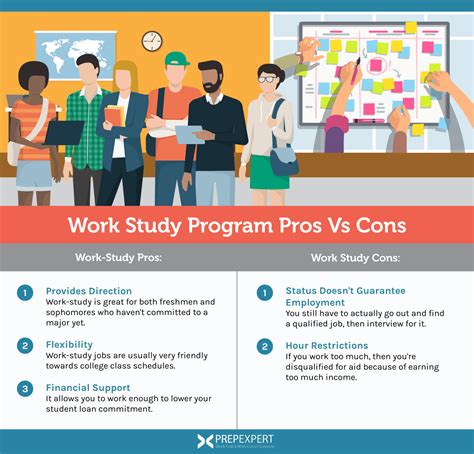

4. Work-Study Programs

Work-study programs are a great way to earn money while attending college. These programs allow you to work part-time jobs on campus or in your community and earn money to help pay for tuition.

How to Apply for Work-Study Programs

To apply for work-study programs, you will need to complete the FAFSA and check with your college or university to see what programs are available.

5. Employer Tuition Reimbursement

Some employers offer tuition reimbursement programs as a benefit to their employees. These programs allow you to attend college and earn a degree while working full-time.

How to Apply for Employer Tuition Reimbursement

To apply for employer tuition reimbursement, you will need to check with your employer to see if they offer this benefit.

6. Military Tuition Assistance

If you are a member of the military, you may be eligible for tuition assistance. The military offers several programs to help service members pay for college tuition.

How to Apply for Military Tuition Assistance

To apply for military tuition assistance, you will need to check with your military branch to see what programs are available.

7. Crowdfunding

Crowdfunding is a relatively new way to pay for college tuition. Platforms like GoFundMe and Kickstarter allow you to create a campaign and raise money from friends, family, and community members.

How to Use Crowdfunding to Pay for College Tuition

To use crowdfunding to pay for college tuition, you will need to create a campaign and share it with your network.

Gallery of College Tuition Images:

College Tuition Image Gallery

FAQs:

What is the FAFSA?

+The FAFSA (Free Application for Federal Student Aid) is a form that collects information about your financial situation and is used to determine your eligibility for federal and state financial aid.

What is the difference between a scholarship and a grant?

+A scholarship is a type of financial aid that is awarded to students based on merit or achievement, while a grant is a type of financial aid that is awarded to students based on financial need.

Can I use crowdfunding to pay for college tuition?

+Yes, you can use crowdfunding to pay for college tuition. Platforms like GoFundMe and Kickstarter allow you to create a campaign and raise money from friends, family, and community members.

In conclusion, paying for college tuition can be a challenge, but there are several options available to help you pay for your education. Whether you are a high school student, a college freshman, or a returning student, there are scholarships, grants, student loans, work-study programs, and more that can help you achieve your academic goals.