Intro

Find affordable Navy insurance near me, including naval base insurance, military insurance quotes, and veteran insurance benefits, with expert guidance on naval insurance plans and coverage options.

As a member of the navy, having the right insurance coverage is crucial to protect yourself and your loved ones from unforeseen circumstances. Whether you're looking for health, life, or disability insurance, it's essential to find a reliable provider that understands the unique needs of navy personnel. In this article, we'll explore the importance of navy insurance, the different types of coverage available, and how to find the best insurance providers near you.

Navy insurance is designed to provide financial protection to navy personnel and their families in the event of an unexpected illness, injury, or death. With the right insurance coverage, you can ensure that your loved ones are taken care of, even if you're no longer able to provide for them. Additionally, navy insurance can help you cover medical expenses, lost wages, and other financial burdens that may arise due to your service.

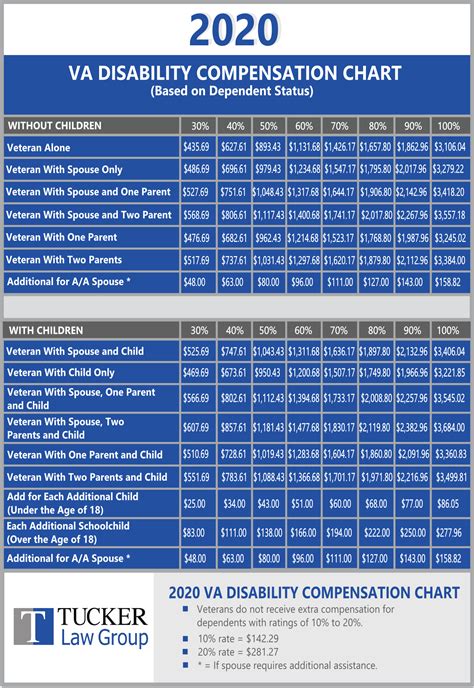

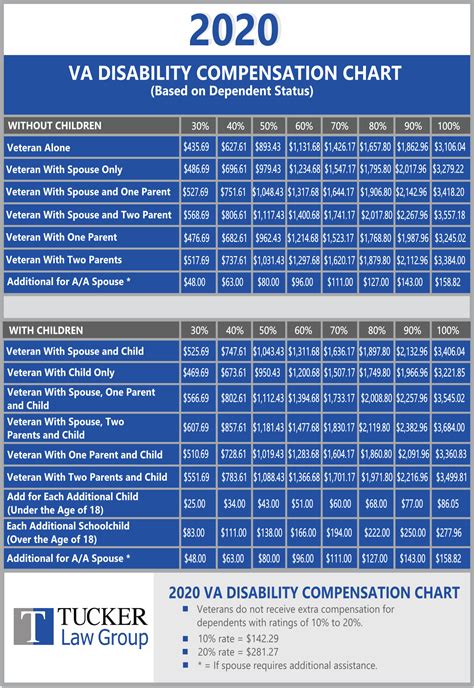

When it comes to navy insurance, there are several types of coverage to consider. These include health insurance, life insurance, disability insurance, and supplemental insurance. Health insurance provides coverage for medical expenses, including doctor visits, hospital stays, and prescriptions. Life insurance provides a death benefit to your beneficiaries in the event of your passing, while disability insurance provides income replacement if you're unable to work due to an illness or injury. Supplemental insurance, on the other hand, provides additional coverage for specific expenses, such as dental or vision care.

Navy Insurance Options

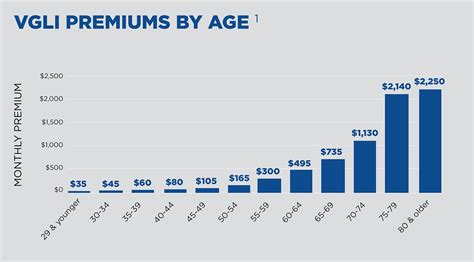

Some of the most popular navy insurance options include the Tricare program, which provides health insurance coverage to active-duty and retired navy personnel and their families. The Servicemembers' Group Life Insurance (SGLI) program, on the other hand, provides life insurance coverage to active-duty and retired navy personnel. The Veterans' Group Life Insurance (VGLI) program provides life insurance coverage to veterans who have separated from service.

Benefits of Navy Insurance

The benefits of navy insurance are numerous. For one, it provides financial protection to navy personnel and their families in the event of an unexpected illness, injury, or death. It also provides peace of mind, knowing that you and your loved ones are protected, no matter what happens. Additionally, navy insurance can help you cover medical expenses, lost wages, and other financial burdens that may arise due to your service.Some of the key benefits of navy insurance include:

- Financial protection for you and your loved ones

- Coverage for medical expenses, including doctor visits, hospital stays, and prescriptions

- Income replacement if you're unable to work due to an illness or injury

- Death benefit for your beneficiaries in the event of your passing

- Supplemental coverage for specific expenses, such as dental or vision care

How to Find Navy Insurance Near Me

Finding navy insurance near you can be a daunting task, especially with so many providers to choose from. However, there are several steps you can take to find the best insurance provider for your needs. First, research different insurance providers and compare their coverage options, premiums, and customer service. You can also read reviews and ask for referrals from fellow navy personnel or veterans.

Some popular ways to find navy insurance near you include:

- Online search: You can search for navy insurance providers in your area using online directories or search engines.

- Word of mouth: Ask fellow navy personnel or veterans for referrals or recommendations.

- Insurance brokers: You can work with an insurance broker who specializes in navy insurance to find the best coverage for your needs.

- Military organizations: You can also contact military organizations, such as the Veterans of Foreign Wars or the American Legion, for information on navy insurance providers.

Navy Insurance Providers

Some of the top navy insurance providers include USAA, Navy Mutual, and Armed Forces Insurance. USAA provides a range of insurance coverage options, including health, life, and disability insurance, to active-duty and retired navy personnel and their families. Navy Mutual, on the other hand, provides life insurance coverage to active-duty and retired navy personnel, as well as supplemental insurance coverage for specific expenses.Armed Forces Insurance provides a range of insurance coverage options, including health, life, and disability insurance, to active-duty and retired navy personnel and their families. Other popular navy insurance providers include Geico, State Farm, and Allstate.

Navy Insurance Costs

The cost of navy insurance can vary depending on several factors, including your age, health, and coverage options. On average, navy insurance premiums can range from a few hundred to several thousand dollars per year. However, the cost of navy insurance is often worth it, considering the financial protection it provides to you and your loved ones.

Some factors that can affect the cost of navy insurance include:

- Age: Older navy personnel may pay higher premiums due to their age and increased health risks.

- Health: Navy personnel with pre-existing medical conditions may pay higher premiums due to their increased health risks.

- Coverage options: The type and amount of coverage you choose can affect the cost of your premiums.

- Provider: Different insurance providers may offer different premiums for the same coverage options.

Navy Insurance Discounts

Many navy insurance providers offer discounts to active-duty and retired navy personnel, as well as their families. These discounts can help reduce the cost of your premiums and make navy insurance more affordable. Some popular discounts include: * Military discounts: Many insurance providers offer discounts to active-duty and retired navy personnel. * Bundle discounts: You can save money by bundling multiple insurance coverage options, such as health and life insurance. * Loyalty discounts: Some insurance providers offer discounts to customers who have been with them for a certain amount of time. * Good health discounts: Navy personnel who are in good health may qualify for discounts on their premiums.Navy Insurance Claims

Filing a navy insurance claim can be a complex and time-consuming process, especially if you're not familiar with the process. However, most insurance providers have a dedicated claims department that can help guide you through the process. To file a claim, you'll typically need to provide documentation, such as medical records or proof of loss, and complete a claims form.

Some tips for filing a navy insurance claim include:

- Read your policy carefully: Understand what is covered and what is not, as well as any exclusions or limitations.

- Keep detailed records: Keep detailed records of your medical expenses, lost wages, and other financial burdens.

- Contact your provider: Reach out to your insurance provider as soon as possible to report your claim and begin the process.

- Be patient: Filing a claim can take time, so be patient and follow up with your provider regularly.

Navy Insurance FAQs

Here are some frequently asked questions about navy insurance: * What is navy insurance? * How do I find navy insurance near me? * What are the benefits of navy insurance? * How much does navy insurance cost? * What discounts are available for navy insurance?Navy Insurance Image Gallery

What is navy insurance?

+Navy insurance is a type of insurance coverage designed specifically for navy personnel and their families. It provides financial protection in the event of an unexpected illness, injury, or death.

How do I find navy insurance near me?

+You can find navy insurance near you by researching different insurance providers, reading reviews, and asking for referrals from fellow navy personnel or veterans. You can also contact military organizations, such as the Veterans of Foreign Wars or the American Legion, for information on navy insurance providers.

What are the benefits of navy insurance?

+The benefits of navy insurance include financial protection for you and your loved ones, coverage for medical expenses, income replacement if you're unable to work due to an illness or injury, and a death benefit for your beneficiaries in the event of your passing.

How much does navy insurance cost?

+The cost of navy insurance can vary depending on several factors, including your age, health, and coverage options. On average, navy insurance premiums can range from a few hundred to several thousand dollars per year.

What discounts are available for navy insurance?

+Many navy insurance providers offer discounts to active-duty and retired navy personnel, as well as their families. These discounts can include military discounts, bundle discounts, loyalty discounts, and good health discounts.

In conclusion, navy insurance is a vital component of any navy personnel's financial plan. With the right coverage, you can protect yourself and your loved ones from unforeseen circumstances and ensure that you're prepared for whatever life may bring. By researching different insurance providers, comparing coverage options, and taking advantage of discounts, you can find the best navy insurance for your needs and budget. We encourage you to share this article with fellow navy personnel and veterans, and to comment below with any questions or concerns you may have about navy insurance.