Intro

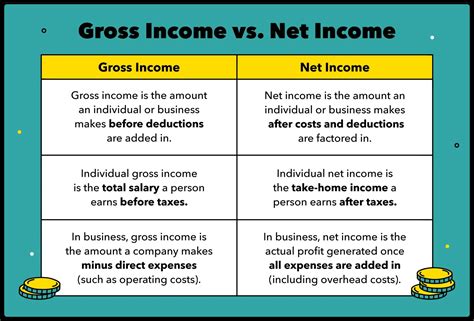

Discover the truth about base pay before taxes deducted. Learn how pre-tax deductions impact your take-home pay and understand the differences between gross income and net income. Explore the role of taxes, benefits, and withholding in your salary, and find out what to expect from your employer. Know your pay, inside and out.

In many cases, the answer to this question is no, base pay before taxes deducted is not always the same as the amount of money you take home. Understanding the differences between base pay, gross income, and net income can help you manage your finances more effectively.

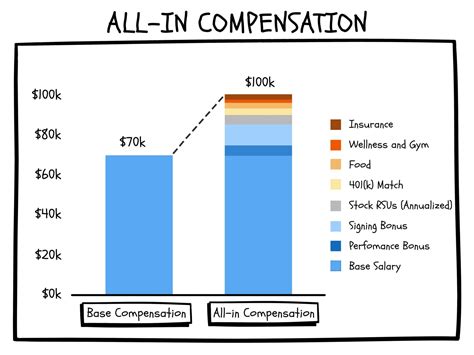

What is Base Pay?

Base pay, also known as basic pay or base salary, is the initial amount of money you earn from your job before any taxes, deductions, or other withholdings are taken out. It's the foundation of your compensation package and is usually the amount you agree upon with your employer when you're hired.

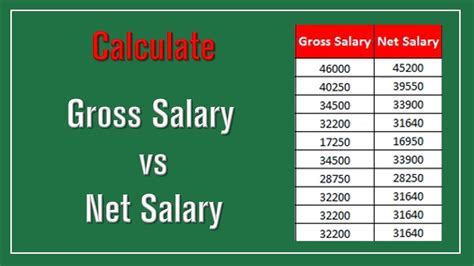

Gross Income vs. Base Pay

Gross income and base pay are often used interchangeably, but they're not exactly the same thing. Gross income is the total amount of money you earn from all sources, including your job, investments, and any side hustles. Base pay, on the other hand, is the amount you earn from your primary job before any deductions or taxes.

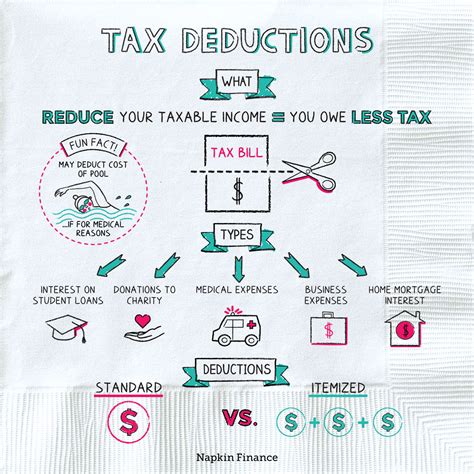

What are Taxes Deducted from Base Pay?

Taxes are a significant deduction from your base pay. The amount of taxes deducted depends on your income level, filing status, and the tax laws in your country or state. In the United States, for example, taxes deducted from base pay may include:

- Federal income taxes

- State income taxes

- Social Security taxes

- Medicare taxes

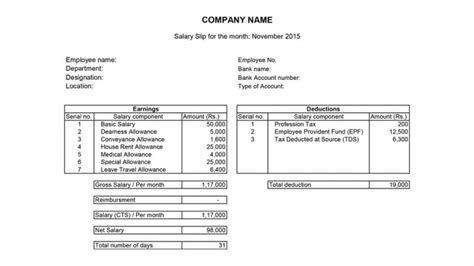

Other Deductions from Base Pay

In addition to taxes, other deductions may be taken from your base pay, such as:

- Health insurance premiums

- Retirement plan contributions (e.g., 401(k))

- Life insurance premiums

- Disability insurance premiums

- Union dues (if applicable)

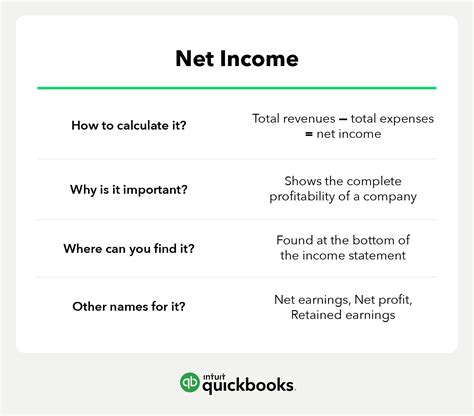

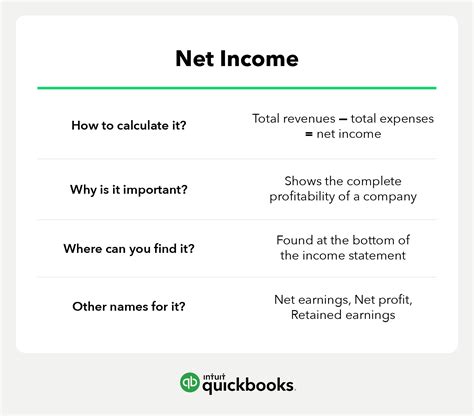

How to Calculate Net Income from Base Pay

To calculate your net income from your base pay, you'll need to subtract all the deductions mentioned above from your base pay. Here's a simple formula:

Net Income = Base Pay - Taxes - Other Deductions

For example, let's say your base pay is $50,000 per year, and your taxes and other deductions total $15,000 per year. Your net income would be:

Net Income = $50,000 - $15,000 = $35,000 per year

Importance of Understanding Base Pay and Net Income

Understanding the difference between base pay and net income is crucial for managing your finances effectively. Here are a few reasons why:

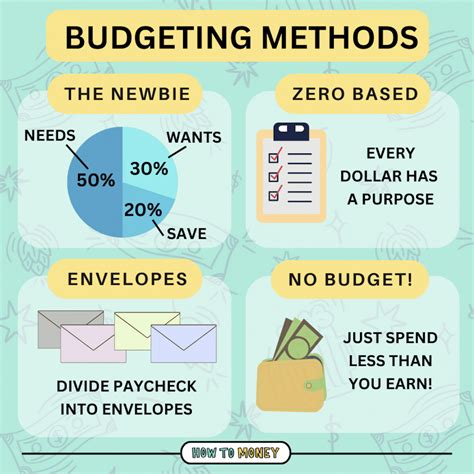

- Budgeting: Knowing your net income helps you create a realistic budget that accounts for all the deductions from your base pay.

- Savings: Understanding the difference between base pay and net income helps you set realistic savings goals and make informed decisions about your finances.

- Financial planning: Accurate financial planning requires a clear understanding of your net income, as it affects your ability to pay off debt, invest, and achieve long-term financial goals.

In conclusion, base pay before taxes deducted is not always the same as the amount of money you take home. Understanding the differences between base pay, gross income, and net income can help you manage your finances more effectively and make informed decisions about your money.

Gallery of Base Pay and Net Income

What is base pay?

+Base pay is the initial amount of money you earn from your job before any taxes, deductions, or other withholdings are taken out.

What is the difference between base pay and gross income?

+Gross income is the total amount of money you earn from all sources, including your job, investments, and any side hustles. Base pay is the amount you earn from your primary job before any deductions or taxes.

How do I calculate my net income from my base pay?

+To calculate your net income, subtract all the deductions from your base pay, including taxes, health insurance premiums, retirement plan contributions, and other withholdings.