Intro

Discover 5 ways Navy FederalCredit Union supports members, including loan options, credit cards, and investment services, offering financial stability and security with low rates and flexible terms.

The importance of understanding the intricacies of financial institutions cannot be overstated, especially when it comes to navigating the complexities of banking and credit unions. One such institution that has garnered significant attention is Navy Federal Credit Union, renowned for its comprehensive range of financial services tailored to meet the unique needs of its members. However, like any financial institution, Navy Federal is not immune to challenges and criticisms. This article delves into the concept of "5 Ways Navy Federal Down," exploring potential downsides or areas of improvement within the institution, while also highlighting its strengths and the overall value it provides to its members.

Understanding the context of Navy Federal's operations and the financial landscape it navigates is crucial. The credit union's mission is to serve its members with a commitment to excellence, integrity, and a passion for service. Despite its robust offerings and member-centric approach, there are aspects where Navy Federal could potentially improve or face challenges. These areas of improvement are not only essential for the institution's growth but also for enhancing the overall member experience.

The financial services sector is highly competitive, with institutions constantly evolving to meet changing member needs and technological advancements. Navy Federal, being a leader in its niche, must continually assess and adapt its services to remain relevant and competitive. This includes addressing any perceived downsides or areas where members feel the institution could better serve them. By understanding these challenges, Navy Federal can work towards mitigating them, thereby strengthening its position in the market and reinforcing its commitment to its members.

Introduction to Navy Federal

Navy Federal Credit Union is the largest credit union in the world, serving over 10 million members. It was established in 1933 with a mission to provide financial services to members of the U.S. military, veterans, and their families. Over the years, Navy Federal has expanded its membership eligibility to include the broader military community, including Department of Defense civilians and contractors. This expansion has enabled more individuals to access its comprehensive range of financial products and services, including banking, loans, credit cards, investments, and insurance.

Benefits of Navy Federal Membership

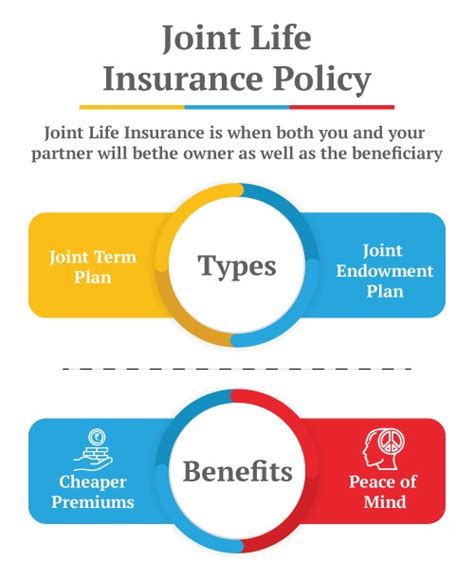

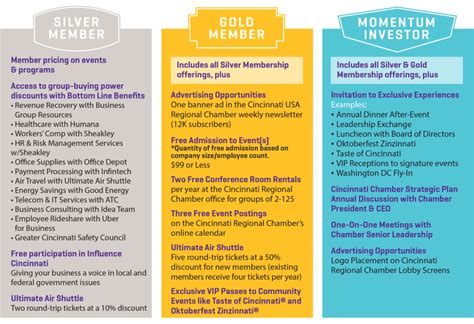

Membership with Navy Federal comes with numerous benefits, designed to support the financial well-being and goals of its members. These benefits include competitive rates on loans and deposits, low fees, and access to exclusive financial products tailored to the military lifestyle. Additionally, Navy Federal offers financial education resources, personalized service, and a commitment to community involvement. For members looking to manage their finances effectively, Navy Federal provides a range of tools and services, from budgeting advice to investment strategies.

Potential Downsides of Navy Federal

While Navy Federal is highly regarded for its services, there are potential downsides that members or prospective members should be aware of. These include:

- Limited Branch and ATM Access: Compared to larger banks, Navy Federal has a more limited network of branches and ATMs, which could be a drawback for members who prefer in-person banking or need frequent access to cash.

- Strict Membership Eligibility: The eligibility criteria for joining Navy Federal can be restrictive, limiting membership to those with a direct connection to the military, veterans, or certain government agencies.

- Customer Service Variability: As with any large institution, there can be variability in the quality of customer service experienced by members, with some reporting positive interactions and others facing challenges in resolving issues.

- Product and Service Limitations: Navy Federal might not offer the full range of financial products and services available at larger banks, potentially limiting options for members with complex financial needs.

- Technology and Digital Banking: While Navy Federal has made significant strides in its digital banking offerings, some members may find the online platform or mobile app less intuitive or feature-rich compared to those of other financial institutions.

Improvement Areas for Navy Federal

To continue serving its members effectively and maintain its competitive edge, Navy Federal should consider addressing the following areas:

- Expanding Digital Services: Continuously updating and enhancing its digital banking platform to meet evolving member needs and preferences.

- Enhancing Customer Service: Implementing measures to ensure consistency and excellence in customer service across all channels.

- Broadening Product Offerings: Assessing the feasibility of introducing new financial products or services that could benefit its members, while remaining true to its mission and expertise.

- Increasing Accessibility: Exploring options to expand its physical and ATM network, or partnering with other financial institutions to enhance accessibility for its members.

- Financial Education and Support: Further developing its financial education resources and support services to empower members in achieving their financial goals.

Gallery of Navy Federal Services

Navy Federal Services Image Gallery

Frequently Asked Questions

What are the eligibility criteria for joining Navy Federal Credit Union?

+Navy Federal membership is open to all Department of Defense and Coast Guard Active Duty, veterans, civilian and contractor personnel, and their families.

Does Navy Federal offer competitive rates on loans and savings accounts?

+Yes, Navy Federal is known for offering competitive rates on both loans and savings products, designed to help members achieve their financial goals.

How does Navy Federal support financial education and wellness for its members?

+Navy Federal provides a variety of financial education resources, including workshops, webinars, and online tools, to support members in managing their finances effectively and achieving financial wellness.

In conclusion, while Navy Federal Credit Union stands out for its commitment to serving the military community and its comprehensive financial services, it is essential to acknowledge potential areas for improvement. By addressing these challenges and continuing to evolve its offerings, Navy Federal can further enhance the value it provides to its members. For individuals considering Navy Federal membership, understanding both the benefits and the potential downsides is crucial for making an informed decision. As the financial landscape continues to evolve, Navy Federal's ability to adapt and innovate will be key to its success and the satisfaction of its members. We invite you to share your thoughts and experiences with Navy Federal, and to explore how its services can support your financial journey.