Intro

Unlock high-paying opportunities in the finance field with our guide to lucrative careers. From investment banking and financial analysis to portfolio management and risk assessment, discover the most in-demand jobs and required skills to succeed in this industry. Explore salary ranges, growth prospects, and tips to get ahead in finance careers.

The finance field is a dynamic and ever-evolving sector that offers numerous lucrative career opportunities for individuals with a passion for numbers, analysis, and problem-solving. From investment banking to financial planning, the finance industry encompasses a wide range of specializations that cater to diverse skills and interests. In this article, we will explore some of the most lucrative careers in the finance field, their job descriptions, salary ranges, and growth prospects.

Investment Banking

Investment banking is one of the most lucrative careers in finance, with top investment bankers earning salaries ranging from $100,000 to over $1 million. Investment bankers work with clients to raise capital, advise on mergers and acquisitions, and manage financial transactions.

- Job Description: Investment bankers analyze financial data, create pitch books, and present investment opportunities to clients.

- Salary Range: $80,000 - $1 million+

- Growth Prospects: High demand for investment banking services, with top firms competing for talent.

Hedge Fund Management

Hedge fund managers are responsible for investing and managing funds on behalf of high-net-worth individuals and institutions. Top-performing hedge fund managers can earn tens of millions of dollars in bonuses.

- Job Description: Hedge fund managers analyze market trends, develop investment strategies, and execute trades.

- Salary Range: $100,000 - $50 million+

- Growth Prospects: Hedge funds continue to attract investors, driving demand for skilled managers.

Private Wealth Management

Private wealth managers work with high-net-worth individuals to manage their investments, create financial plans, and provide estate planning services.

- Job Description: Private wealth managers analyze client financial data, create investment plans, and provide financial advice.

- Salary Range: $80,000 - $500,000+

- Growth Prospects: Increasing demand for wealth management services, with top firms competing for talent.

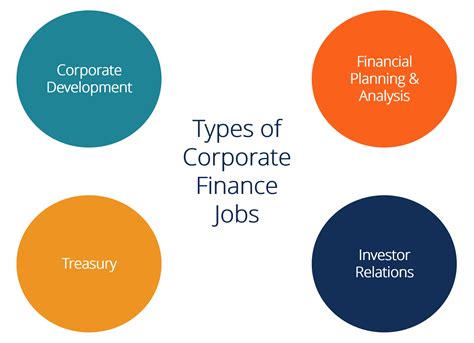

Corporate Finance

Corporate finance professionals work with companies to manage their financial operations, including financial planning, budgeting, and forecasting.

- Job Description: Corporate finance professionals analyze financial data, create financial models, and develop financial strategies.

- Salary Range: $60,000 - $200,000+

- Growth Prospects: Companies continue to need skilled finance professionals to manage their financial operations.

Financial Planning and Analysis

Financial planning and analysis (FP&A) professionals work with companies to develop financial plans, create forecasts, and analyze financial performance.

- Job Description: FP&A professionals analyze financial data, create financial models, and develop financial strategies.

- Salary Range: $60,000 - $150,000+

- Growth Prospects: Companies continue to need skilled FP&A professionals to drive business growth.

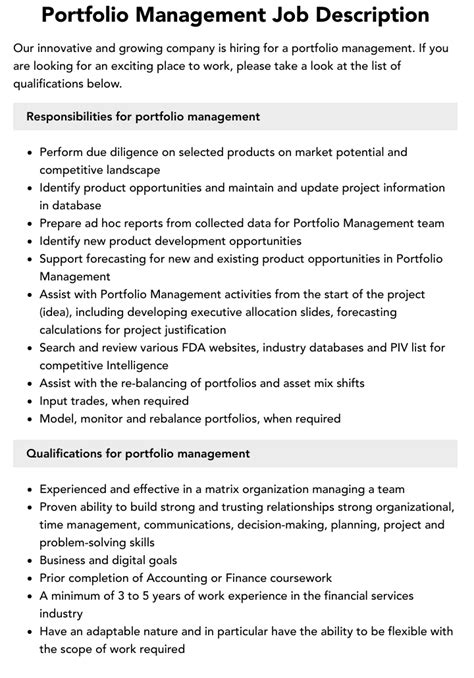

Portfolio Management

Portfolio managers work with investment companies to manage investment portfolios, including stocks, bonds, and other securities.

- Job Description: Portfolio managers analyze market trends, develop investment strategies, and execute trades.

- Salary Range: $80,000 - $500,000+

- Growth Prospects: Investment companies continue to need skilled portfolio managers to drive investment returns.

Risk Management

Risk management professionals work with companies to identify and mitigate financial risks, including market risk, credit risk, and operational risk.

- Job Description: Risk management professionals analyze financial data, identify potential risks, and develop risk mitigation strategies.

- Salary Range: $60,000 - $200,000+

- Growth Prospects: Companies continue to need skilled risk management professionals to manage financial risks.

Financial Regulation and Compliance

Financial regulation and compliance professionals work with companies to ensure compliance with financial regulations, including anti-money laundering and know-your-customer requirements.

- Job Description: Financial regulation and compliance professionals analyze financial data, identify compliance risks, and develop compliance strategies.

- Salary Range: $50,000 - $150,000+

- Growth Prospects: Companies continue to need skilled compliance professionals to navigate complex regulatory environments.

Gallery of Finance Careers

Finance Careers Image Gallery

FAQs

What are the most lucrative careers in finance?

+The most lucrative careers in finance include investment banking, hedge fund management, private wealth management, corporate finance, financial planning and analysis, portfolio management, risk management, and financial regulation and compliance.

What is the average salary for a finance professional?

+The average salary for a finance professional varies widely depending on the specific career, location, and experience level. However, salaries for finance professionals can range from $50,000 to over $1 million.

What skills are required to succeed in finance?

+To succeed in finance, professionals need to possess strong analytical, problem-solving, and communication skills, as well as a deep understanding of financial concepts and regulations.

We hope this article has provided valuable insights into the most lucrative careers in finance. Whether you are just starting your career or looking to transition to a new role, the finance industry offers a wide range of opportunities for professionals with the right skills and experience.