Intro

Discover life insurance options tailored for retired military personnel. Explore Veterans Group Life Insurance, Survivor Benefit Plan, and private insurance alternatives. Learn how to maximize coverage, navigate eligibility, and choose the best policy for your post-service needs. Get informed about your life insurance benefits and secure your familys financial future.

Life insurance is an essential aspect of financial planning, especially for retired military personnel who have dedicated their lives to serving their country. As a veteran, you may be eligible for unique life insurance options that cater to your specific needs and circumstances. In this article, we will explore the various life insurance options available to retired military personnel, highlighting their benefits, drawbacks, and key considerations.

Understanding Life Insurance Options for Retired Military Personnel

As a retired military personnel, you have access to a range of life insurance options that are designed to provide financial security and protection for you and your loved ones. These options include:

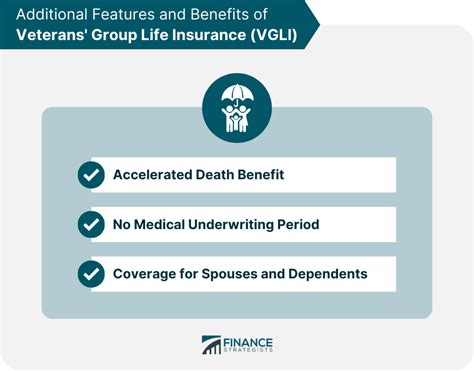

- Veterans' Group Life Insurance (VGLI): This is a life insurance program offered by the Department of Veterans Affairs (VA) that allows you to convert your Servicemembers' Group Life Insurance (SGLI) coverage to a civilian policy. VGLI provides coverage up to $400,000 and is available to all eligible veterans.

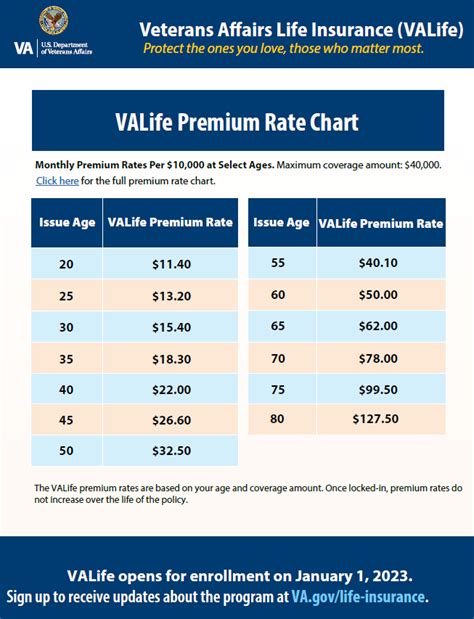

- Service-Disabled Veterans' Life Insurance (S-DVI): This program provides life insurance coverage to veterans who have been rated for a service-connected disability. S-DVI offers coverage up to $40,000 and is available to all eligible veterans.

- Military Funeral Honors: While not a traditional life insurance policy, Military Funeral Honors provides a way to honor your service and legacy after passing away. This program includes a ceremonial funeral, a folded American flag, and a final salute.

Benefits of Life Insurance for Retired Military Personnel

Life insurance can provide numerous benefits to retired military personnel, including:

- Financial Security: Life insurance can provide a financial safety net for your loved ones in the event of your passing, helping to cover funeral expenses, outstanding debts, and ongoing living costs.

- Legacy Planning: Life insurance can be used to create a lasting legacy for your loved ones, providing a tax-free inheritance or funding for future expenses such as education or healthcare.

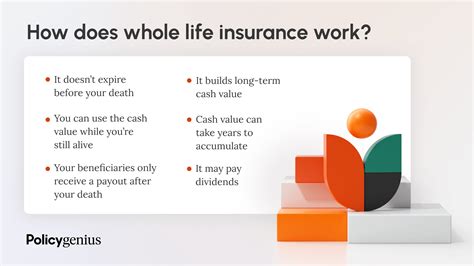

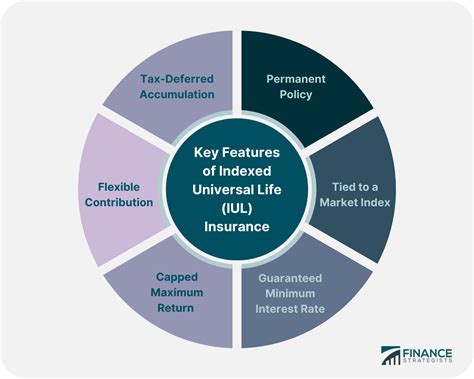

- Supplemental Retirement Income: Some life insurance policies, such as whole life or universal life insurance, can accumulate a cash value over time, providing a potential source of supplemental retirement income.

Key Considerations for Retired Military Personnel

When selecting a life insurance policy, there are several key considerations to keep in mind, including:

- Coverage Amount: Determine how much coverage you need to provide for your loved ones, considering factors such as funeral expenses, outstanding debts, and ongoing living costs.

- Policy Type: Choose from a range of policy types, including term life, whole life, and universal life insurance, each with its own unique benefits and drawbacks.

- Premium Costs: Consider the premium costs associated with your chosen policy, ensuring that they fit within your budget and financial goals.

- Riders and Add-ons: Explore available riders and add-ons, such as waiver of premium or accidental death benefit, which can enhance your policy's benefits and flexibility.

How to Choose the Right Life Insurance Policy

Choosing the right life insurance policy can be a complex and overwhelming process, especially with the numerous options available to retired military personnel. To make an informed decision, consider the following steps:

- Assess Your Needs: Determine how much coverage you need and what type of policy best suits your goals and circumstances.

- Research Options: Explore the various life insurance options available to retired military personnel, including VGLI, S-DVI, and private insurance policies.

- Compare Policies: Compare the benefits, drawbacks, and premium costs of different policies, considering factors such as coverage amount, policy type, and riders.

- Seek Professional Advice: Consult with a licensed insurance professional or financial advisor to ensure you are making an informed decision.

Gallery of Veterans' Life Insurance Options

Veterans' Life Insurance Options Gallery

Frequently Asked Questions

What is Veterans' Group Life Insurance (VGLI)?

+VGLI is a life insurance program offered by the Department of Veterans Affairs (VA) that allows eligible veterans to convert their Servicemembers' Group Life Insurance (SGLI) coverage to a civilian policy.

What is Service-Disabled Veterans' Life Insurance (S-DVI)?

+S-DVI is a life insurance program offered by the Department of Veterans Affairs (VA) that provides coverage to veterans who have been rated for a service-connected disability.

Can I purchase private life insurance as a retired military personnel?

+Yes, you can purchase private life insurance as a retired military personnel. In fact, many veterans find that private insurance policies offer more comprehensive coverage and flexibility than VA-sponsored policies.

In conclusion, life insurance is a crucial aspect of financial planning for retired military personnel, providing a financial safety net and legacy planning opportunities. By understanding the various life insurance options available, including VGLI, S-DVI, and private insurance policies, you can make an informed decision that meets your unique needs and circumstances.