Intro

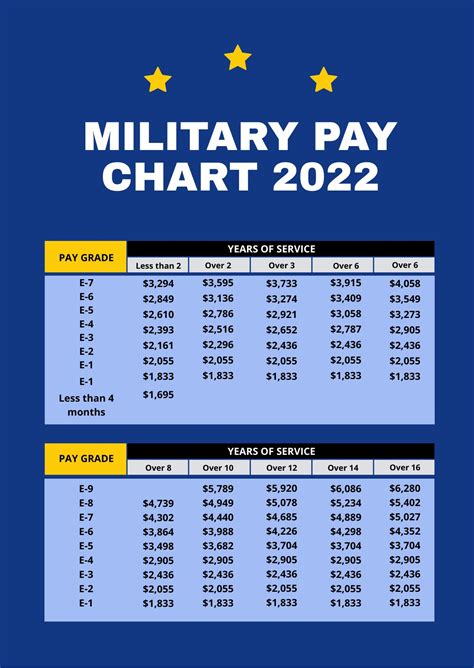

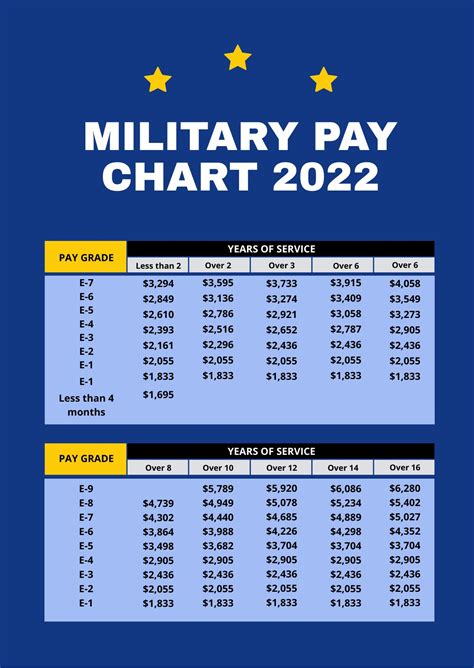

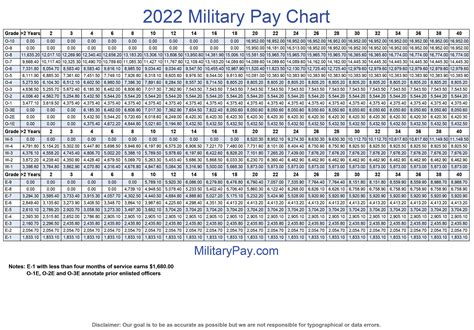

Discover how to calculate military deployment pay with our expert guide. Learn the 5 essential methods to determine your deployment pay, including Basic Allowance for Subsistence (BAS), Basic Allowance for Housing (BAH), and Hazardous Duty Pay. Understand your military pay entitlements and maximize your deployment compensation.

Military deployment can be a challenging and unpredictable experience for service members and their families. One aspect that can provide some stability and financial relief is the additional pay that comes with deployment. However, calculating military deployment pay can be complex, and there are various ways to do so. In this article, we will explore five ways to calculate military deployment pay.

What is Military Deployment Pay?

Military deployment pay is a type of special pay that service members receive when they are deployed to a combat zone or a designated hazardous duty area. The purpose of this pay is to compensate service members for the increased risks and hardships associated with deployment. Military deployment pay can include various types of pay, such as combat pay, hazardous duty pay, and family separation pay.

Method 1: Basic Allowance for Subsistence (BAS) and Basic Allowance for Housing (BAH)

One way to calculate military deployment pay is to use the Basic Allowance for Subsistence (BAS) and Basic Allowance for Housing (BAH) rates. BAS is a monthly allowance that service members receive to cover their food expenses, while BAH is a monthly allowance that service members receive to cover their housing expenses.

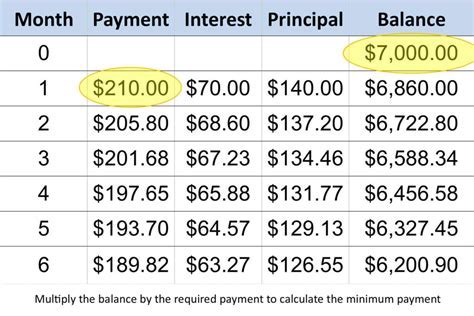

To calculate deployment pay using BAS and BAH rates, service members can use the following formula:

Deployment Pay = (BAS rate x number of months deployed) + (BAH rate x number of months deployed)

For example, if a service member is deployed for 6 months and the BAS rate is $369.39 per month, and the BAH rate is $1,500 per month, their deployment pay would be:

Deployment Pay = ($369.39 x 6) + ($1,500 x 6) = $2,216.34 + $9,000 = $11,216.34

Method 2: Combat Pay

Another way to calculate military deployment pay is to use the combat pay rate. Combat pay is a type of special pay that service members receive when they are deployed to a combat zone.

To calculate combat pay, service members can use the following formula:

Combat Pay = (combat pay rate x number of months deployed)

For example, if a service member is deployed to a combat zone for 6 months and the combat pay rate is $225 per month, their combat pay would be:

Combat Pay = ($225 x 6) = $1,350

Method 3: Family Separation Pay

Family separation pay is a type of special pay that service members receive when they are deployed and separated from their families.

To calculate family separation pay, service members can use the following formula:

Family Separation Pay = (family separation pay rate x number of months deployed)

For example, if a service member is deployed for 6 months and the family separation pay rate is $250 per month, their family separation pay would be:

Family Separation Pay = ($250 x 6) = $1,500

Method 4: Hazardous Duty Pay

Hazardous duty pay is a type of special pay that service members receive when they are deployed to a hazardous duty area.

To calculate hazardous duty pay, service members can use the following formula:

Hazardous Duty Pay = (hazardous duty pay rate x number of months deployed)

For example, if a service member is deployed to a hazardous duty area for 6 months and the hazardous duty pay rate is $150 per month, their hazardous duty pay would be:

Hazardous Duty Pay = ($150 x 6) = $900

Method 5: Tax-Free Allowances

Finally, service members can also calculate their deployment pay by using tax-free allowances. Tax-free allowances are a type of special pay that service members receive when they are deployed to a combat zone or a designated hazardous duty area.

To calculate tax-free allowances, service members can use the following formula:

Tax-Free Allowances = (tax-free allowance rate x number of months deployed)

For example, if a service member is deployed to a combat zone for 6 months and the tax-free allowance rate is $1,000 per month, their tax-free allowances would be:

Tax-Free Allowances = ($1,000 x 6) = $6,000

Gallery of Military Deployment Pay

Military Deployment Pay Image Gallery

Frequently Asked Questions

How do I calculate my military deployment pay?

+There are several ways to calculate military deployment pay, including using the Basic Allowance for Subsistence (BAS) and Basic Allowance for Housing (BAH) rates, combat pay rate, family separation pay rate, hazardous duty pay rate, and tax-free allowances.

What is the difference between combat pay and hazardous duty pay?

+Combat pay is a type of special pay that service members receive when they are deployed to a combat zone, while hazardous duty pay is a type of special pay that service members receive when they are deployed to a hazardous duty area.

How do I claim my military deployment pay?

+Service members can claim their military deployment pay by submitting a request through their unit's personnel office or by contacting the Defense Finance and Accounting Service (DFAS) directly.

In conclusion, calculating military deployment pay can be complex, but by using one of the five methods outlined above, service members can ensure that they receive the correct amount of pay for their deployment.