Intro

Transitioning to civilian life? Understand the ins and outs of life insurance after military retirement. Learn how to navigate post-service coverage, including VGLI and commercial options, to ensure your familys financial security. Discover the best life insurance choices for veterans and make informed decisions for a secure future.

Transitioning from military life to civilian life can be a significant change, and one of the essential aspects to consider is life insurance. After dedicating years of service to the country, it's crucial to ensure that you and your loved ones are protected financially, regardless of what the future holds. In this article, we'll delve into the world of life insurance after military retirement, exploring the options, benefits, and what you need to know to make informed decisions.

Understanding Your Military Life Insurance Options

As a military retiree, you're likely familiar with the Servicemembers' Group Life Insurance (SGLI) program, which provides low-cost term life insurance to active-duty, reserve, and National Guard members. However, when you retire, your SGLI coverage will eventually terminate. It's essential to understand your options for continuing or converting your life insurance coverage.

Veterans' Group Life Insurance (VGLI)

The Veterans' Group Life Insurance (VGLI) program allows you to convert your SGLI coverage to a civilian life insurance policy. VGLI is a term life insurance program that provides coverage up to $400,000. To be eligible, you must apply within one year and 120 days of your separation from service. Keep in mind that VGLI premiums increase with age, and you may be required to provide proof of good health.

Life Insurance Options for Military Retirees

In addition to VGLI, you have several other life insurance options to consider as a military retiree:

Term Life Insurance

Term life insurance provides coverage for a specific period (e.g., 10, 20, or 30 years). If you pass away during the term, your beneficiary will receive the death benefit. Term life insurance is often less expensive than permanent life insurance and can be an excellent option for those on a budget.

Permanent Life Insurance

Permanent life insurance, such as whole life or universal life insurance, provides lifetime coverage as long as premiums are paid. These policies often come with a cash value component, which can be borrowed against or used to pay premiums.

Group Life Insurance

If you're employed after military retirement, you may be eligible for group life insurance through your employer. Group life insurance is often less expensive than individual life insurance and can provide a level of coverage.

What to Consider When Choosing a Life Insurance Policy

When selecting a life insurance policy, there are several factors to consider:

Benefit Amount

Determine how much coverage you need to ensure your loved ones are protected financially. Consider your income, debts, and other financial obligations.

Term Length

If you choose term life insurance, decide on the term length that best suits your needs. Consider your retirement goals, outstanding debts, and the age of your dependents.

Premiums

Life insurance premiums can vary significantly depending on your age, health, and coverage amount. Ensure you understand the premium structure and any potential increases.

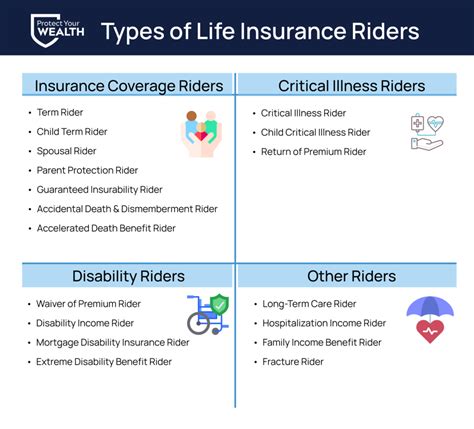

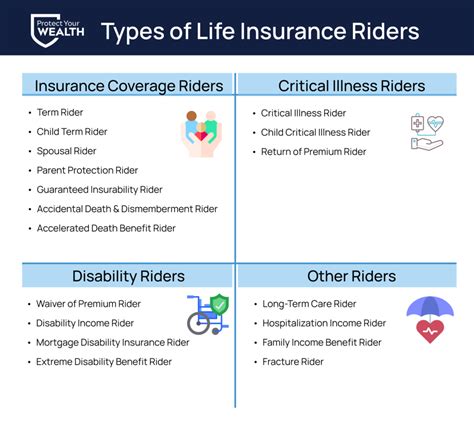

Riders and Add-ons

Some life insurance policies offer riders or add-ons that can enhance your coverage. Examples include waiver of premium, accidental death benefit, or long-term care riders.

Tips for Military Retirees When Buying Life Insurance

When purchasing life insurance as a military retiree, keep the following tips in mind:

Assess Your Needs

Reevaluate your life insurance needs after military retirement. Consider your new income, debts, and financial obligations.

Compare Policies

Shop around and compare life insurance policies from various providers. Ensure you understand the terms, conditions, and premiums.

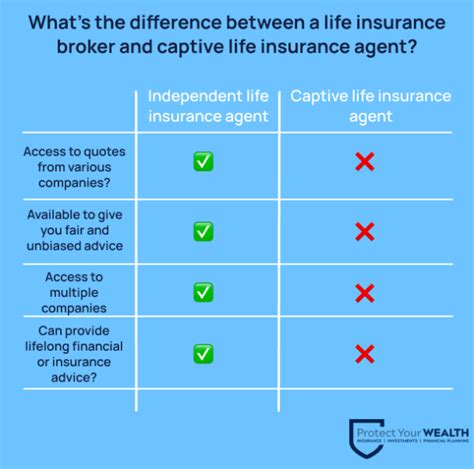

Consider a Broker or Agent

Working with a licensed broker or agent can help you navigate the complex world of life insurance. They can provide guidance and help you find the best policy for your needs.

Conclusion

Life insurance is a vital component of your overall financial plan, especially after military retirement. By understanding your options, considering your needs, and selecting the right policy, you can ensure that your loved ones are protected financially, regardless of what the future holds. Remember to assess your needs, compare policies, and consider working with a broker or agent to find the best life insurance policy for your unique situation.

Life Insurance After Military Retirement Image Gallery

What is the difference between SGLI and VGLI?

+SGLI (Servicemembers' Group Life Insurance) is a low-cost term life insurance program for active-duty, reserve, and National Guard members. VGLI (Veterans' Group Life Insurance) is a term life insurance program that allows you to convert your SGLI coverage to a civilian life insurance policy after separation from service.

Can I keep my SGLI coverage after military retirement?

+No, SGLI coverage will eventually terminate after military retirement. However, you can convert your SGLI coverage to VGLI within one year and 120 days of your separation from service.

What are the benefits of term life insurance for military retirees?

+Term life insurance provides coverage for a specific period (e.g., 10, 20, or 30 years). It's often less expensive than permanent life insurance and can be an excellent option for military retirees who need coverage for a specific period, such as until their children are grown or until their mortgage is paid off.

Can I purchase life insurance from a private provider?

+Yes, you can purchase life insurance from a private provider. In fact, many military retirees choose to shop around and compare policies from various providers to find the best coverage for their needs.

What are life insurance riders, and how do they work?

+Life insurance riders are additional features or benefits that can be added to your life insurance policy. Examples include waiver of premium, accidental death benefit, or long-term care riders. Riders can enhance your coverage and provide additional protection for your loved ones.