Intro

Unlock financial stability with military pay advance loans. Discover 5 ways these loans can provide emergency funding, cover unexpected expenses, and bridge the pay gap for active-duty personnel and veterans. Learn how to navigate the benefits and risks of military payday loans, and find relief from financial stress.

As a member of the military, you may face unique financial challenges that can be difficult to overcome. One of the most significant challenges is managing your finances while serving overseas or during periods of deployment. Military pay advance loans can provide a vital lifeline during these times, helping you cover essential expenses and avoid financial hardship.

These loans are specifically designed for military personnel and offer a range of benefits that can help you navigate financial difficulties. Here are five ways military pay advance loans can help:

Understanding Military Pay Advance Loans

Military pay advance loans are short-term loans that allow you to access a portion of your upcoming pay early. These loans are usually provided by private lenders and are designed to help military personnel cover unexpected expenses or financial emergencies.

1. Emergency Funding

One of the primary benefits of military pay advance loans is emergency funding. If you're facing an unexpected expense, such as a medical bill or car repair, these loans can provide the necessary funds to cover the cost. This can help you avoid financial hardship and ensure that you're able to meet your financial obligations.

- Fast access to cash: Military pay advance loans can provide fast access to cash, often within 24 hours of approval.

- No credit check: Many lenders do not require a credit check, making it easier to qualify for a loan.

- Flexible repayment terms: Repayment terms can be flexible, allowing you to repay the loan in installments.

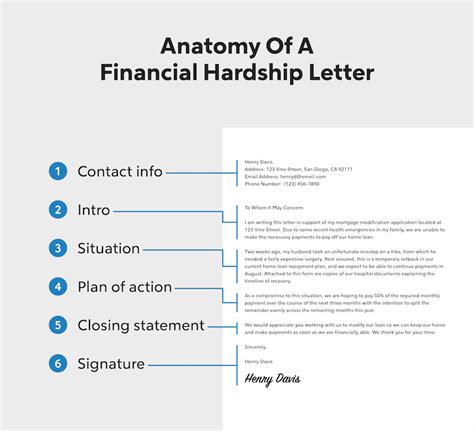

2. Avoiding Financial Hardship

Military pay advance loans can help you avoid financial hardship by providing a safety net during difficult times. If you're struggling to make ends meet, these loans can provide the necessary funds to cover essential expenses, such as rent/mortgage, utilities, and food.

- Essential expenses: Military pay advance loans can help you cover essential expenses, such as rent/mortgage, utilities, and food.

- Avoiding debt: By providing a short-term loan, military pay advance loans can help you avoid debt and financial hardship.

- Peace of mind: Knowing that you have access to emergency funding can provide peace of mind and reduce financial stress.

3. Managing Deployment Finances

Deployment can be a challenging time for military personnel, and managing finances can be particularly difficult. Military pay advance loans can help you manage your finances during deployment by providing access to emergency funding.

- Emergency funding: Military pay advance loans can provide emergency funding to cover unexpected expenses during deployment.

- Flexible repayment terms: Repayment terms can be flexible, allowing you to repay the loan in installments.

- No credit check: Many lenders do not require a credit check, making it easier to qualify for a loan.

4. Building Credit

Military pay advance loans can also help you build credit. By repaying the loan on time, you can demonstrate responsible credit behavior and improve your credit score.

- Responsible credit behavior: Repaying a military pay advance loan on time can demonstrate responsible credit behavior.

- Credit score improvement: By repaying the loan on time, you can improve your credit score and access better loan terms in the future.

- Credit reporting: Some lenders report repayment activity to credit bureaus, helping you build credit.

5. Access to Financial Resources

Finally, military pay advance loans can provide access to financial resources that may not be available otherwise. These loans can help you cover unexpected expenses or financial emergencies, providing a vital lifeline during difficult times.

- Access to cash: Military pay advance loans can provide fast access to cash, often within 24 hours of approval.

- Financial flexibility: These loans can provide financial flexibility, allowing you to cover unexpected expenses or financial emergencies.

- Peace of mind: Knowing that you have access to emergency funding can provide peace of mind and reduce financial stress.

Military Pay Advance Loans Image Gallery

What is a military pay advance loan?

+A military pay advance loan is a short-term loan that allows military personnel to access a portion of their upcoming pay early.

How do I qualify for a military pay advance loan?

+To qualify for a military pay advance loan, you typically need to be an active-duty military personnel with a steady income and a good credit history.

What are the benefits of a military pay advance loan?

+The benefits of a military pay advance loan include fast access to cash, no credit check, and flexible repayment terms.

If you're a military personnel facing financial difficulties, consider reaching out to a reputable lender to discuss your options. Military pay advance loans can provide a vital lifeline during difficult times, helping you cover essential expenses and avoid financial hardship.