Intro

Discover the financial implications of military life as a married or single service member. Learn about the 5 key military pay differences that affect your take-home pay, including Basic Allowance for Housing (BAH), Basic Allowance for Subsistence (BAS), and more. Get insights into military compensation and benefits to maximize your earnings.

Marriage is a significant life milestone that can bring about numerous changes, including financial adjustments. For military personnel, marriage can also impact their pay and benefits. In this article, we will explore the differences in military pay between married and single service members, highlighting the benefits and considerations that come with each status.

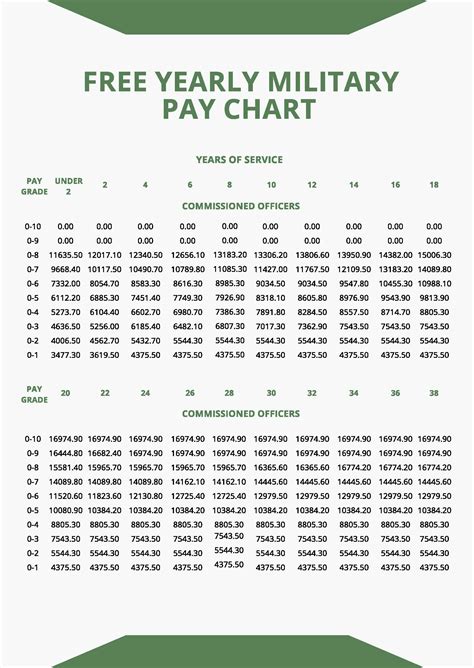

Understanding Military Pay

Military pay is based on a combination of factors, including rank, time in service, and family size. The military uses a complex formula to calculate pay, taking into account the service member's Basic Allowance for Housing (BAH), Basic Allowance for Subsistence (BAS), and other benefits. Marriage can affect these calculations, resulting in differences in pay between married and single service members.

Military Pay for Married Service Members

Married service members are entitled to various benefits that can increase their pay. Some of these benefits include:

- Increased BAH: Married service members receive a higher BAH rate, which can result in a significant increase in their pay.

- Dependent Allowance: Service members with dependents (spouse and/or children) receive a dependent allowance, which is a tax-free benefit that helps to offset the cost of supporting a family.

- Family Subsistence Supplemental Allowance (FSSA): Eligible service members with families can receive FSSA, a supplemental allowance that helps to cover the cost of food and other expenses.

Examples of Increased Pay for Married Service Members

- A married E-4 with two dependents may receive an additional $500-700 per month in BAH and dependent allowance.

- A married O-3 with three dependents may receive an additional $1,000-1,500 per month in BAH and dependent allowance.

Military Pay for Single Service Members

Single service members do not receive the same level of benefits as married service members. However, they may still be eligible for certain benefits, such as:

- Single BAH: Single service members receive a lower BAH rate, which can result in a lower overall pay.

- BAS: All service members, regardless of marital status, receive BAS, which is a tax-free allowance that helps to cover the cost of food.

Examples of Pay for Single Service Members

- A single E-4 may receive a lower BAH rate, resulting in a decrease of $200-400 per month in pay.

- A single O-3 may receive a lower BAH rate, resulting in a decrease of $500-1,000 per month in pay.

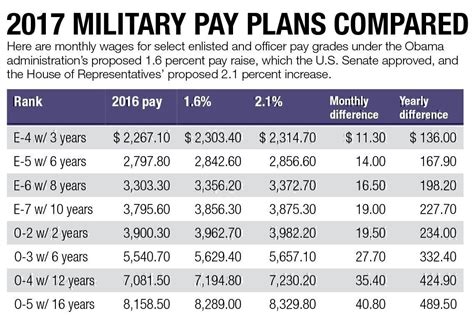

5 Key Differences in Military Pay between Married and Single Service Members

- BAH: Married service members receive a higher BAH rate, while single service members receive a lower rate.

- Dependent Allowance: Married service members with dependents receive a dependent allowance, while single service members do not.

- FSSA: Eligible married service members with families can receive FSSA, while single service members are not eligible.

- Tax Benefits: Married service members may be eligible for tax benefits, such as the Military Spouse Tax Credit, while single service members are not.

- Overall Pay: Married service members typically receive a higher overall pay due to the increased BAH and dependent allowance.

Considerations for Married Service Members

- Increased Financial Obligations: Married service members may have increased financial obligations, such as supporting a spouse and/or children.

- Changes in Benefits: Marriage can result in changes to benefits, such as BAH and dependent allowance.

- Tax Implications: Marriage can have tax implications, such as the Military Spouse Tax Credit.

Considerations for Single Service Members

- Lower Financial Obligations: Single service members typically have lower financial obligations.

- Fewer Benefits: Single service members may not be eligible for certain benefits, such as dependent allowance and FSSA.

- Tax Implications: Single service members may not be eligible for tax benefits, such as the Military Spouse Tax Credit.

Gallery of Military Marriage Benefits

Military Marriage Benefits Image Gallery

Frequently Asked Questions

How does marriage affect military pay?

+Marriage can increase military pay due to increased BAH and dependent allowance.

What benefits do married service members receive?

+Married service members receive increased BAH, dependent allowance, and FSSA.

How does being single affect military pay?

+Being single typically results in lower BAH and fewer benefits.

We hope this article has provided a comprehensive overview of the differences in military pay between married and single service members. Whether you're married or single, it's essential to understand how your marital status affects your pay and benefits.