Intro

Send money globally with ease using Money Gram, a secure international money transfer service. Enjoy fast, reliable, and convenient transactions to over 200 countries. Learn how to use Money Gram for online money transfers, currency exchange, and more. Discover the benefits of using Money Gram for your international payment needs.

Money Gram: Secure International Money Transfers Made Easy

In today's globalized world, sending money across borders has become a common necessity. Whether you're supporting family members abroad, paying for international services, or investing in foreign markets, you need a reliable and secure way to transfer funds. MoneyGram is a well-established player in the international money transfer market, offering a range of services that cater to diverse needs. In this article, we'll delve into the world of MoneyGram, exploring its features, benefits, and how it facilitates secure international money transfers.

What is MoneyGram?

MoneyGram is a global payment company that enables users to send and receive money worldwide. Founded in 1940, the company has evolved over the years to become one of the largest money transfer providers in the world. With a presence in over 200 countries and territories, MoneyGram offers a range of services, including money transfers, bill payments, and prepaid cards.How Does MoneyGram Work?

MoneyGram's money transfer process is straightforward and convenient. Here's a step-by-step overview:

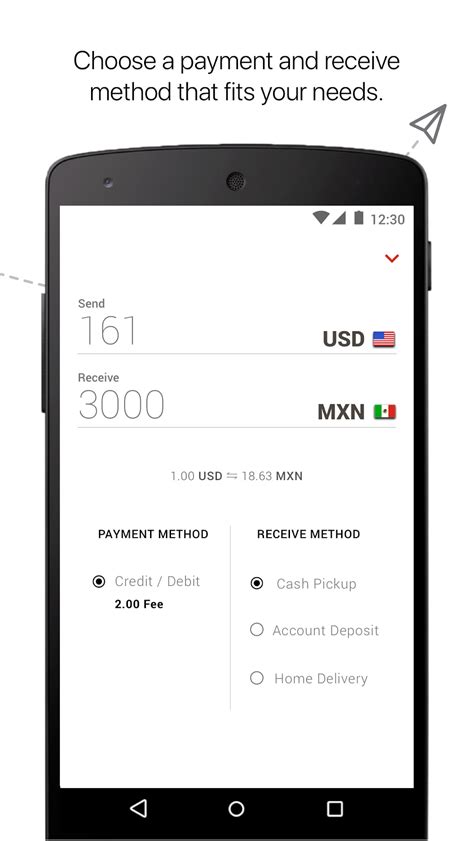

- Send Money: Users can initiate a money transfer by visiting a MoneyGram agent location, using the mobile app, or logging in to their online account.

- Choose Transfer Method: Users can select from various transfer methods, including cash, credit/debit card, or bank account.

- Enter Recipient Information: Users need to provide the recipient's name, address, and other relevant details.

- Pay Transfer Fee: Users pay the applicable transfer fee, which varies depending on the transfer method and amount.

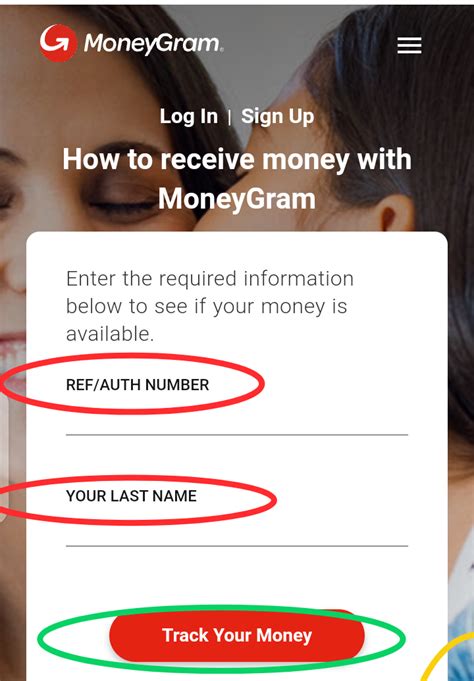

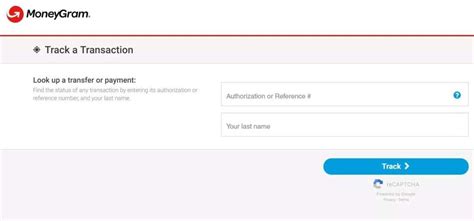

- Track Transfer: Users can track the transfer status using the MoneyGram tracking system.

Benefits of Using MoneyGram

- Convenience: MoneyGram offers multiple transfer channels, including online, mobile, and agent locations, making it easy to send money from anywhere.

- Speed: MoneyGram transfers are typically processed within minutes, ensuring that recipients receive the funds quickly.

- Security: MoneyGram uses advanced security measures, including encryption and secure servers, to protect user data and transactions.

- Reliability: With over 75 years of experience, MoneyGram has established a reputation for reliability and trustworthiness.

- Competitive Exchange Rates: MoneyGram offers competitive exchange rates, which can help users save money on international transfers.

MoneyGram Fees and Exchange Rates

MoneyGram's fees and exchange rates vary depending on the transfer method, amount, and destination country. Here's a breakdown of the typical fees and exchange rates:

- Transfer Fees: MoneyGram charges a transfer fee, which ranges from $1.50 to $10.00, depending on the transfer amount and method.

- Exchange Rates: MoneyGram offers competitive exchange rates, which can vary depending on the market conditions.

- Additional Fees: Users may incur additional fees, such as cash advance fees or ATM fees, depending on the transfer method.

MoneyGram Security Features

- Encryption: MoneyGram uses advanced encryption technology to protect user data and transactions.

- Secure Servers: MoneyGram's servers are equipped with state-of-the-art security measures, including firewalls and intrusion detection systems.

- Identity Verification: MoneyGram requires users to verify their identity before initiating a transfer, ensuring that only authorized users can access the account.

- Transaction Monitoring: MoneyGram's system continuously monitors transactions for suspicious activity, enabling swift action in case of any irregularities.

MoneyGram Alternatives

While MoneyGram is a popular choice for international money transfers, there are alternative services that offer competitive features and fees. Some of the notable alternatives include:

- Western Union: Western Union is a well-established player in the money transfer market, offering a range of services, including money transfers and bill payments.

- PayPal: PayPal is a popular online payment platform that enables users to send and receive money worldwide.

- TransferWise: TransferWise is a peer-to-peer money transfer service that offers competitive exchange rates and low fees.

Conclusion

MoneyGram is a secure and reliable way to send money internationally. With its range of services, competitive fees, and robust security features, MoneyGram has established itself as a leader in the money transfer market. Whether you're sending money to family members abroad or paying for international services, MoneyGram is a convenient and trustworthy option.

MoneyGram Image Gallery

What is MoneyGram's transfer limit?

+MoneyGram's transfer limit varies depending on the transfer method and destination country. Typically, the maximum transfer limit is $10,000.

How long does it take to process a MoneyGram transfer?

+MoneyGram transfers are typically processed within minutes, but the exact processing time may vary depending on the transfer method and destination country.

Can I cancel a MoneyGram transfer?

+Yes, you can cancel a MoneyGram transfer, but you'll need to contact MoneyGram's customer support as soon as possible. Please note that cancellation fees may apply.