Intro

Learn how to use a money order safely and efficiently with our step-by-step guide. Discover the benefits of using money orders for secure transactions, how to purchase and fill out a money order, and tips for avoiding scams and fees. Protect your finances and send payments with confidence using these reliable payment instruments.

Using a money order can be a convenient and secure way to make payments, especially when you don't want to use cash or credit cards. However, it's essential to understand how to use a money order safely and efficiently to avoid any potential issues.

Money orders are prepaid payment instruments that can be purchased at various locations, such as post offices, banks, and retail stores. They are often used for transactions that require a secure and guaranteed form of payment, such as paying bills, sending money to individuals, or making purchases online.

To use a money order safely and efficiently, follow these steps:

- Purchase from a trusted location: Buy a money order from a reputable and authorized location, such as a post office or a bank. This will help ensure that the money order is legitimate and secure.

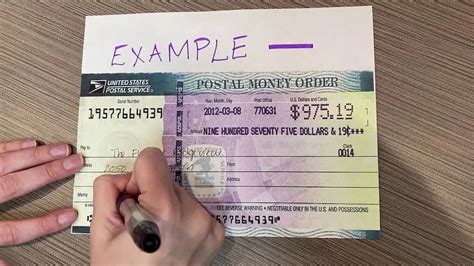

- Fill out the money order correctly: Make sure to fill out the money order correctly, including the recipient's name, address, and the amount. Use a pen and make sure the handwriting is legible.

- Use the correct payment method: Pay for the money order using a secure payment method, such as cash or a debit card. Avoid using credit cards, as they may charge additional fees.

- Keep a record: Keep a record of the money order, including the serial number, date, and amount. This will help you track the payment and resolve any issues that may arise.

- Send the money order securely: Send the money order via a secure method, such as certified mail or a trackable shipping service.

Benefits of Using a Money Order

Using a money order can provide several benefits, including:

- Security: Money orders are prepaid, which means that the funds are guaranteed and secure.

- Convenience: Money orders can be purchased at various locations and sent via mail or online.

- No risk of overdraft: Since money orders are prepaid, there is no risk of overdraft or bounced checks.

- No credit check: Money orders do not require a credit check, making them accessible to individuals with poor credit.

Common Mistakes to Avoid

When using a money order, there are several common mistakes to avoid, including:

- Insufficient funds: Make sure to have sufficient funds to cover the amount of the money order.

- Incorrect information: Ensure that the recipient's name, address, and amount are correct.

- Lost or stolen money order: Keep a record of the money order and report any lost or stolen money orders to the issuer immediately.

Types of Money Orders

There are several types of money orders available, including:

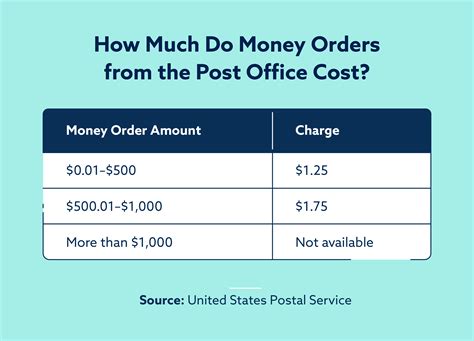

- USPS Money Order: Issued by the United States Postal Service, these money orders are widely accepted and can be purchased at post offices.

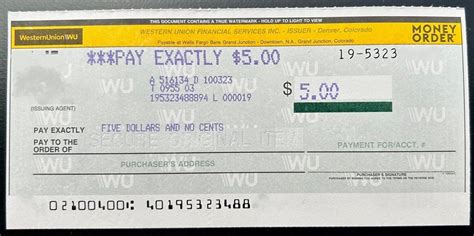

- Western Union Money Order: Issued by Western Union, these money orders are widely accepted and can be purchased at various locations.

- MoneyGram Money Order: Issued by MoneyGram, these money orders are widely accepted and can be purchased at various locations.

How to Track a Money Order

To track a money order, follow these steps:

- Contact the issuer: Contact the issuer of the money order, such as the post office or Western Union, to inquire about the status of the payment.

- Use the serial number: Use the serial number on the money order to track the payment.

- Check online: Check the issuer's website to track the payment online.

Money Order Fees

Money order fees vary depending on the issuer and the amount of the money order. Here are some common fees associated with money orders:

- Purchase fee: A fee charged by the issuer for purchasing a money order.

- Transfer fee: A fee charged for transferring funds from one location to another.

- Exchange fee: A fee charged for exchanging a money order for cash.

Alternatives to Money Orders

There are several alternatives to money orders, including:

- Checks: Checks can be used for transactions, but they may require a credit check and can be subject to overdraft fees.

- Credit cards: Credit cards can be used for transactions, but they may charge additional fees and interest rates.

- Digital payments: Digital payments, such as PayPal or Venmo, can be used for transactions, but they may charge additional fees.

Conclusion

Using a money order can be a convenient and secure way to make payments. However, it's essential to understand how to use a money order safely and efficiently to avoid any potential issues. By following the steps outlined in this article, you can use a money order with confidence and avoid common mistakes.

Money Order Safety and Efficiency Image Gallery

What is a money order?

+A money order is a prepaid payment instrument that can be purchased at various locations, such as post offices, banks, and retail stores.

How do I track a money order?

+To track a money order, contact the issuer, use the serial number, or check the issuer's website.

What are the benefits of using a money order?

+The benefits of using a money order include security, convenience, no risk of overdraft, and no credit check.