Intro

Discover how to save on MoneyGram fees with our expert guide. Learn 5 simple ways to avoid transfer charges, exchange rate markups, and other hidden costs. Reduce your money transfer fees and get the most out of your international transactions with our actionable tips and tricks.

Sending and receiving money across the globe has become easier with services like MoneyGram. However, the fees associated with these transactions can be a significant burden. Whether you're sending money to family abroad or receiving payment from a client, it's essential to minimize the costs involved. In this article, we'll explore five ways to avoid MoneyGram fees, helping you save money and make the most of your transactions.

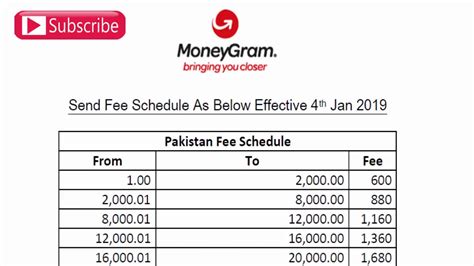

Understanding MoneyGram Fees

Before we dive into the ways to avoid fees, it's crucial to understand the types of fees MoneyGram charges. These fees typically include:

- Transfer fees: A percentage of the amount being sent, which can range from 1% to 5%

- Exchange rate fees: MoneyGram's exchange rates may not be the most competitive, resulting in additional costs

- Payment method fees: Fees for using certain payment methods, such as credit cards

- Delivery fees: Fees for expedited delivery or other special services

1. Choose the Right Transfer Option

MoneyGram offers various transfer options, each with its own set of fees. To avoid unnecessary costs, choose the option that best suits your needs. For example:

- Online transfers: Typically have lower fees compared to in-person transfers

- Bank transfers: May have lower fees compared to credit card transfers

- Standard delivery: Opt for standard delivery instead of expedited delivery to save on fees

Be Mindful of Exchange Rates

Exchange rates can significantly impact the amount of money the recipient receives. To avoid unfavorable exchange rates, consider the following:

- Use a currency converter: Compare MoneyGram's exchange rates with other providers to ensure you're getting the best deal

- Transfer during optimal times: Transfer money during times when the exchange rate is in your favor

- Avoid last-minute transfers: Plan ahead to avoid making transfers during times of unfavorable exchange rates

2. Use a Debit Card or Bank Account

Using a debit card or bank account to fund your transfer can help you avoid payment method fees. Credit cards, on the other hand, may incur additional fees. To avoid these fees:

- Use a debit card: Debit cards are often fee-free and can be a cost-effective option

- Link your bank account: Transfer funds directly from your bank account to avoid payment method fees

Other Payment Methods to Consider

If you don't have access to a debit card or bank account, consider the following payment methods:

- Cash: Some MoneyGram locations accept cash payments, which can be a fee-free option

- Online payment services: Services like PayPal or Google Pay may offer lower fees compared to credit cards

3. Avoid Using MoneyGram for Small Transfers

MoneyGram's fees can be disproportionate to the amount being transferred, making it a costly option for small transfers. To avoid unnecessary fees:

- Use alternative services: Services like TransferWise or WorldRemit may offer lower fees for small transfers

- Batch transfers: If possible, batch multiple small transfers together to reduce the overall fee

Transfer in Bulk to Save on Fees

Transferring larger amounts can help you save on fees. To make the most of this strategy:

- Plan ahead: Accumulate funds before making a transfer to reduce the overall fee

- Use a fee calculator: MoneyGram's fee calculator can help you determine the most cost-effective transfer amount

4. Take Advantage of Promotions and Discounts

MoneyGram occasionally offers promotions and discounts that can help you save on fees. To stay informed:

- Follow MoneyGram's social media: Stay up-to-date with the latest promotions and discounts

- Sign up for newsletters: Receive exclusive offers and discounts directly to your inbox

- Use coupon codes: Look for coupon codes online that can be applied to your transfer

Other Ways to Save on Fees

In addition to promotions and discounts, consider the following ways to save on fees:

- Use a MoneyGram loyalty program: If available, join a loyalty program to earn rewards and discounts

- Refer friends and family: Refer others to MoneyGram and earn discounts on your next transfer

5. Consider Alternative Money Transfer Services

If you're not satisfied with MoneyGram's fees, consider alternative money transfer services. Some popular options include:

- TransferWise: Known for their competitive exchange rates and lower fees

- WorldRemit: Offers a range of transfer options and competitive fees

- XE Money Transfer: Provides competitive exchange rates and lower fees

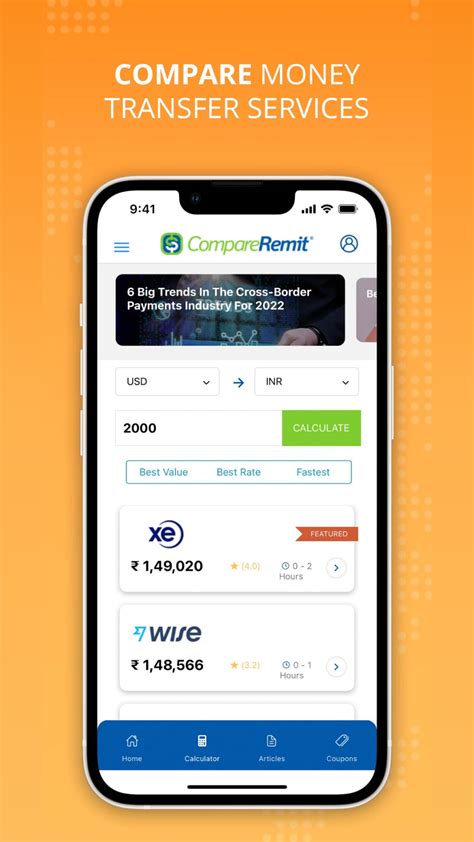

Compare Money Transfer Services

Before choosing an alternative service, compare their fees and exchange rates with MoneyGram's. To make an informed decision:

- Use a comparison tool: Websites like Monito or CompareRemit can help you compare fees and exchange rates

- Read reviews: Check out reviews from other customers to get a sense of each service's strengths and weaknesses

Gallery of Money Transfer Services

Money Transfer Services Image Gallery

FAQs

What are the fees associated with MoneyGram transfers?

+MoneyGram's fees include transfer fees, exchange rate fees, payment method fees, and delivery fees.

How can I avoid MoneyGram fees?

+Choose the right transfer option, be mindful of exchange rates, use a debit card or bank account, avoid small transfers, take advantage of promotions and discounts, and consider alternative money transfer services.

What are some alternative money transfer services to MoneyGram?

+Some popular alternatives include TransferWise, WorldRemit, and XE Money Transfer.

In conclusion, avoiding MoneyGram fees requires a combination of strategies, from choosing the right transfer option to considering alternative money transfer services. By being mindful of exchange rates, using a debit card or bank account, and taking advantage of promotions and discounts, you can minimize the costs associated with MoneyGram transfers. Don't forget to explore alternative services and compare their fees and exchange rates before making a decision.