Intro

Send money online with MoneyGram, a fast and secure way to transfer funds globally. Learn how to use MoneyGrams online services for international money transfers, bill payments, and mobile top-ups. Discover the benefits, fees, and transfer times to ensure your money reaches its destination quickly and reliably.

Sending money online has become a necessity in today's digital age. With the rise of online transactions, it's now possible to send money to anyone, anywhere in the world with just a few clicks. One of the most popular and reliable ways to send money online is through MoneyGram. In this article, we'll explore the benefits of using MoneyGram to send money online and how to do it safely and efficiently.

The Importance of Online Money Transfer Services

With the increasing number of people living and working abroad, the need for reliable and efficient online money transfer services has grown significantly. MoneyGram is one of the leading online money transfer services that allows individuals to send and receive money from anywhere in the world. The service is particularly useful for people who need to send money to family members or friends living abroad, or for businesses that need to make international payments.

Benefits of Using MoneyGram

MoneyGram offers a range of benefits that make it a popular choice for online money transfers. Some of the benefits include:

- Convenience: MoneyGram allows you to send money online from the comfort of your own home, 24/7.

- Speed: MoneyGram transfers are typically processed quickly, with most transfers completed within minutes.

- Security: MoneyGram uses advanced security measures to protect your transactions and ensure that your money is safe.

- Wide reach: MoneyGram has a global network of agents and partners, making it possible to send money to almost anywhere in the world.

How to Send Money Online with MoneyGram

Sending money online with MoneyGram is a straightforward process that can be completed in a few easy steps. Here's a step-by-step guide to get you started:

- Create an account: To send money online with MoneyGram, you'll need to create an account on their website. This will require you to provide some basic information, such as your name, address, and phone number.

- Enter the recipient's details: Once you've created your account, you'll need to enter the recipient's details, including their name, address, and phone number.

- Choose the transfer method: MoneyGram offers a range of transfer methods, including online transfers, mobile transfers, and in-person transfers. Choose the method that best suits your needs.

- Pay for the transfer: You'll need to pay for the transfer using a debit or credit card, or by linking your bank account to your MoneyGram account.

- Confirm the transfer: Once you've paid for the transfer, you'll need to confirm the details and authorize the transfer.

Tips for Safe and Efficient Money Transfers

When sending money online with MoneyGram, there are a few tips to keep in mind to ensure safe and efficient transfers:

- Use a secure internet connection: Make sure you're using a secure internet connection to protect your personal and financial information.

- Verify the recipient's details: Double-check the recipient's details to ensure that the money is going to the right person.

- Use a trusted payment method: Use a trusted payment method, such as a debit or credit card, or a linked bank account, to pay for the transfer.

- Monitor the transfer: Keep an eye on the transfer to ensure that it's processed quickly and efficiently.

Common Issues and Solutions

While MoneyGram is a reliable online money transfer service, there are some common issues that can arise. Here are some common issues and solutions:

- Delayed transfers: If your transfer is delayed, it may be due to a variety of reasons, including incorrect recipient details or issues with the payment method. To resolve the issue, contact MoneyGram's customer support team.

- Incorrect recipient details: If you've entered incorrect recipient details, you may need to cancel the transfer and start again. To avoid this, double-check the recipient's details before confirming the transfer.

- Payment issues: If you're experiencing issues with payment, it may be due to a problem with your debit or credit card, or with your linked bank account. To resolve the issue, contact your bank or card issuer.

Frequently Asked Questions

Here are some frequently asked questions about sending money online with MoneyGram:

Q: How long does it take to send money online with MoneyGram? A: The time it takes to send money online with MoneyGram depends on the transfer method you choose. Online transfers are typically processed quickly, with most transfers completed within minutes.

Q: Is it safe to send money online with MoneyGram? A: Yes, it's safe to send money online with MoneyGram. MoneyGram uses advanced security measures to protect your transactions and ensure that your money is safe.

Q: Can I cancel a transfer if I've entered incorrect recipient details? A: Yes, you can cancel a transfer if you've entered incorrect recipient details. However, you'll need to contact MoneyGram's customer support team to initiate the cancellation process.

Q: Can I send money online with MoneyGram to any country? A: MoneyGram has a global network of agents and partners, making it possible to send money to almost anywhere in the world. However, there may be some restrictions or limitations on sending money to certain countries.

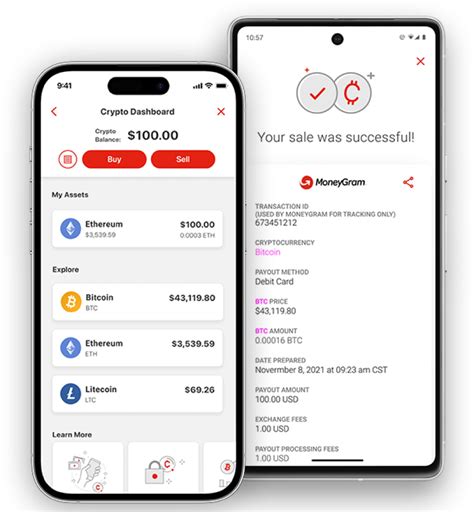

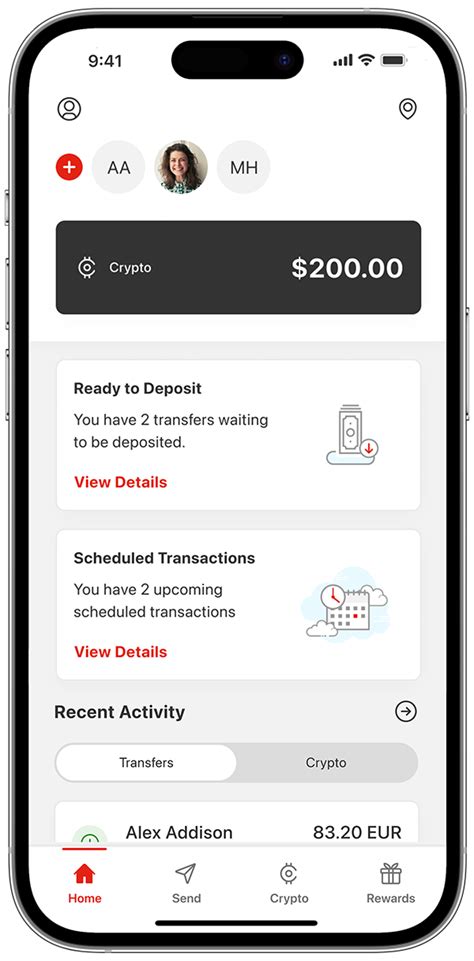

MoneyGram Image Gallery

Conclusion

Sending money online with MoneyGram is a convenient, safe, and efficient way to transfer funds to anyone, anywhere in the world. With a range of transfer methods and a global network of agents and partners, MoneyGram makes it easy to send money online. By following the tips and guidelines outlined in this article, you can ensure safe and efficient transfers every time.